Pay hikes, rate hikes and the fate of China's housing market

Making sense of the latest trends in property and economics from around the globe.

3 minutes to read

Cities

House price growth in cities across the world is now outpacing national markets amid the broad return of urban life.

After moving largely in tandem last quarter, prices across the 150 cities in Knight Frank's Global Cities Index climbed 9.8% during the year to Q2, compared to 9.2% growth in corresponding national markets. The Canadian city of Halifax leads the index this quarter, with price growth of 30.8% per annum. Some 57 cities saw prices rise by 10% or more.

As Kate Everett-Allen notes, the question now is how long the boom - one largely confined to advanced economies – has to run. Our view is that demand will start to wane as pandemic amassed savings diminish and as monetary policy tightens. Norway opted to raise rates last month and New Zealand's central bank followed suit overnight. The UK and the US likely aren't far behind.

China

Two years ago, house prices in six Chinese mainland cities were rising at an annual rate of more than 10%. Now only Guangzhou meets the criteria (11.4%).

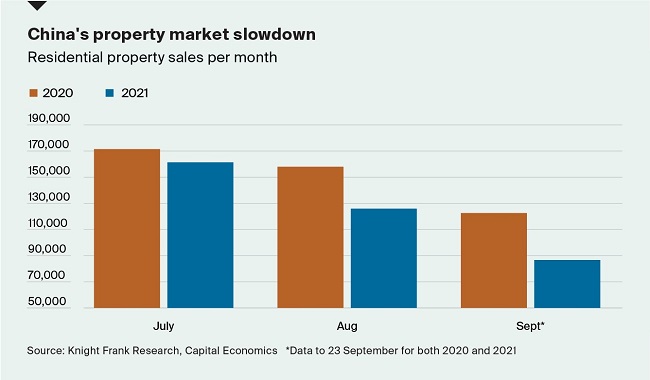

The Evergrande debacle has cast a shadow over once surging urban house prices in China and, although the gravity of the situation only emerged in Q3, there was evidence of a slowdown in prices during Q2. The most recent data available suggests sales activity is continuing to slow (see chart).

The extent to which Evergrande's woes further impact the wider property market, both in China and abroad, remains unclear. The scope of its debt beyond the $300 billion it has in reported liabilities remains uncertain for the time being. Mid-sized developer Fantasia missed a payment deadline overnight, which makes headlines this morning. Fantasia ranked 60th in a list of contracted sales in the first quarter of this year versus third for Evergrande, according to Bloomberg.

Wages

The PM's speech at the Conservative Party Conference, scheduled for later today, will include a pledge to raise the minimum wage to £9.42 an hour, which has been briefed to the papers as part of a broader shift towards a higher wage, higher productivity economy.

Wages are indeed rising, but in a very uneven manner. This FT piece has a good summary. The Office for National Statistics pegs pay growth at somewhere between 3.6% and 5.1% for the three months to July. Meanwhile, the Bank of England estimates private sector pay growth at around 4%.

In this Twitter thread, Noble Francis, Economics Director at the Construction Products Association, assesses how all this is landing in our corner of the economy. Construction wages climbed an average 11% in the three months to July and the cost of materials surged 15% during the same period, which will heap pressure on specialist contractors working on fixed price contracts whose average profit margins tend to be around 2-3%.

Deposit unlock

Nationwide this week became the first major lender to sign up to Deposit Unlock, the industry's replacement for Help to Buy.

Developed by Gallagher Re and the Home Builders' Federation, Deposit Unlock supports 95% LTV lending on newbuild properties up to the value of £750,000. Unlike Help to Buy, it is available for both first-time buyers and 'second steppers'.

Nationwide's involvement is a significant moment and provides a healthy dose of certainty to housebuilders purchasing land with one eye on the closure of the Help to Buy scheme in March 2023.

In other news

Kate Everett-Allen outlines five key trends homebuyers should have on their radar and Faisal Durrani analyses a shift in attitudes amongst Middle East property investors.

Elsewhere - GPE reports strong leasing in Q3, Allbirds walks back ‘sustainable IPO’ claims, the IMF trims its global growth forecasts, law firms launch wellness schemes to reduce burnout, and finally, Adam Tooze on inflation.

Subscribe to regular updates here.