Putin and property, a big bet on London offices and will interest rates hit pre-2007 levels?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Inflation

There's a relatively clear line to be drawn from Putin's movement of troops into Ukraine to some tangible impacts on property markets. Oil came within touching distance of $100 a barrel yesterday and follows warnings from the UK's energy regulator Ofgem that an invasion would lead to further, significant increases in energy bills.

The Bank of England was already expecting inflation to hit 7% by April but it's possible energy prices push that higher. In the US, oil at $110 could be the trigger that pushes consumer price inflation to 10%, levels not seen since 1981, according to consultancy RSM. It's uncertain how Western central banks will react to this - faster tightening of monetary policy could help tame inflation but the risks of tipping economies into recession are clear. Who would sit on the BoE's Monetary Policy Committee right now?

Commercial property has long been a favoured hedge against inflation but the outlook for global residential markets has been given a hefty dose of uncertainty.

How investors navigate this is one of a number of growing, systemic risks that we'll be tackling head on at the launch of The Wealth Report 2022 next week. Key economic, wealth and real estate trends have accelerated over the past twelve months, but disruption across major property sectors is also at new heights. Join us for a 30-minute first-look on Wednesday, March 2nd at 9am GMT - sign up here.

Supply

BoE Deputy Governor Dave Ramsden told the National Farmers' Union annual conference yesterday that some "modest" tightening will indeed be necessary over the coming months but beyond that, the outlook remains uncertain - in part due to the Russia-Ukraine conflict. Here is Mr Ramsden via Reuters:

"The word 'modest' is significant here though - I do not envisage the Bank Rate rising to anything like its pre-2007 level of 5% or above, let alone to the kind of levels we used to see before the MPC was formed in 1997."

How far interest rates track north is among the most important questions for the housing market over the medium term, but of more immediate importance is when supply is likely to improve. Data published by HMRC yesterday revealed that UK property transactions hit 85,520 in January, 12.6% lower than January 2021 and 22.2% lower than December 2021.

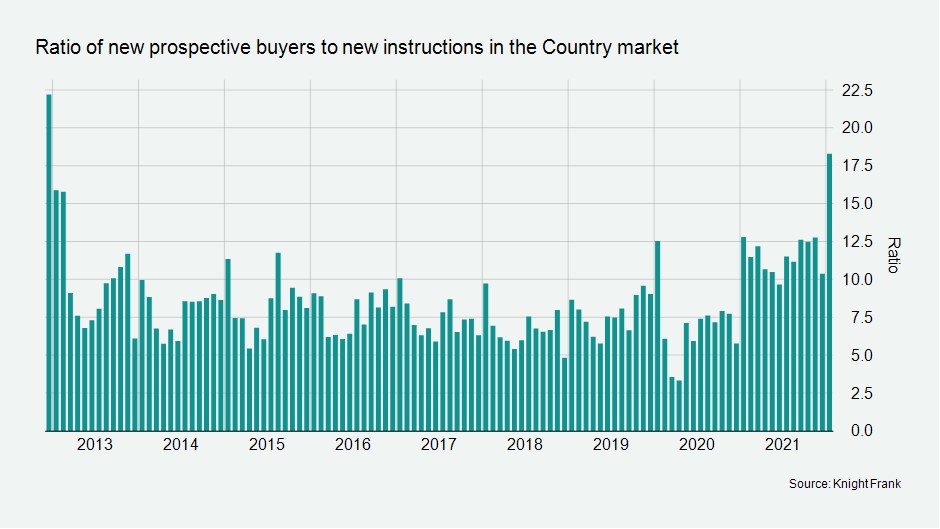

The dearth of supply is weighing heavily on activity and it's a seller's market out there. The latest Knight Frank data from the country market puts the ratio of new prospective buyers to new instructions at 18.2, the highest level in nine years. Chris Druce has more.

Confidence

There's little evidence so far that all this uncertainty is hitting consumer spending. On Monday Stephen Springham took an in-depth look at January's stellar retail figures "that completely fly in the face of any economic logic."

The latest monthly survey from IHS Markit and the Chartered Institute of Procurement & Supply suggests there has been a swift rebound in economic activity following the disruption of Omicron. Private sector output expanded at the fastest pace for eight months, led by a strong recovery in consumer spending on travel, leisure and entertainment. Private sector companies reported another steep increase in incoming new work.

That's being felt in the employment market. Confidence in the economy and hiring intentions both rose in January, according to The Recruitment and Employment Confederation.

Offices

The London office tower known as the Scalpel is to be sold for more than £800 million, according to reports in the FT and React News. A deal would be among the largest since the onset of the crisis.

We've talked a lot about the outsized pool of demand from occupiers for space in the relatively tight pool of the highest quality, green offices - themes we explored earlier this month in The London Report 2022. Year-end leasing volumes for 2021, although down on long-term averages, were up almost 40% year-on-year. Active demand currently stands at 7.6 million square feet, suggesting a significant flow of future transactions.

