Entrenching ESG, the four-day week and is UK housing supply starting to build?

Making sense of the latest trends in property and economics from around the globe

5 minutes to read

ESG entrenched

Aviva will this week write to CEOs of 1,500 companies in 30 countries urging them to deliver and track progress on key ESG issues or face consequences like being sacked or paid less. The Sunday Times has seen a copy.

It has hallmarks of Blackrock founder and chief executive Larry Fink's seminal letter of four years ago, which can perhaps be credited with starting the fierce debate over whether firms are supposed to maximise value for shareholders or put ESG goals first, and the degree to which the two overlap.

There has been a fair bit of push back since then. The most notable example came from ex-Blackrock chief investment officer Tariq Fancy late last summer, who said the executives he used to work with "must know they're exaggerating the degree of overlap between purpose and profit". Indeed, if ESG compliant firms did provide higher returns we wouldn't need to be having the conversation at all, he said.

Mr Fink's latest letter, published last week sought to further dispel the idea that ESG goals were in conflict with building sustainable businesses for the long term. “We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients,” he said.

Both his and Mr Versey's letters hint at the degree to which the view that ESG goals are in lockstep with shareholder value are now entrenched among the most influential long term investors. From a markets and cost of capital perspective, that consensus is arguably all that matters. Shareholders and pension holders need to hope that the view is correct.

Seniors housing

Earlier this month the House of Lords’ Built Environment Committee released a report on the challenges of solving the housing crisis. The authors lamented the lack of progress on housing for the elderly, which they said had to be part of the solution.

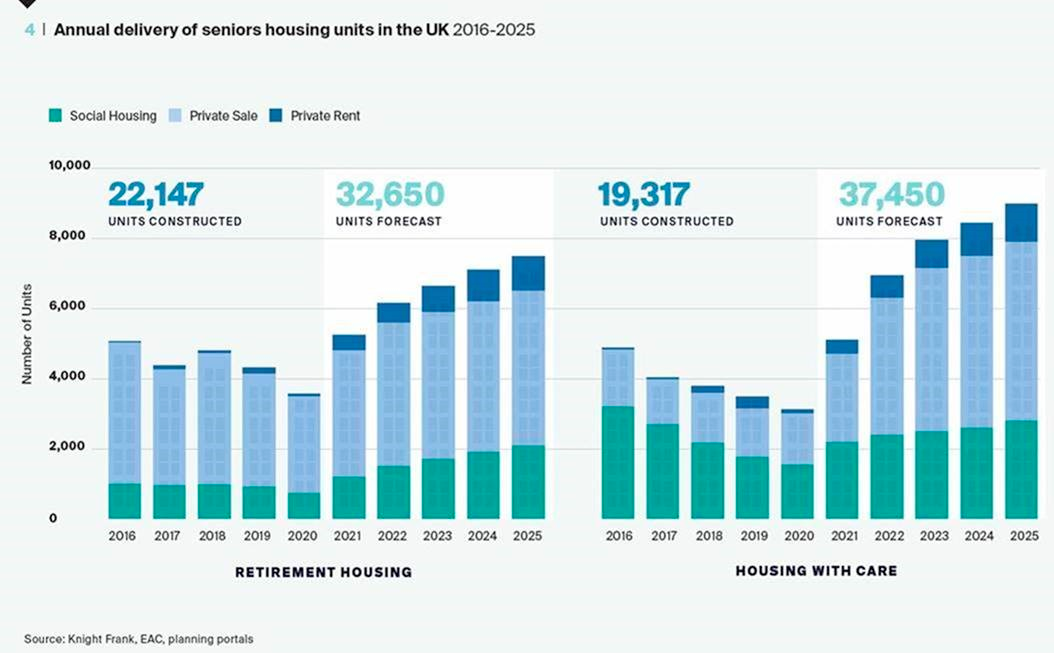

Indeed, while the number of specialist seniors housing units in the UK will grow by 9% over the next five years, the rate of delivery (see chart) will be dwarfed by the UK’s ageing population, deepening the existing mismatch between supply and demand. In real terms, it means that the number of seniors housing units per 1,000 individuals aged 75+ is expected to drop to 120 by 2025, down from 137 in 2010 and 128 currently.

The House of Lords' report did a good job of laying out the problems but was light on solutions and there are, in fact, a raft of zero-cost options available that we outline here. They include allocating a percentage of the country’s housing delivery target of 300,000 homes to be built as age-appropriate housing; holding local authorities to account to ensure seniors housing delivery is properly meeting local needs and giving more support to seniors housing in planning policy through its own planning use class, to name just three.

