Bonuses, golden visas and a temporary reprieve for UK mortgage borrowers

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

Student numbers

The pandemic posed a test for the UK's purpose built student accommodation (PBSA) market. Changes to fees in the wake of Brexit were weighing on EU applications already and the crisis raised questions as to whether or not large numbers of students would still be willing to travel long distances to study.

The data suggests the sector is passing the test. This is the first year in six in which the population of UK 18 year olds is larger than it was the previous year. Initial applications data for the 2022/23 academic year shows a 5% increase in the number of 18 year olds in the UK applying to go to university this autumn, driven by record participation rates among school leavers in England, Wales and Northern Ireland.

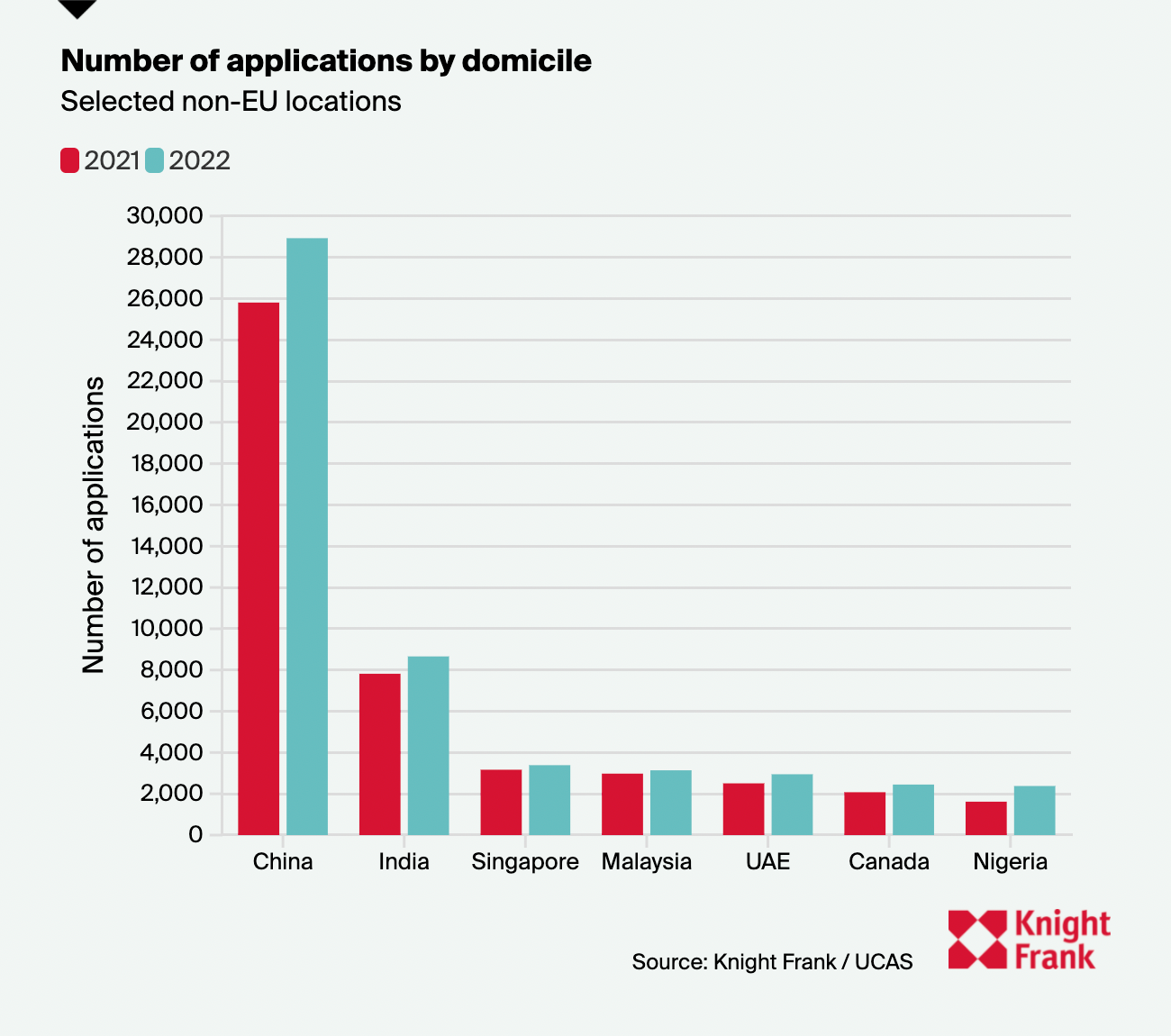

Applications from international students, who are more likely to live in PBSA, were 4% higher than last year. That's despite a 19% fall in applications from EU students. Applications from China grew 12.1% year-on-year, while applications from India were 11% higher, the data shows (see chart). The number of applicants from India has almost doubled in the last two years. See the analysis for more.

Mortgages

Mortgage rates in the US are spiking ahead of the anticipated interest rate hike in March. The average rate for a 30-year loan was 3.92%, up from 3.69% last week and the highest since May 2019 - see data from Freddie Mac via Bloomberg.

This is to be expected, mortgage rates generally rise with the base rate. But we're not seeing the same pattern in the UK, at least not yet. We did see a jump in UK mortgage rates ahead of the much mooted November rate hike that never materialised, but since then it's been eerily quiet.

Speaking with colleagues at Knight Frank Finance, the view is this is a temporary reprieve. Lenders begin the year with new targets and want to do as much business as possible during the early weeks of the year, which is dampening any desire to move up rates. The Bank of England is likely to hike the rate again on March 17th, which makes it a matter of time before we see borrowing costs start to follow the trends we're seeing in the US.

Bonuses

It's reporting season for the banks and early signs suggest that the Square Mile will follow Wall Street in paying bonuses at a scale not seen for a decade.

Standard Chartered is among the first to report on this side of the Atlantic. It's staff will share a $1.37bn bonus pot, up 38% compared to a year earlier. Goldman Sachs spent an average 23% more per employee.

The UK's largest four high street lenders will report their data over the course of the next week.

Golden visas

The UK government yesterday scrapped its "Golden Visa" scheme, which offered a route to residency for those investing at least 2 million pounds.

The move has been prompted by the Ukraine/Russia crisis but is part of a broader cooling on these types of schemes. As Flora Harley notes, Portugal has already tightened its Golden Visa program and other nations may not renew.

The Home Secretary's comments on social media suggests this is part of a broader crackdown, with more detail due in the forthcoming economic crime bill. We talked on Wednesday about proposals for a beneficial ownership register that have been bouncing around Westminster since 2016.

In other news...

With the biannual Fashion Week visiting the world’s fashion capitals over the next month, Chris Druce looks at which city is the top performer for mainstream house price growth.

Elsewhere - landlord excluded from cladding fix (Telegraph), UK seven-day COVID-19 infections down nearly 27% on week before (Reuters), ECB chief economist shifts inflation stance (FT), and finally, households feel the pinch of rising costs (Times).