City property prices rise, interest rate hikes and vacant property taxes

Your international property and economics update tracking, analysing and forecasting trends from around the world.

3 minutes to read

Interest rates

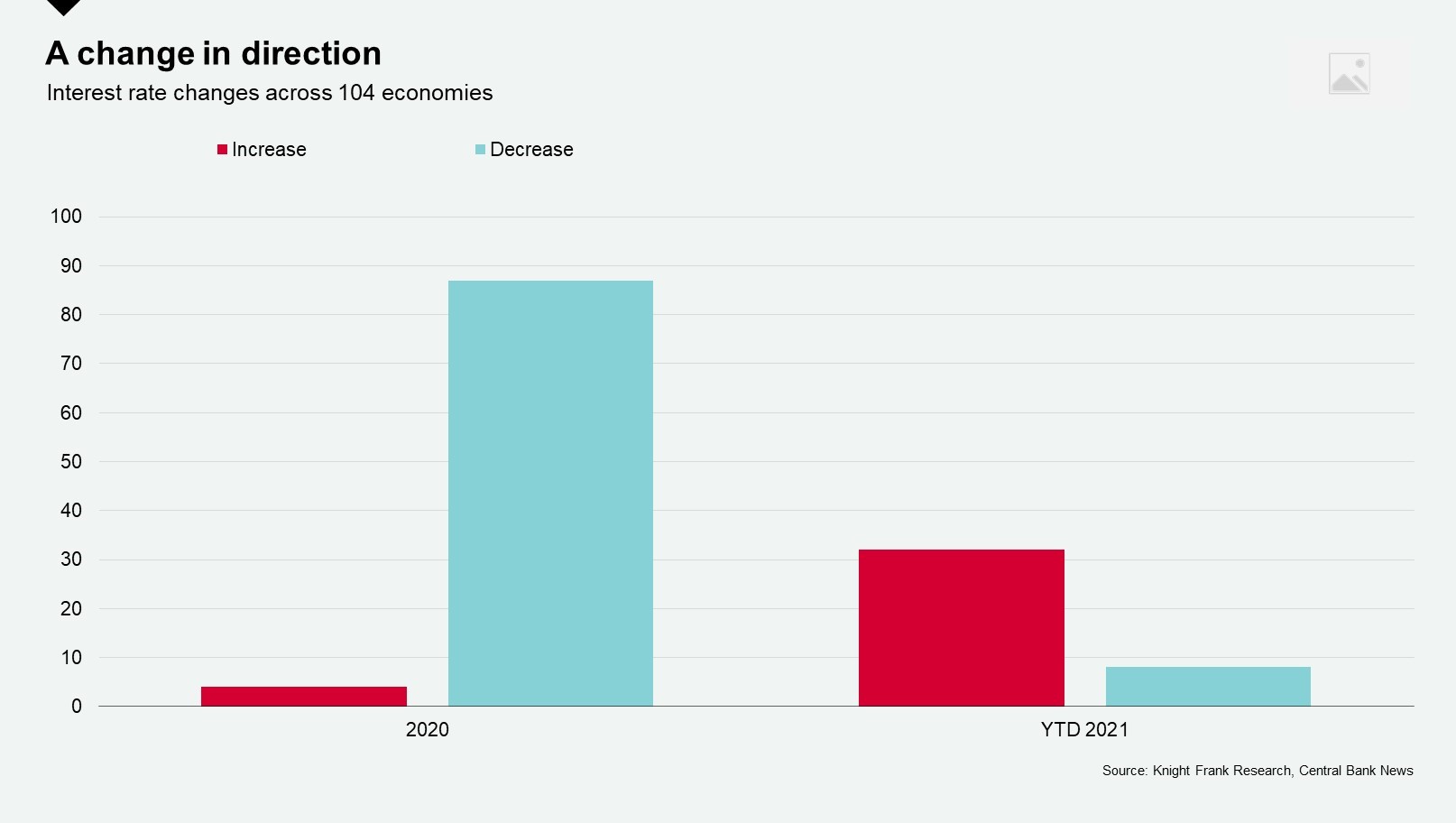

Norway led, and now New Zealand and Poland have followed suit. There is a clear change of direction when it comes to monetary policy amongst advanced economies.

The US and the UK are expected to be hot on their heels with Minutes from the Bank of England’s MPC suggesting members were edging closer to a rate rise at September’s meeting.

To date, 32 out of 104 economies have raised interest rates in 2021, up from just four in 2020.

But will rising rates be enough to stifle inflationary pressures and in particular booming housing markets? Over the summer the word ‘inflation’ was rarely heard without the prefix “transitory” but as supply chains slow and labour shortages mount, so analysts are looking less assured.

If inflation does persist, we expect more HNWIs to act early and take advantage of cheap debt, using property and its income-generating qualities as a hedge against inflation before rates start to rise.

City house prices

Across the 150 cities tracked in our Global Residential Cities Index, prices are rising in 139 of them suggesting that far from bringing about the death of the city, the pandemic has heightened the appeal of urban living globally.

