Record sales as UAE residential market bounces back

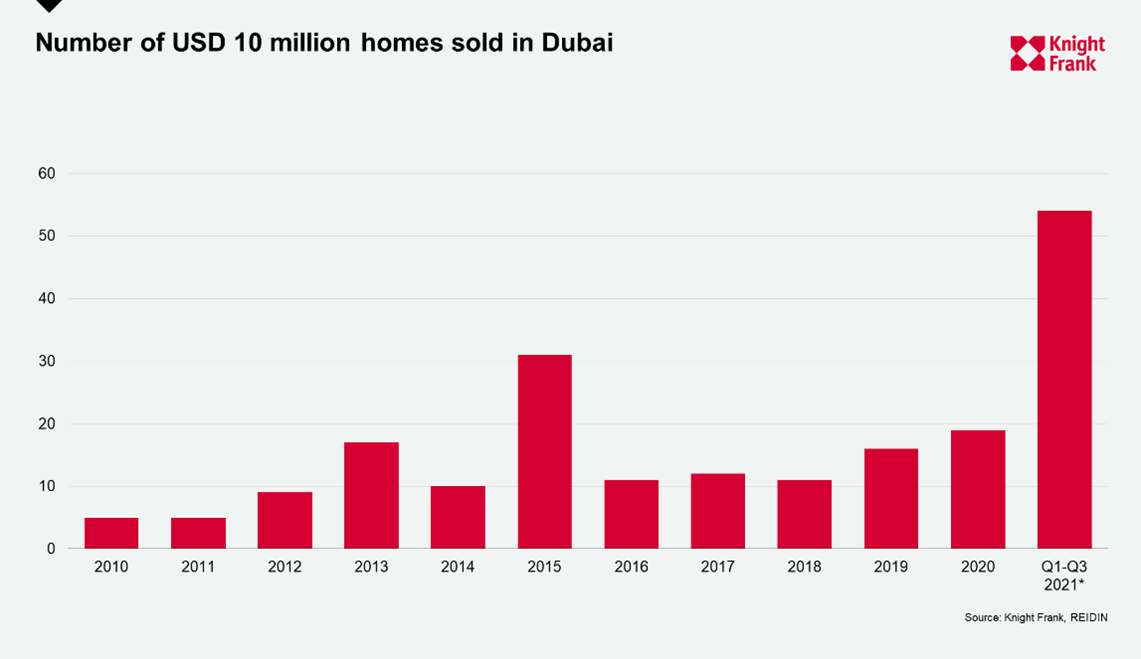

New record of 54 US$ 10m+ homes sold in Dubai as villa prices up 16.5% year on year and Abu Dhabi residential values climb.

2 minutes to read

Residential property values in the UAE’s two largest cities, Dubai and Abu Dhabi, have expanded at their fastest pace since 2015.

Faisal Durrani, head of Middle East research, explained: “The market is roaring back to life. The emerging euphoria around the fact that the UAE has the pandemic so well and truly under control, coupled with the excitement around the much-anticipated World Expo are adding to the confidence that is taking hold in the residential market.”

Not to be understated, but the UAE’s decisive, rapid and world leading response to the pandemic has caught the attention of the world’s wealthy who continue to flock to Dubai, snapping up the most expensive homes in locations such as the Palm Jumeirah and Jumeirah Bay. This has played a large part in driving up villa values, according to Knight Frank.

