Rise of the silver surfer and implications for urban logistics distribution

65% of 65s and over now shopping online in 2020

5 minutes to read

The use of the internet by older adults is growing at such a substantial rate that they are becoming an increasingly important potential market for e-commerce. Much of the focus has been on the younger adults aged 16-24 and 25-34 years, who have the highest percentage of online shoppers, with less attention paid to the online behaviours and shopping habits of older consumers.

Though there has been little change in high internet use for adults aged 16-44 years in recent years, the proportion of those aged 75 years and over who are recent internet users has nearly doubled since 2013, from 29% to 54% in 2020. According to the ONS, in households where there is only one adult who is over 65 years, 80% had internet access in 2020, compared with just 36% in 2012.

The notable shift in shopping habits amongst older shoppers over the past ten years was further boosted by the onset of the COVID-19 pandemic, propelling older shoppers to increase their internet usage and their online spend. Though older shoppers still spend less than average, they are the fastest-growing group of online shoppers by age group, arguing that demographics are expected to play a lesser role in the future of online penetration rates.

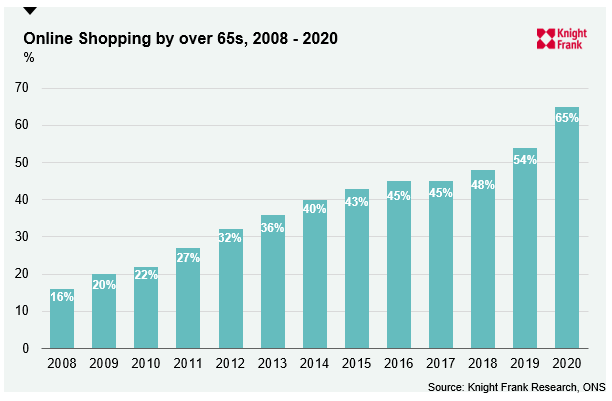

From January to February 2020, 87% of all adults shopped online within the previous twelve months, up from 53% in 2008. Those aged 65 years and over recorded the highest growth rates, rising from 16% to 65% over the same period (Source: ONS). Not only is the proportion of older adults shopping online rising, but they are also shopping online more frequently, resulting in increasing demand for rapid end-consumer deliveries. According to data from Mintel, the number of over 65s shopping online weekly grew from 16% in 2019 to 28% in 2021.

Click to enlarge image

The pandemic motivated many older adults who may have been “shielding”, into using the internet for the first time to purchase groceries when lockdown hit in March 2020. This created an almost brand-new customer base overnight for grocery stores and pharmacists offering delivery services. Research from Kantar Worldpanel showed that over 65s spent 94% more on supermarket deliveries in April of 2020, during the lockdown period, than they did in April 2019. Mintel also reported in November 2020 that, of those older online grocery shoppers, 86% did so at least once a week and 43% of whom did so 2-3 times per week.

In terms of the type of goods bought online by older adults, in recent years we have seen the fastest growth in medicinal purchases, recording a three-fold increase between 2013 and 2019 (most recent comparable data available from ONS). This is followed by clothes, shoes or sports goods (+136%) and food and groceries (+113%). In 2020, the most popular items purchased by over 65s were clothes, furniture, household and gardening products, books and medicine.

Click to enlarge image

Recent data by Mintel indicates that Amazon is the most popular retailer in which over 65s are shopping, followed by eBay. For food and groceries, the most popular online platforms are Tesco, Sainsbury’s, ASDA, Morrisons and Iceland. It has been highly documented that the online grocery market soared in 2020, growing by 78% to reach £22.3 billion. But it is in the older cohort where a stark jump in demographics was seen, with the number of over 75s using online services for all/most of their grocery needs jumping from 8% to 28% between 2019 and 2020 and a similar surge among the 65-74 age group.

Driven by the increase in medicine purchased online by the elderly and vulnerable from 2020, some of the larger pharmaceutical retailers such as Lloyds, Boots and Well are offering free or reduced-rate delivery services of NHS prescriptions across the UK. As online purchases in the healthcare market grow, so too does the demand for pharmaceutical warehousing and logistics facilities, and e-commerce and “distance selling” pharmacies will continue to play a vital role in the supply chain.

Mintel also reported that, while these older shoppers are more likely to reduce their level of online shopping post-pandemic, the market only needs to retain small portions of this inflated demand to see a significant legacy boost. In a market that has traditionally focused on serving the younger shopper, the increased interest among older age groups in the online channel presents significant opportunities and feeds into the likelihood of a net boost to the overall online channel from the pandemic. Approximately 22% of 55-64s expect to continue to do more shopping online post-pandemic, compared to 8% who plan to do less, while 18% of over 65s plan to do more, compared to 11% who expect to do less.

The challenge for many retailers in this changing shopping environment is the trade-off between investing in physical space and investing in their digital platform. Such businesses must follow these consumers who are moving online. What we are seeing within the sector is the changing strategy among retailers, particularly department stores and grocery retailers, who are committing to moving more of their business online and trimming their store estate. Some retailers have also caught on and have partnered with Amazon for grocery delivery offerings. The long-term impact of such trends means a rising demand for last-mile logistics services, particularly in locations impacted the most by the rise in over 65s shopping online. Geographically, the density of over 65s residents is greater outside the M25 and in the outer London boroughs, while only 11% live in the inner London boroughs (Source: ONS). This means a clear and greater demand for logistics services in more suburban and rural locations than in the urban parts of London, and a more dispersed consumer base results in greater complexities and costs of the services provided by logistic companies.

However, in contrast with younger generations who are increasingly demanding faster turnaround times, attitudes towards fast deliveries among the over 65s appear to be less critical. Over 65s appear to be much more driven by functional and simplistic factors of shopping online, such as free delivery, low prices, a wide range of products, and easy-to-use websites (Source: Mintel).

Although younger, urban residents remain more inclined to shop online compared with older residents in less densely populated areas, the geography of online shopping patterns is shifting as the demographic profile of online shoppers is changing. Growing demand from older shoppers residing in suburban and rural locations has implications for last-mile delivery providers in terms of their delivery methods and location strategy.