The last mile supply crunch, the flight to quality offices and the Bank of England's rate conundrum

Making sense of the latest trends in property and economics from around the globe.

4 minutes to read

Will they, won't they

With consumer confidence now at its lowest level since the first lockdown amid rising cases of Covid-19, soaring energy bills and deepening concerns about the UK's economic outlook, you'd be forgiven for thinking the Bank of England might opt to hold interest rates at record lows until the economy is completely out of the woods.

Markets don't think so. Gauges of futures prices put the odds of a rate at November's meeting of the Monetary Policy Committee at 80%. The decision will be published on the 4th.

Governor Andrew Bailey's statements that officials would need to act to curb inflation set hares running over the weekend. Despite news that inflation dipped to 3.1% in September, Huw Pill, the Bank's chief economist, tells the FT this morning he sees inflation hitting 5% and that officials will take a "live" decision on rates at the November meeting.

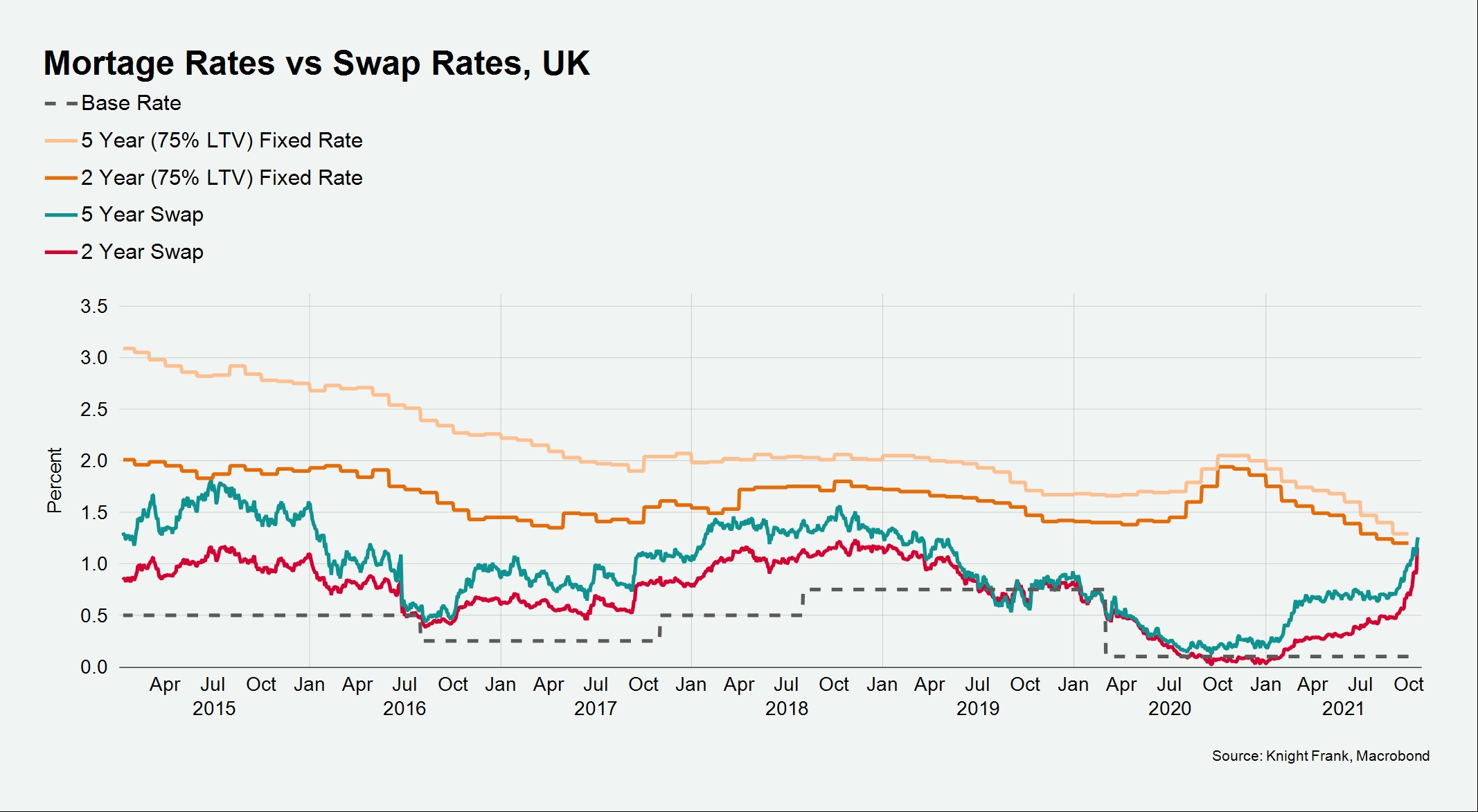

Swap rates, a good barometer of the path of borrowing costs, are climbing sharply. Spreads between 2 and 5 yr fixed rate mortgages at 75% LTV and their respective rates in the swaps market are now approaching zero.

Swap rates are climbing sharply

Last mile

Warnings from car manufacturers during the height of the Brexit negotiations, the blocking of the Suez by the Ever Given and various forms of disruption during Covid-19 revealed the fragility of global supply chains.

Manufacturers have reacted by shifting operations closer to the end consumer, putting them in direct competition for urban logistics space with third party delivery companies, e-commerce operators and the rapidly expanding roster of companies offering grocery delivery in minutes.

A new report from our industrial research team reveals the scope of the "rampant demand" for urban logistics space. Across the UK, the vacancy rate for units under 100,000 sq ft and located in urban areas, is now just 3.2% and is expected to fall further.

The team estimates some 1.36 million square feet of industrial space is required for every £billion of online sales. Of that space, 320,000 square feet should be last-mile or "spoke" facilities. E-commerce spend soared by £36 billion in 2020 compared to a year earlier, equating to a need for an extra 11 million square feet of last-mile space. Forecasts for online spend suggest the market will need another 12 million square feet by 2025.

The flight to quality

The latest data from the Paris office market confirms trends we're seeing in many global cities; occupiers want better quality space, in more central locations, even closer to amenities.

Take up in Paris is likely to end the year at about 1.7 million sq m, according to a new report from David Bourla. That's an improvement on the take up of 1.38 million sq m last year, though still down on the 2.4 million sq m of take up in 2019.

Since the beginning of 2021, 71% major transactions have involved new or redeveloped space, mirroring London, where in the second quarter just under 70% of all take-up was for new and refurbished space.

Performance of the various submarkets was varied, though the CBD outperformed with take up rising 61% in a year. A shortage of office space is now on the horizon - more than half of all offices over 5,000 sq m due for delivery by the end of 2023 are now pre-let. Across Paris just under 300,000 sq m of office space over 5,000 sq m is expected to be available by the end of 2023, and annual take up has averaged 290,000 sq m since 2016.

Occupiers in Paris want better quality space

Country houses

Price growth in the country market moderated to 2.1% in the third quarter.

While this was the weakest quarterly rate this year, it compares to 2% in Q3 2020 during the stamp duty holiday and remains significantly above pre-pandemic levels. It may, however, be an early sign that the ‘escape to the country’ momentum is peaking, according to Chris Druce:

“After a remarkable period of activity some of the heat has come out of the country market as we move into autumn. However, the return to normality will likely be a slow process with demand still significantly outstripping supply, a situation that is unlikely to improve significantly until next spring.”