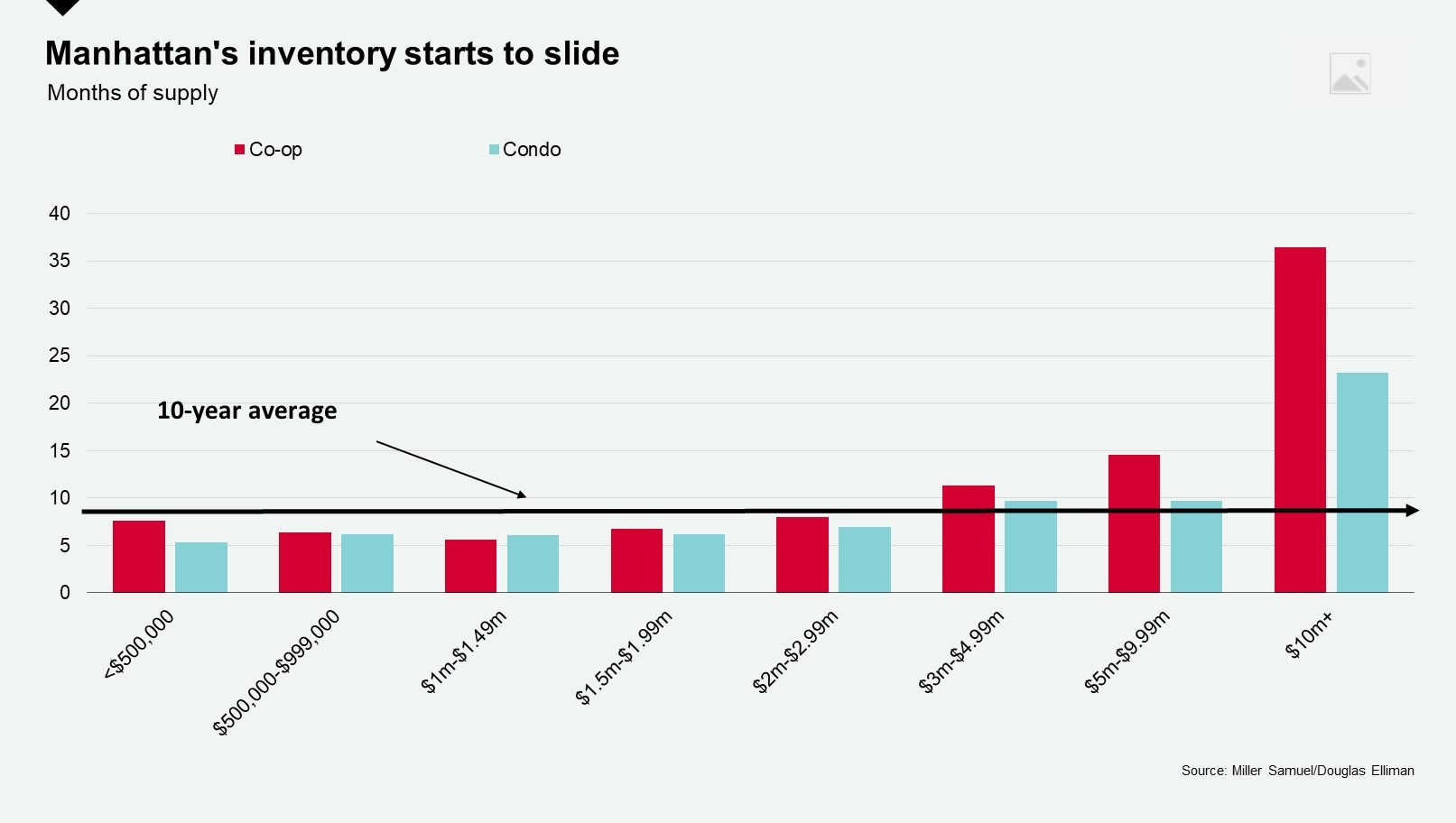

New data from Miller Samuel underlines the extent to which the Manhattan market has picked up. The supply of properties priced below US$3 million is now below its 10-year average, with co-ops and condos prices between US$1 million and US$1.49 million having the lowest stock level.

Taming times

Alongside rate rises, governments are slowly starting to introduce new policies to tackle escalating prices.

Justin Trudeau, who won a second term in office with a pledge to ban foreign buyers from Canada for two years, has yet to provide any firm detail, but the move clearly overshadows the foreign buyer taxes introduced in British Colombia and Ontario since 2016.

Australia has raised the minimum interest rate buffer that banks use when accessing the serviceability of home loan applications and Los Angeles is planning to put a vacant homes tax on the ballot for 2022. We expect more.

Evergrande

A year ago Chinese regulators put in place limits on the amount of leverage property companies can take on. According to Don Whineland, The Economist’s China Business and Finance Editor, “Essentially the government has created almost an artificial cash crunch that is pushing these developers towards default, and in some cases collapse.”

President Xi Jinping’s “Common Prosperity” message has, at its core a determination to address wealth inequality, and part of that is lowering house prices or at least stabilising house prices after strong growth over the last decade. In 2017, Jinping asserted, “Houses are built to be inhabited, not for speculation.”

The question is whether Evergrande is too big to fail? The signs so far are that it is, and the government is stepping in to minimise some of the fallout, not surprising given the Chinese mainland’s property market accounts for around 20% of GDP.

But Evergrande isn’t unique. According to analysis by the Financial Times, almost half of China’s 30 largest developers are in breach of at least one of the three red lines that were introduced with the aim of constraining developers’ debt levels. All eyes are now on the extent to which the ripple effect can be contained.

In other news

Enquiries for Italian property increased by 76% in early 2021 and the Italian flat tax is attracting strong interest from HNWIs revaluating their lifestyle post-Covid-19.

The ski season is almost upon us and with mountain living undergoing something of a revival why not sign up here to receive your copy of the Ski Property Report, our annual look at the French and Swiss Alps as well as Colorado’s top resorts.

Image by Pete Linforth from Pixabay