Riding out Omicron, the Great Resignation and the consumer spending splurge

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Riding it out

Further restrictions to tackle Covid are off the table for the time being. Boris Johnson last night said the country could "ride out" Omicron without going further than the Plan B measures already in place, despite the fact the UK recorded more than 1.2 million new infections in the most recent seven days.

There are tentative signs that the Omicron surge is beginning to abate in London and data suggesting the variant is much milder than Delta has strengthened over the Christmas break. In the US, where cases have just hit a record 1 million in a single day, hospitalisations are rising but remain far below recent peaks. Roughly 50 to 65% of admissions in some New York hospitals show up at the hospital for other ailments and then test positive for the virus, according to the NYT.

Still, the timing has been awful for many parts of the economy, particularly retail and hospitality. Footfall across British retail destinations in the days following Christmas was down a quarter compared to the same week in 2019, according to Springboard. The number of shoppers was down 15% on the previous week.

The restless consumer

Households have tucked away record amounts of excess savings during the pandemic and various surveys suggest a splurge will arrive eventually. Stephen Springham's future gazing report on the UK leisure sector published late last year talked of the restless consumer, "chomping at the bit" to begin spending when it feels safe to do so.

Bank of England data published yesterday suggests a surge in spending may be imminent. Household borrowing increased in November for the first time since the onset of the pandemic. The largest slice of growth came from an extra £900 million of borrowing on credit cards. Meanwhile, the amount flowing into National Savings and Investment Accounts fell to a net £4.7 billion, down from an average of £11.2 billion during the twelve months to October 2021. Omicron may hamper December's readings but it's clear a shift in attitudes is underway.

The same dataset revealed mortgage approvals for house purchase remained unchanged at 67,000 in November, the lowest since June 2020. Borrowing for house purchase is now broadly back in line with the pre-pandemic average. The ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages fell 9 basis points to 1.50% - a new series low.

The Great Resignation

More than 4.5 million US workers quit their jobs in November. That represented an 8.9% increase from October and broke September’s high-water mark of 4.36 million.

The global theme now known as "The Great Resignation" looks like it will stretch well into its third year. Some 60% of managers in the UK private sector say it is now harder to recruit for job roles than it was pre-Covid-19, according to a Chartered Management Institute survey for Bloomberg News.

The trend has two big drivers that are tricky to disentangle. People have been walking away from jobs in elevated numbers looking for new roles which fit their requirements, which has also been driving a huge amount of activity in the housing market. The second is a shortage of workers in low-wage roles such as hospitality, where employers are offering rising incentives to lure workers away from their current roles. We saw Amazon offering £3,000 bonuses to lure seasonal workers back in October. Most of the turnover in the US during November was in the latter category according to NYT analysis.

House prices

UK annual house price growth increased to 10.4% in December, from 10% a month earlier, according to Nationwide. That caps the strongest calendar year for house price growth since 2006.