Housing supply

“Normal house price economics are out of the window until the supply side improves,” Kevin Cammack of Cenkos Securities wrote in a note to clients last week.

Mr Cammack was describing the UK housing market but it could apply to a raft of markets globally. In the US, for example, existing home sales fell nearly 5% in December alone as inventory dropped to its lowest level since 1999.

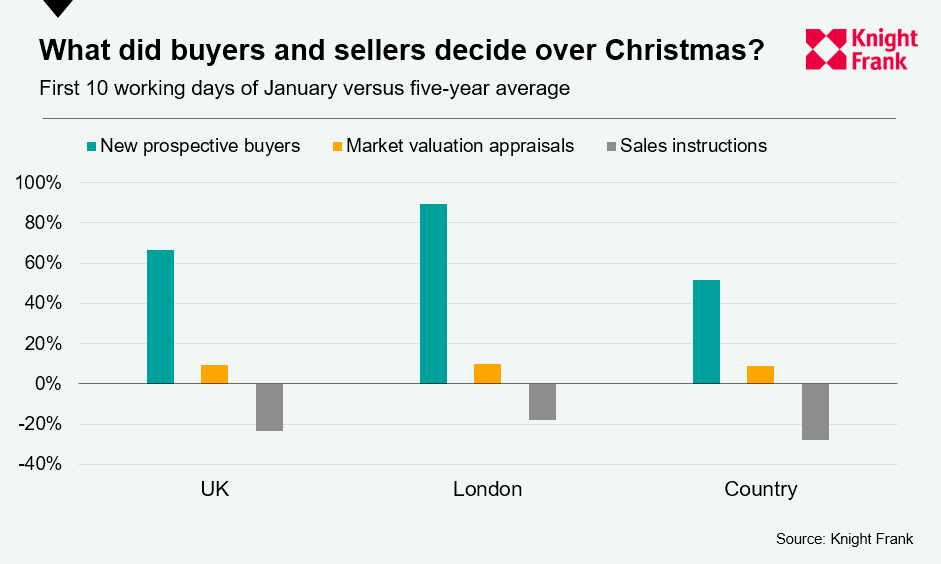

We check in to see if data from the first ten days of January suggests supply is improving across the UK.The answer to that question is “tentatively”, as the below chart demonstrates. Market valuation appraisals are a leading indicator of supply and the UK figure was 9% higher than the five-year average. Indeed, compared to the same period last year (when the country was locking down), the figure was up by 48% and its highest since 2016. It was a similar trend across all parts of the country.

The four-day week

Last week, six firms including the British arm of camera company Canon joined a four-day working week trial being run by the universities of Cambridge and Oxford. The researchers are hoping between 20 and 30 businesses will sign up.

The research has generated a huge amount of interest and there is unquestionably now momentum behind the idea. We talked last month about trade unions applying pressure at Lloyds Bank to introduce a four-day working week without cutting salaries, which would make it by far the largest employer to do so.

The arguments are summarised in this feature from the FT's Pilita Clark, who predicts it won't be long before the four-day week "begins to canter rather than creep" for one key reason - younger managers keen on the idea relative to their older peers. Nearly 80% of senior managers under the age of 35 liked the thought of adopting a four-day week compared with 56% of those aged 55 or older, according to Chartered Management Institute data.

In other news...

Stephen Springham takes stock of Christmas trading and the 2021 full year now the official figures are out: "the final quarter of the year was decent, even if the current direction of travel is less certain. And the outturn figures for 2021 as a whole far exceeded even the most optimistic of forecasts any of us were making this time last year."

In a new Rural Market Update, Andrew Shirley notes the rally in world wheat markets as fears over a potential conflict between Russia and the Ukraine heightened. Chicago Board of Trade (CBOT) wheat futures were up 7%, regaining all of 2022’s losses:

"The nervousness is understandable. Russia is the world's primary wheat exporter with as much as ten million tonnes from its estimated 35-million-tonne surplus left to ship this season, according to trader Frontier. Ukraine, the fourth-largest exporter, has eight million tonnes from its 24.5-million-tonne surplus to ship. Together, the two countries account for almost 30% of the world's wheat export trade."

Elsewhere - Inside the setbacks of Biden's first year (NYT), a Bank of England policymaker adds fuel to speculation we'll see another rate hike in February (Reuters), Africa's central banks set to hold rates to stimulate growth (Bloomberg), and finally, could blockchain speed up home buying? (FT).

Photo by Kervin Edward Lara from Pexels