Seniors housing investment on the rise

New entrants, the growth of rental and strong fundamentals drove record levels of investment into the UK seniors housing market last year.

2 minutes to read

2021 was another record-breaking year for investment into the UK seniors housing market with institutional investors spending £1.4 billion in the sector last year.

Annual spend was up 2.2% on the £1.3 billion spent in 2020, which was the previous record.

The number of deals agreed was also up, by 15% year-on-year, which reflects 2021 being a far more active market for investment than in 2020, when total spend was dominated by Lonestar’s £647 million acquisition of McCarthy Stone (accounting for c.40% of total investment). Excluding this deal from the figures means investment was up by more than 50% year-on-year.

As well as existing investors looking to build scale, last year saw a number of new entrants to the market including Blackrock, Macquarie, M&G and Natwest. There were also a handful of notable deals for rental-only platforms, including M&G’s investment into the Birchgrove portfolio, and Brigid Investments funding a portfolio of rental housing operated by McCarthy Stone.

We expect more will follow in 2022. Knight Frank has identified a further £1.6 billion of capital which has been committed to the sector but not yet deployed.

Confidence grows

Record investment volumes and a deepening pool of active investors point to a growing confidence in the sector’s ability to deliver attractive, sustainable returns.

It also reflects a wider pivot from investors away from traditional real estate assets towards residential product. Indeed, Build to Rent investment volumes also broke records in 2021, while there was a substantial amount of investment activity within the student market.

Housing for an ageing population

In January, a report from the House of Lords’ Built Environment Committee suggested that specialist seniors housing could be one part of the solution to the housing crisis, noting that to date, “little progress has been made on housing for the elderly”.

Analysis of development data shows that the supply of seniors housing is increasing - driven by private sector investment - albeit gradually.

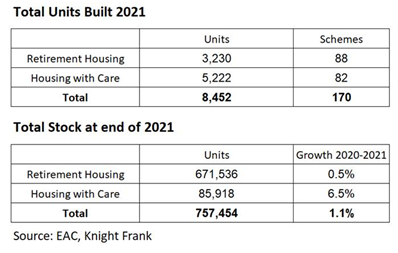

Last year saw an additional 8,500 units delivered across 170 retirement housing and integrated retirement community (IRC) schemes in the UK, an increase of 26% on annual delivery from 2020. IRC schemes, offering increasing service-led propositions, accounted almost two thirds of units delivered in 2021, and saw a 6.5% growth on total stock over the 2021 period.

It takes the total number of seniors housing units to in excess of 757,000. A further 10,000 units are estimated to be in the pipeline for delivery in 2022.

Furthermore, our analysis has identified more than 200 planning applications submitted for seniors housing schemes in 2021. Almost 120 of these have since received planning permission (as of December 2021) and are expected to be delivered in the coming years.