Midweek property news update - 8 September

The city revival, the green homes mess and why construction is "bloody hard work" at the moment

4 minutes to read

Solving the green homes problem, continued...

When the government withdrew the Green Homes Grant vouchers after just six months it was pretty clear the scheme must have been suffering some significant failings. Many of them were laid bare last night by the government's public spending watchdog in a report that illustrates why that particular idea was so flawed, but also highlights challenges for any future attempts to green the nation's stock of existing homes.

The National Audit Office report found the government introduced the scheme both to hit net zero by 2050 and to provide a short term economic boost, but the tension between the long term and short term goals, plus the short delivery time, led to an overly complex mess. That was illustrated by the fact that more than half of the 170,000 applications were rejected or withdrawn.

The scheme was beset by a shortage of skills. By September last year there were 880 potential installers registered with TrustMark, but by 6 November 2020 only 248 had registered to participate. In the end the vouchers will have resulted in upgrades to about 47,500 homes at a cost to the taxpayer of about £314 million, of which an eye-watering £50 million was spent on admin.

Ministers will take a silver lining from public interest in participating, which by all accounts was pretty good. The Department for BEIS encouraged homeowners to access the Simple Energy Advice website for guidance. The site received more than 550,000 unique visits in the first six months. The public submitted applications for more than 40,000 vouchers in October last year alone.

Escape to the country

New data from Chris Druce reveals a moderation in the number of homebuyers moving from urban to rural locations, one of the dominant trends of the past 18 months.

The percentage of transactions taking place in the UK's towns and cities outside of London hit 42% in the second quarter of 2021, the highest Q2 figure in ten years. Momentum held at 40% during July and August, above the ten year average of 37%. Meanwhile, the number of offers accepted from UK buyers moving from urban to rural locations peaked at 28% January, before dipping to 23% in June.

“After a year dominated by the escape to the country trend, there are signs that demand is getting stronger in towns and regional cities as buyers look for the best of both worlds: space and greenery but easy access to services and amenities,” says Chris.

Inflation

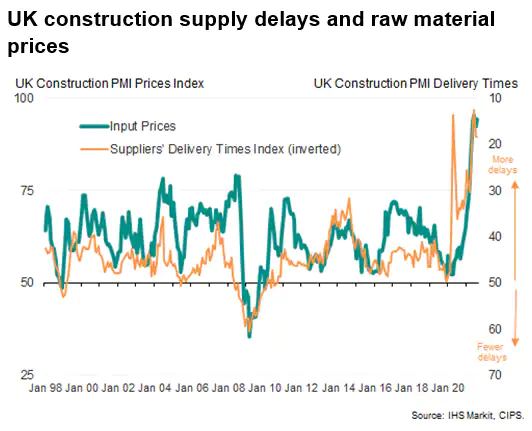

"The UK construction industry is being hit by unprecedented shortages of raw materials and labour, the costs of which are also rising at rates far in excess of anything previously recorded in over two decades of PMI survey history."

That's the top line from yesterday's IHS Markit Purchasing Managers Index. A reading of construction activity slowed to 55.2, the lowest since February. While anything above 50 constitutes growth in activity, the reading is now below the 53.8 long run average, which the company said was disappointing given the level of stimulus and the stage of the recovery.

The slowdown can be partially attributed to ongoing and near-record shortages of raw materials, as measured by suppliers' delivery times (see chart from the report below). Those have led to unprecedented price hikes for building materials in recent months.

All-in-all, it's "bloody hard work" getting materials on site to keep production on schedule, Graham Prothero, Vistry’s chief operating officer, tells the FT.

Prime London

The balance of power in Prime London's lettings market has tipped in favour of landlords.

To underline the strength of demand, the number of new prospective tenants registering with Knight Frank in August was 73% higher than the same month in 2019. The lettings market in 2019 was itself strong by most measures, recording the highest number of tenancies agreed for a decade.

Strong demand and low supply are behind the shift. Supply is low because, in similar fashion to parts of the sales market, the shelves have emptied quickly due to strong demand. Meanwhile, many would-be landlords sold in order to take advantage of the frenetic sales market in the first half of the year caused by the stamp duty holiday.

“It’s turned into a landlord’s market in recent weeks and that has happened very quickly,” said Gary Hall, head of lettings at Knight Frank. “Supply is tight in some areas and demand has gone through the roof.”

In other news...

In a new Rural Market Update, Andrew Shirley mulls the unintended consequences created by policymakers who don’t always comprehend the bigger picture.

Elsewhere - Halifax on house prices hitting a new record, the end of Covid-19 unemployment benefits poses a test for the US recovery, but a top US Fed official wants a quick taper anyway, UK employers are planning to make the fewest job cuts in seven years despite the end of furlough, Bank of England official says we'll need a rate hike next year if inflation stays on track, and finally, ICAP says traders working from home take fewer risks.