'Permanent' inflation, another boom year for BTR & will the UK see 5 interest rate hikes this year?

Making sense of the latest trends in property and economics from around the globe

4 minutes to read

Inflation

Inflation is the theme of the week. The Bank of England will on Thursday decide whether to raise the base rate again - likely to 0.5% - which would cap its first back-to-back hike since 2004. Annual consumer price inflation is running at 5.4%, it's highest rate in 30 years, and price rises are becoming increasingly broad based.

Trading in futures contracts suggests there could be as many as five - yes five, interest rate hikes this year, moving the base rate to circa 1.5%. Markets put the probability of a rise on Thursday at about 90%.

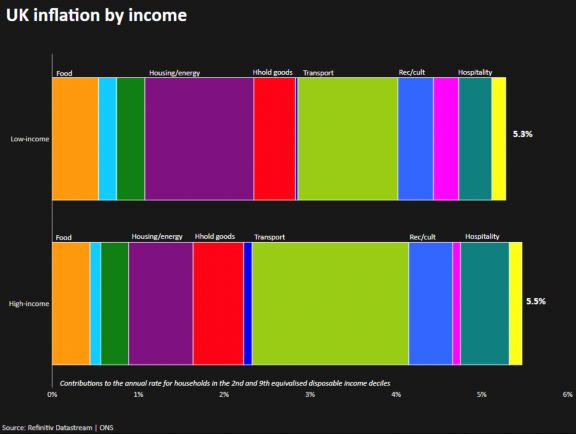

Inflation is impacting high and low income families to similar degrees, according to data published by the ONS on Friday. High income households' rate of 5.5% slightly outstrips lower income households' rate of 5.3%, largely due to transport costs, though spending at restaurants, on furniture and household goods, recreation and culture, and health also fuelled gains (see chart courtesy of Reuters). Low-income households’ experience of inflation has been driven by rising prices in housing-related costs.

Team Permanent

Whether or not inflation is a transitory quirk of pandemic-induced disruption or long-lasting feature of post-crisis economics has divided experts largely into two camps - Team Transitory and Team Permanent. You could say that Fed chair Jerome Powell was the captain of Team Transitory until late November, when he suggested it's "probably a good time to retire" the word transitory amid mounting evidence that rising prices extended beyond the cost of goods warped by the pandemic.

Nicolai Tangen, chief executive of Norges Bank Investment Management - Norway's $1.3tn oil fund - tells the Financial Times this morning that he is "the team leader for team permanent". His fund is seeing inflationary pressures "across the board", from Ikea furniture to trucking rates and energy.

Can central banks tame the beast? We're about to find out. We talked on Friday about Nomura analyst Robert Dent's view that the Fed may opt for a "shock and awe" approach by hiking 50 basis points in March. Raphael Bostic, president of the Fed’s Atlanta branch, tells the FT that a half percentage point increase is on the table if the data warrants it.

Headwinds

The UK housing market faces various headwinds in 2022, most notably rising mortgage rates, but so far the data suggests it's going to be another strong year.

The number of new UK prospective buyers registering with Knight Frank in the week beginning 10 January was the second highest figure in the last decade. Meanwhile, the number of market valuation appraisals (a leading indicator of new supply) in the week starting 17 January was the sixth highest figure recorded over the last ten years. Here's Tom Bill:

The positive performance of the housing market took most people by surprise over the last two years. It feels increasingly likely this will be repeated in 2022, even in the absence of a stamp duty holiday, albeit transactions will be down on 2021 numbers.

Another record year

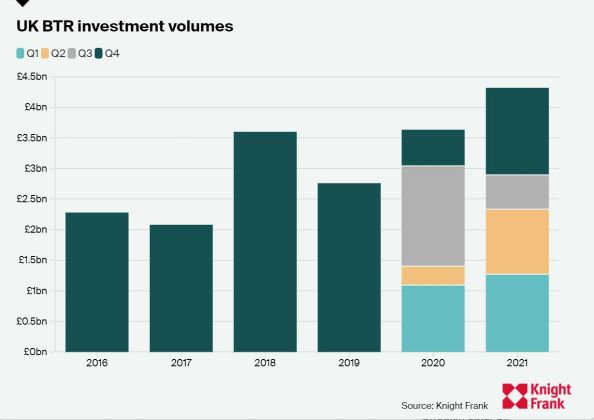

Investment in the UK Build to Rent (BTR) sector continues to rise. More than £1.4 billion worth of deals were agreed in the final three months of 2021, pushing year-end investment volumes to a record £4.3 billion.

Annual spend was up 19% on 2020, the previous record year. Deal volumes were also up by nearly a third year-on-year. Some 76% of deals struck were for schemes outside of London and almost a quarter of deals agreed during the year came from new entrants to the market.

The UK’s BTR stock now stands at around 60,000 completed homes with a further 170,000 either under construction, with planning granted, or in pre-planning. This brings the total pipeline to a possible 230,000 purpose-built rental homes due to be delivered in the coming years.

In other news...

In a new Rural Market Update, Andrew Shirley covers the competition meat and dairy producers face against the multi-million pound advertising budgets of plant-based alternatives, and how one big brand is playing fast and loose with the facts.

Elsewhere - Britain's empty shop numbers edge lower for first time since 2018 (Reuters), Britain to review buildings insurance cost rise after Grenfell fire (Reuters), Omicron slows UK growth to weakest since April (Reuters), Asian economic growth to outstrip Americas and Europe (FT), London’s economic growth set to outstrip regions again (Times), and finally, levelling-up plans target rogue landlords in the private sector (Times).