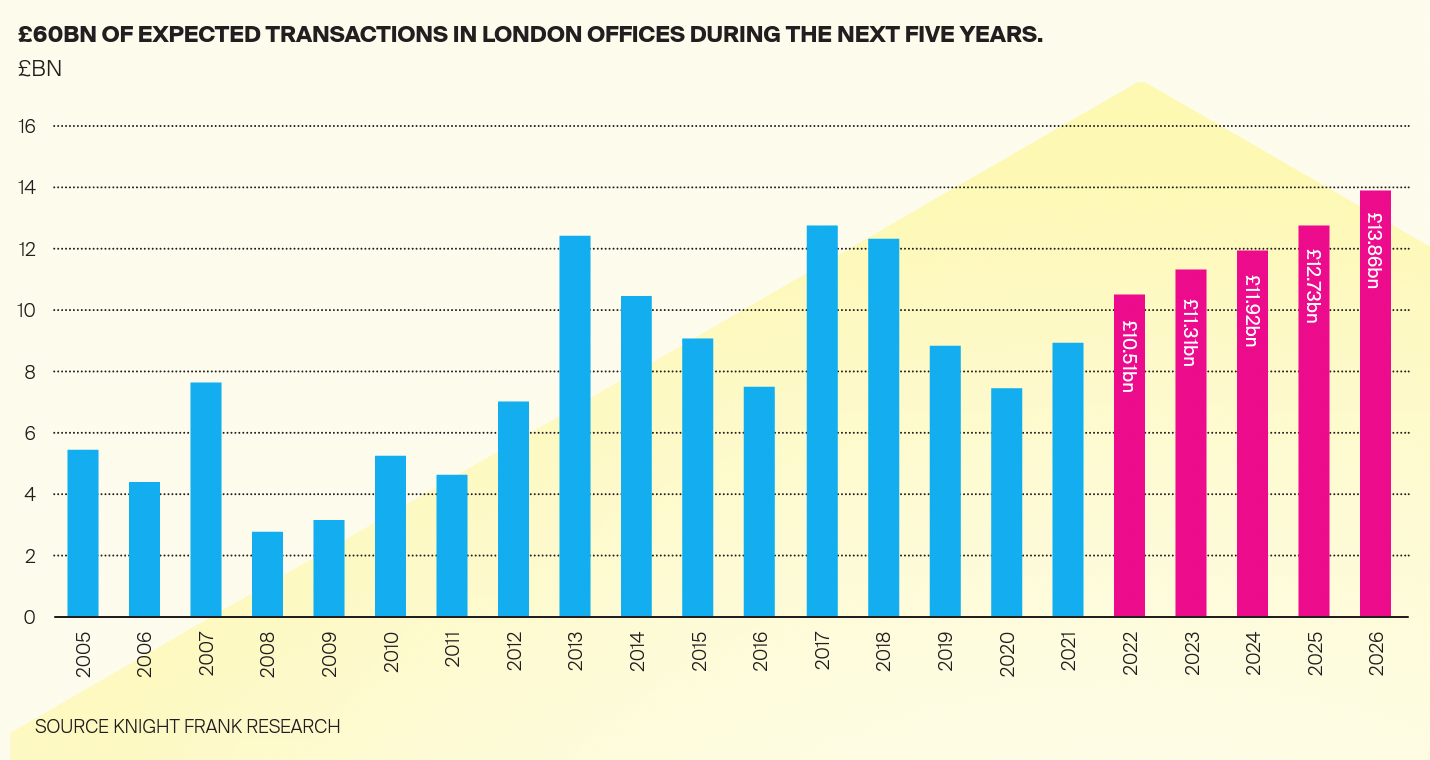

That's giving investors confidence. We project capital flows into London offices of £10.5 billion in 2022, a year-on-year increase of 16.8%. Additionally, the cumulative total of international transactions in London over the next five years is forecast to be £60.3 billion, the highest five-year total for over fifteen years.

As Lee Elliott has noted, there is a recognition that the office may not be a fixed, five-days a week requirement, but it is clearly a valuable contributor to organisational culture; client interaction; staff development; recruitment; on-boarding; collaboration and socialisation. Our survey of almost 400 global business leaders for (Y)OUR SPACE revealed that 90% of respondents regard real estate as an important device that supports, facilitates or portrays business strategy – an increase, despite the challenges of the pandemic, on the 85% subscribing to this point of view in our original survey back in 2018.

Few sectors have displayed more belief in these themes than big tech. The NYT tracked the industry's big bet on the office in this piece yesterday.

In other news...

Lawyer makes case for joyful firm with happiness officer role (Times), and finally, Russia's richest lose $33 billion as Ukraine crisis deepens (Bloomberg).

Photo by Sebastian Doe on Unsplash