US homes sales plunge, China cuts rates and pressure builds on councils missing housing targets

Making sense of the latest trends in property and economics from around the globe

3 minutes to read

A rate cut in China

While many of the world's central banks look to tighten monetary policy, China's central bank cut its key interest rate for the first time in two years in the face of slowing growth.

China's economy expanded 8.1% over the course of 2021, well above the government's 6% target, but various signs suggest that expansion will shrink this year. Goldman Sachs expects growth to come in at 4.3% for 2022.

Record exports from recovering global trade is maintaining momentum to some extent, but repeated outbreaks of Covid-19 and the ongoing property slump looks set to continue through the year. Home sales by value declined 19.6% from a year earlier during December, a sixth consecutive monthly drop, according to a Bloomberg tally of official figures. Investment in property declined 14%.

US homes sales drop

US home sales fell 11% in December compared to a year earlier, the biggest drop since the onset of the pandemic. according to Redfin. The fall wasn't for lack of demand - home prices soared 15% over the course of the year.

The dearth of available properties is now acute. There were 19% fewer listings in December compared to a year earlier, the lowest on record.

“There are plenty of homebuyers on the hunt, but there is just nothing for sale," says Redfin Chief Economist Daryl Fairweather. "In many markets, shopping for a home feels like going to the grocery store only to find the shelves bare.”