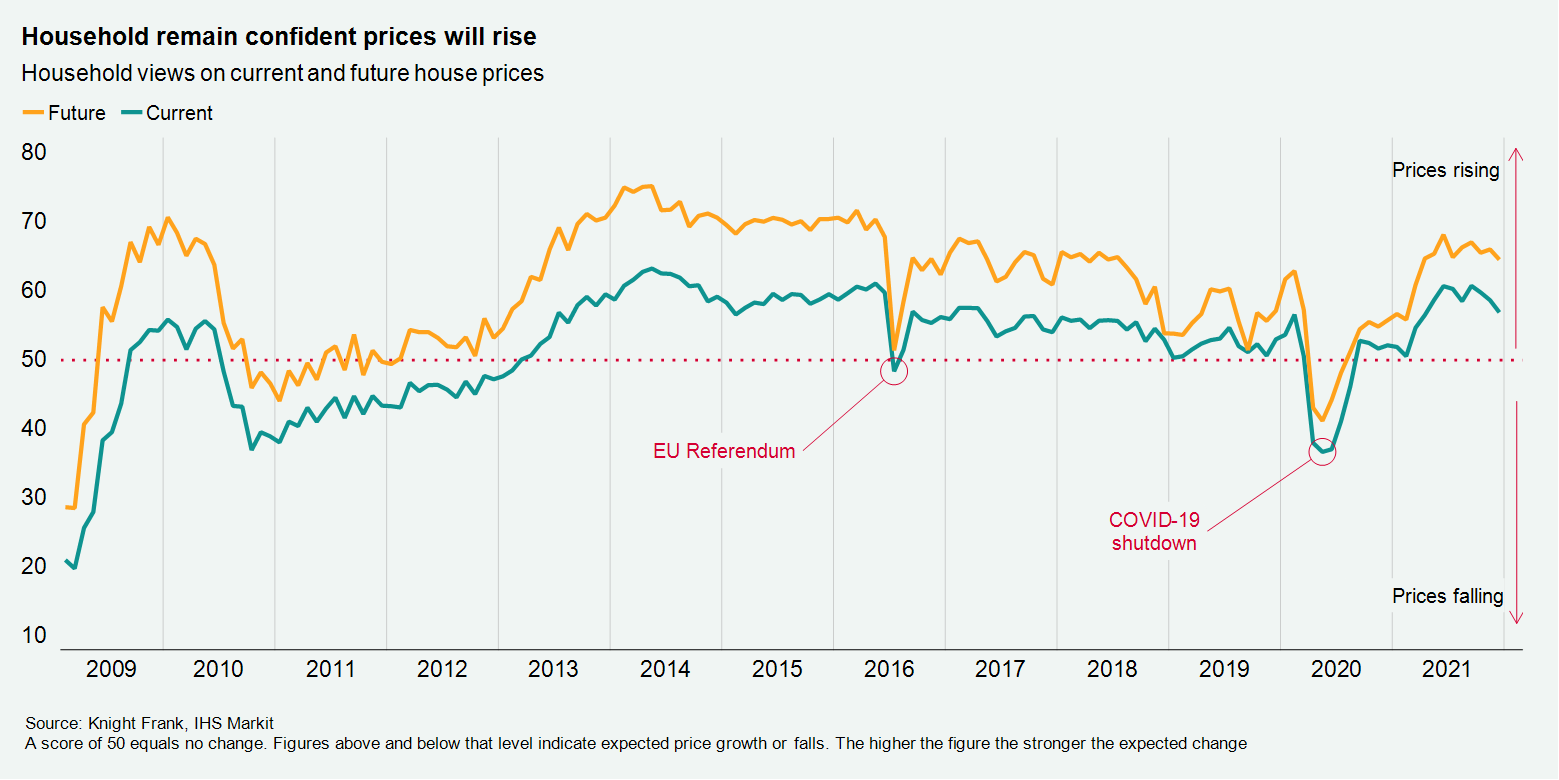

Our house view remains that we'll see house price growth ease over the course of 2022 as the supply shortage normalises and interest rates rise further. Households' views on future house price growth remained robust though eased a little in December (see chart). You can read more on our outlook for the year in the UK residential market and a range of other real estate sectors in our House View.

Tom Bill gives his view on what to expect in prime central London over the coming months. Average prices increased 1.3% in the year to December. Meanwhile, Chris Druce has the latest from the Scottish Prime Market. There was no change in quarterly price growth between Q3 and Q4 in the Prime Scottish Index, however prices in the 12 months to December finished the year up 5.8%. This is the strongest year-end performance since 2008.

In other news...

Chinese banks cut back traditional lending as concern over economy mounts (FT), Evergrande ordered to tear down 39 buildings (Times), WeWork founder Adam Neumann finds a new home in an apartments network (Times), 10 ways cities came back in 2021 (Bloomberg), Covid-19 testing rules in UK to be relaxed to reduce staff shortages (Reuters), and finally, UK factory activity growth revised up in December (Reuters).