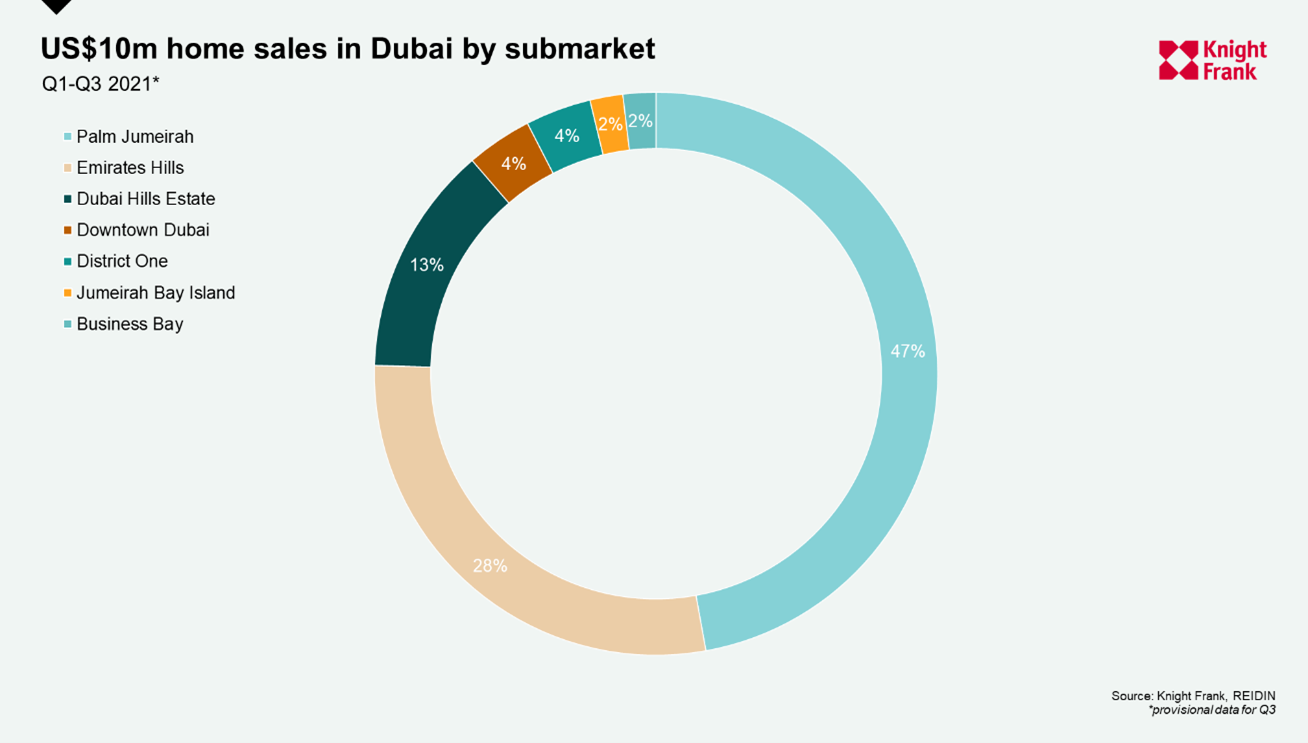

Durrani continued: “Villa prices in Dubai are provisionally up by 5% in Q3 and nearly 17% higher than they were at this time last year. Indeed, the number of $10m plus homes sold currently stands at 54, smashing the previous record of 31, set back in 2015 – and there’s still three months left to run this year. Unsurprisingly, the Palm Jumeirah and Emirates Hills account for almost 75% of super prime home sales in the city, but we are witnessing new Dubai submarkets such as Business Bay join the exclusive list of US$ 10m plus locations. It was only a matter of time before the ‘halo-effect’ from Downtown Dubai spilled over to surrounding markets, highlighting that not only is Dubai’s super prime market expanding, but it is also maturing.”

Abu Dhabi back in the black

Not to be outdone, values in Abu Dhabi too are climbing, with residential values overall enjoying their second consecutive quarter of positive year on year increases, according to Knight Frank’s analysis.

Residential values in the Emirati capital are now 2% higher than they were a year ago, with villas (3.1%) experiencing stronger growth than apartments (1.8%).

“As has been the case throughout the pandemic, existing and aspiring home-owners have their eyes firmly set on larger homes, whether for more room for a home office, or access to extra space, indoors, or outdoors. It really is a case of bigger is better, as has been reflected in recent rapid off-plan villa sales projects in Abu Dhabi, such as Aldar’s 480-villa Noya Viva development on Yas Island, which sold out in 48 hours in April, or the more recent swift sale of all 83 villas at Saadiyat Reserve the Dunes”, concluded Durrani.

US$10m+ home sales in Dubai by submarket in 2021*

- Palm Jumeirah: 25

- Emirates Hills: 15

- Dubai Hills Estate: 7

- Downtown Dubai: 2

- District One: 2

- Jumeirah Bay Island: 1

- Business Bay: 1

*includes provisional data for Q3 2021

For more information, please contact Faisal Durrani