Missed targets in England

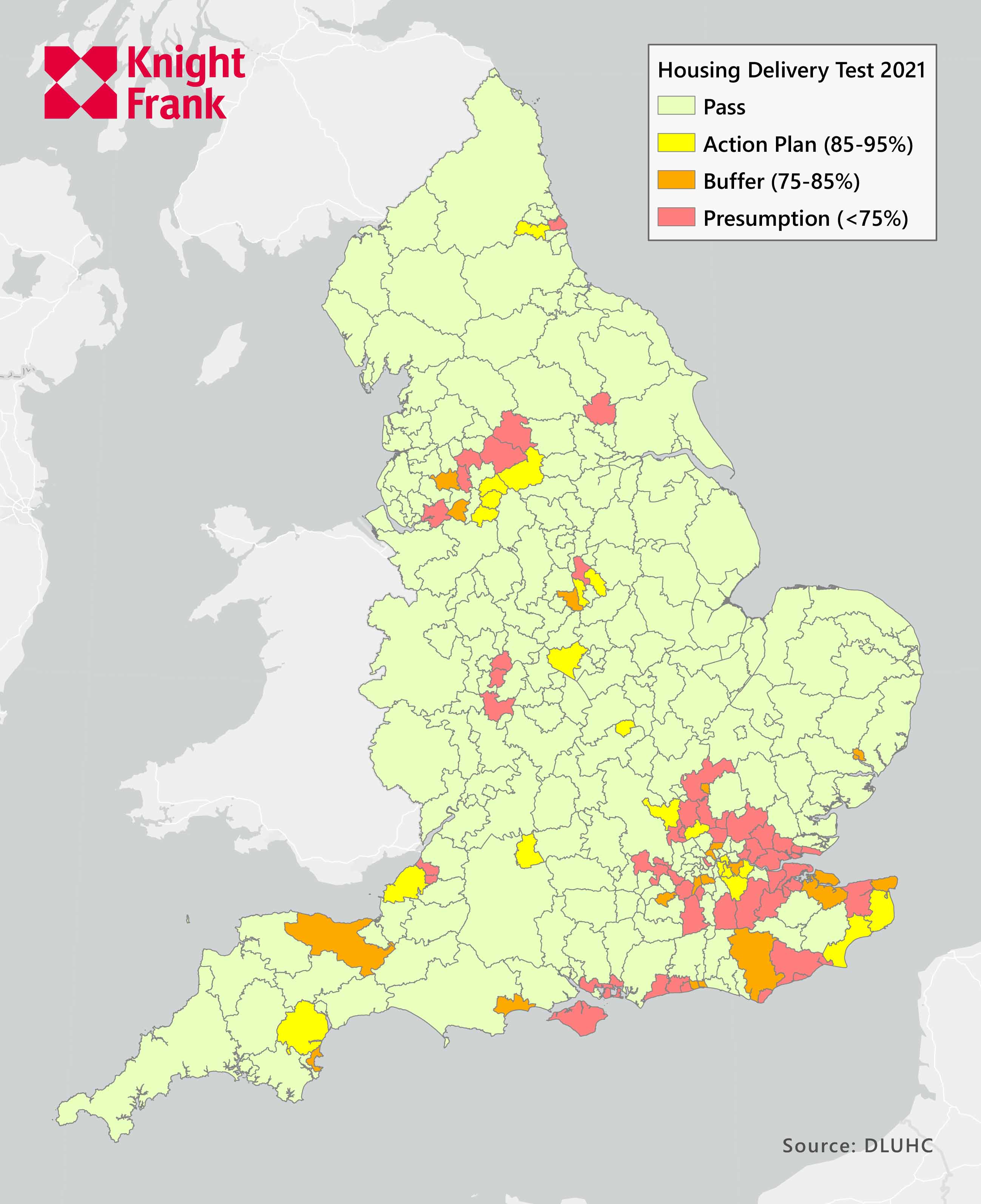

Some 51 local planning authorities (LPAs) in England delivered less than 75% of their official housing targets in the three years to March 2021, according to the results of the latest Housing Delivery Test (HDT).

These LPAs now face presumption in favour of sustainable development, a policy that approves any development unless its adverse impacts "significantly and demonstrably" outweigh their benefits. Consequently, these areas face having less sway over planning decisions. A further 19 LPAs saw delivery fall short by between 75% and 85% of housing need, therefore requiring the addition of a 20% buffer to their calculation of five year housing land supply.

Most LPAs that now face the presumption in favour of development are located in the East of England or the South East (see map), though there is also a noticeable grouping around Greater Manchester. Most of these contain some element of Green Belt coverage.

Rental supply tightens

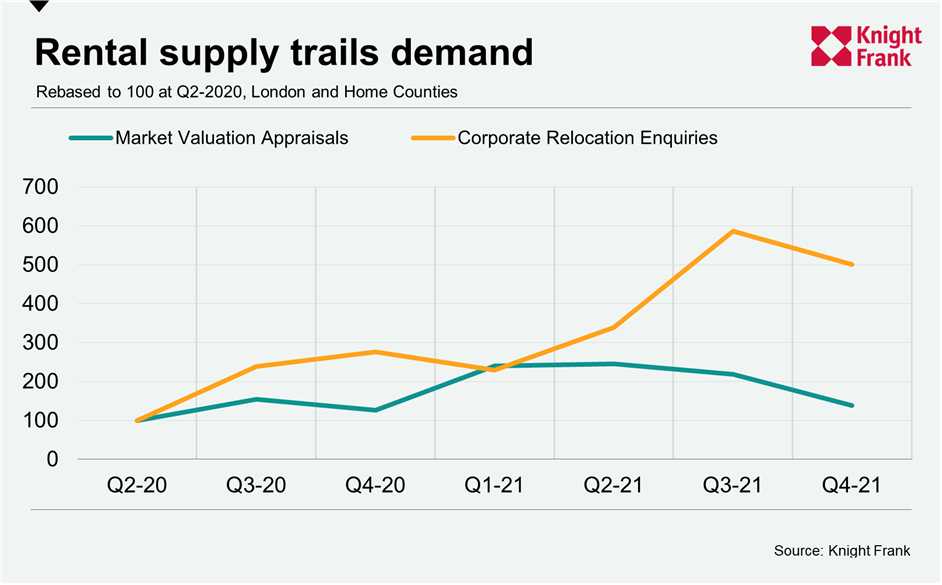

A shortage of supply of rental properties across London and the Home Counties is set to tighten further in the Spring, following a surge in corporate relocation enquiries. That will pile further upwards pressure on rents.

The number of corporate relocation enquiries was five times higher in the final quarter of last year than it was in Q2 2020. The enquiries come from companies of all sizes looking to relocate staff to the UK across a range of sectors including finance, tech and energy.

Meanwhile, the number of market valuation appraisals was only 38% higher. Appraisals take place when a prospective landlord values their property for the rental market and act as a leading indicator of supply. There will be a steadier flow of students looking for rental properties in the early months of 2022 than previous years, which will accentuate this imbalance.

In other news...

Stephen Springham gives his verdict on retail's Christmas sales: consumer demand is extremely strong, with scant regard for supposed economic headwinds.

In a new Rural Market Update, Andrew Shirley covers the booming Irish land market, and Knight Frank's new Head of Viticulture.

Elsewhere - L&Q housing association launches pioneering sustainability-linked bond (Investment Week), HSBC could restrict new mortgages as households face energy squeeze (the Sunday Telegraph), City Airport boss banks on revival of business travel to pre-pandemic levels (FT), Hundreds of UK construction businesses collapsing every month (FT), American bosses look to Britain for revenue growth (Times), and finally, Singapore's cooling measures start to bite (Bloomberg).