House prices surge (again), retail's quiet Christmas, and your festive property reading

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Global house prices

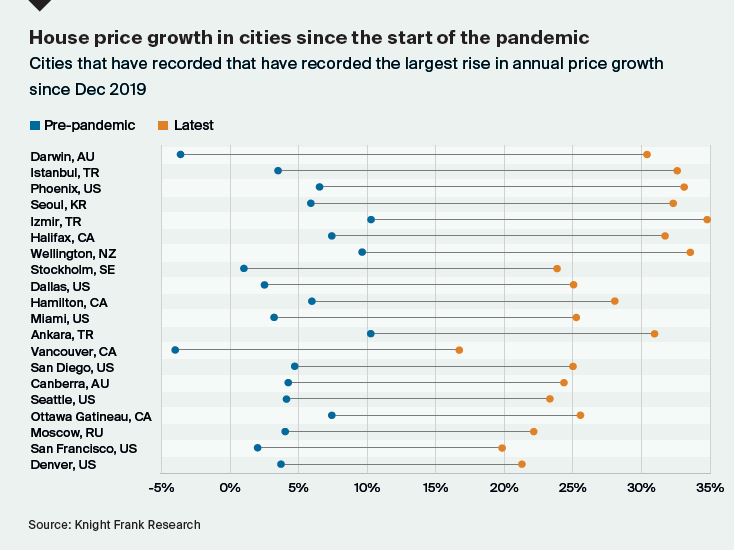

Massive government stimulus, lockdown savings, a pandemic-induced lifestyle reassessment, and low interest rates have all continued to fuel the global surge in house prices. In the year to Q3 growth hit 10.6% across the 150 cities in Knight Frank's Global Cities Index, the fastest pace in 17 years.

Of the 150 cities tracked, 93% saw prices increase over the 12-month period and a remarkable 44% saw prices increase by more than 10%. Cities in New Zealand, the US, Canada and Australia all rank strongly, with Wellington (34%), Phoenix (33%), Halifax (32%) and Hobart (31%) their respective frontrunners.

Darwin and Dubai represent the most improved markets. The Australian state capital saw annual price growth jump from 19% in June to 30% in September whilst Dubai, a city that has seen seven years of negative price growth, saw a marked shift with annual price growth reaching 6% in September, up from -4% in June.

Omicron

Preliminary studies published in the UK and South Africa suggest fewer people with Omicron are needing hospital treatment than with other variants. Estimates range from a 30% to a 70% reduction.

Though positive, the news has arrived late for the retail and hospitality industry. Visitor numbers in London's West End were 27% lower on Tuesday compared with the same day in 2019, according to the New West End Company. More than 50% of venues around the country reported a drop in revenue of at least 40% for last weekend, according to UK Hospitality.

Your festive reading wrap…

The Knight Frank research team have curated the perfect list of things to read and listen to over the Christmas holiday. In between the mince pies we hope you find time to enjoy our recommendations.

First up, Kate Everett-Allen picks this episode from The Economist’s Money Talks podcast, ‘It's not just Evergrande’ (Link)

“Although Evergrande has now defaulted, the signs are that in the eyes of the Chinese authorities it is too big to fail and its core business will be shored up in some way. This podcast from November provides a succinct round up as to why China’s poorly regulated small and medium-sized banks are largely to blame for China’s indebted developers and wider financial stresses. China’s future property market performance will have implications for global real estate – commercial and residential.”

Next Tom Bill thinks we all need to do our bit to understand virtual property: -

‘What is virtual real estate and why do I care?’ (Podcast) - The Real Wealth Show (Link)

‘Virtual real estate plot sells for record $2.4 million’ (Article) - Reuters (Link)

‘When Purchasing a Real Estate NFT, What Are You Really Buying?’ (Article) - Mansion Global (Link)

"Someone who used to work in physical real estate explaining the appeal of virtual real estate – blockchain enabled it and the pandemic has accelerated the growth of the metaverse, whatever that is. It seems the old adage 'they aren’t making any more of it’ no longer applies to land, but how would a bursting NFT bubble compare to the real thing?"

Following that virtual trip Anna Ward provides some much needed space for reflection and points to ‘Four Thousand Weeks’ by Oliver Burkeman (Link)

"An interesting way of looking at how we use our time. For property industry executives there is relevance both for how they use their own time, and in the context of the pandemic how changes in priorities will impact residential and commercial property markets."

Oliver Knight looks to one of the biggest stories of the year - the collapse and rise of London’s residential lettings market during the pandemic - recommending this (Link) podcast from the Knight Frank Intelligence Talks series

"The covid inspired ‘death of the city’ narrative was firmly put to rest in 2021, the resurgence in demand for rental property will have long-run impacts with growing numbers of institutional investors taking notice, expect more growth in 2022.”

Sticking with big narratives, Flora Harley thinks we need to keep focused on prices and selects this article on US inflation by Ira Kalish (Link)

“Jay Powell's journey with the term "transitory" in relation to inflation has been a fascinating case study in deciphering the words of central bankers. The case is a reminder to avoid taking headlines as they are – transitory was never meant to mean a few months of inflation, by numerical reasoning will take at least a year to work through.”

Finally Andrew Shirley takes us for a much needed winter walk

“I’d recommend Wilding: The return of nature to a British farm by Isabella Tree (Link) because it highlights in a beautifully written way why landowners need to take a fresh look at how they manage their farms or estates in a world that is experiencing a huge drop in biodiversity and a rapid decline in soil fertility.”

That’s all from the Knight Frank Research team until the New Year.

I hope you all have a very Happy Christmas.