Why Barbados is expected to shine bright this winter

An effective Covid-19 strategy, an innovative visa programme as well as significant investment in the island’s infrastructure are together providing a boost to Barbados’s property market

4 minutes to read

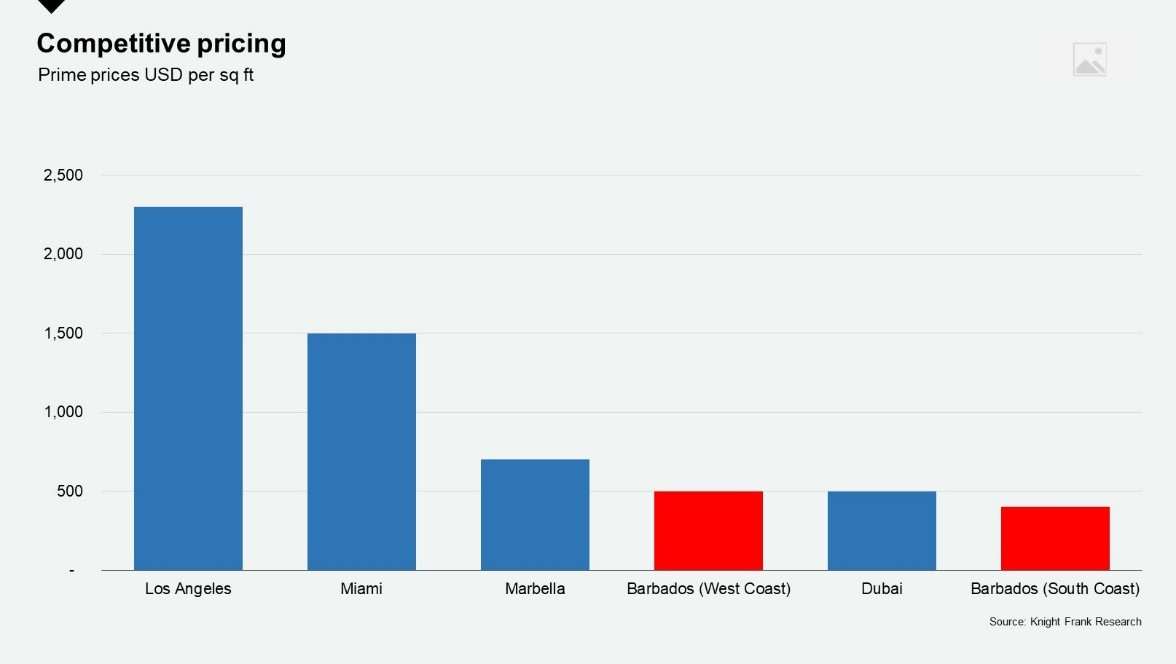

- Prime prices for beachfront apartments range from $400 per sq ft on the island’s south coast to $600 per sq ft on the west coast

- The 12-month welcome visa attracted 2,953 applicants between July 2020 and 31 August 2021

- British and European residents can travel to Barbados without the need to quarantine on arrival provided they show a negative PCR test three days before their flight’s arrival

One of the first countries to announce its 12-month welcome visa, Barbados’s property market was given a boost by the scheme. Of the 2,953 applicants 1,987 were approved according to the Barbados Government.

The “digital nomad” visa allows applicants to live and work on the island for up to 12 months provided they earn US$50,000 or more per annum or have the same in savings.

According to data from the Barbados Government, the top five leading countries seeking entry under the programme are the US, the UK, Canada< Nigeria and Ireland with 71% per cent of them aged 45 or under. To date, over eight million dollars in fees have been generated by the programme.

Most opted to rent long term but with many now coming to the end of their 12-month stay, estate agents are beginning to see more enquiries from those looking to retain a foothold on the island by purchasing a second home.

According to Knight Frank’s Edward de Mallet Morgan, “The Caribbean is seeing strong sales activity but where Barbados stands out is in terms of the choice of properties it offers, everything from beachfront apartments to larger traditional-style villas inland, often overlooking the island’s pristine golf courses.”

Edward adds: “If you are looking to buy in Barbados, we are advising clients to start their search sooner rather than later. Now that most travel restrictions have eased, this season looks like it will be one of the busiest we’ve seen for several years, both in terms of sales and rentals.”

Why Barbados?

Located outside of the Caribbean’s Hurricane belt with no restrictions on foreign ownership, the island’s efficient fiscal environment, including no inheritance tax or capital gains tax, offers benefits to wealthy individuals and their families.

Although the welcome visa has grabbed the headlines, Barbados also offers Special Entry and Reside Permits (SERPs), the initiative allows non-residents to gain residency for five years in return for a US$2m property investment, conditions apply. High-net-worth individuals owning assets of US$5 million or more worldwide are also eligible to apply.

For second home owners who let their home to remote workers during the crisis the good news is tourists are now returning to Barbados bolstering short-term lets once more.

Barbados hits 10,000 tourist milestone in July

In July, Barbados recorded over 10,000 air passenger arrivals for the first time since December 2020 according to the Barbados Tourism Marketing Inc. suggesting a buoyant winter season ahead. US arrivals accounted for 43% and UK tourists 34% of the total in July.

Effective discount for UK buyers

The Barbadian dollar is pegged to the US dollar and as the pound has strengthening against the US dollar - it currently sits at around 1.36 compared to a low of 1.16 in March 2020 - UK buyers are now experiencing a comparative discount while in turn UK vendors can often afford to be more flexible on price.

Relative value

Barbados offers relative value compared to major cities and key second home destinations. The financial crisis took a heavy toll on the Caribbean’s property markets but fast forward a decade and the island offers good value with prices down around 20% from their pre-2008 peak. There are clear signs that the market is stabilising particularly on the desirable West Coast where sale volumes are rising.

According to Andrew Blandford-Newson, Knight Frank’s Barbados expert, “While a home in Barbados is ultimately a lifestyle purchase rather than a high-yielding investment, most second home purchasers opt to rent their property and generate a small return. Rental demand is highest between December and February but as temperatures rarely fall below 23°C, Barbados provides year-round appeal.”

Barbados Buying Guide

• There is no stamp duty or capital gains tax

• The Grantley Adams International Airport is earmarked for significant investment, with scheduled flights to 24 destinations in 14 countries

• The Barbadian dollar is pegged to the US dollar 2:1

• Attorney fees are approx. 1% - 2.5% plus 17.5% VAT

• US$ mortgages are readily available to non-nationals

A full version of Knight Frank’s Barbados Buying Guide

Get in touch with the team, search for your Bajan home, or explore which neighbourhood our expert team are tipping for growth.

Image by PublicDomainPictures from Pixabay