Revealed: penthouse premiums around the world

Exclusivity, privacy and sweeping spaces make penthouses the pinnacle of urban living. New Knight Frank research reveals the premiums buyers are willing to pay for the crown jewels in new developments.

3 minutes to read

Sweeping lateral spaces and spectacular views have long made penthouses the crown jewel of new developments.

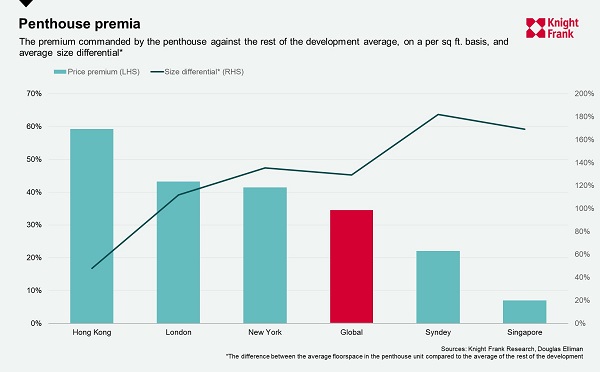

Knight Frank research across five global cities reveals penthouses are on average 129% larger than the average unit in the same development and can command a premium of 35% per square foot (psf). Exclusivity and privacy also underpin values and local factors such as configuration of developments and sales technique mean premiums in various cities can differ by as much as 50%.

Unique characteristics

“Buyers have sought out one-of-a-kind residences as a unique haven for them and their families, particularly within the last six months,” says Andrew Wachtfogel, Executive Vice President & Head of Research at Douglas Elliman Development Marketing in New York, where a penthouse commands an average premium of 40% per square foot compared to other units. “Plus, these homes frequently include a prized feature in any city – private outdoor space.”

Design elements can also add to the price achievable. Developers transcend the luxury features in a penthouse, from the size of rooms and ceiling heights down to the smallest detail on specification, according to Alexander Lewis, a Partner in Knight Frank’s Development Consultancy.

“It is not unusual for penthouse purchasers to buy early off plan to allow them to tailor the space, coordinating with the developer, which is assisted by the fact that the penthouse can be altered with less structural implications and disturbance,” he says.

Record prices

Penthouses accordingly continue to break £psf records in their respective markets notably at the Chiltern Place in Marylebone, One Grosvenor Square in Mayfair and One Kensington Gardens, although One Hyde Park still holds London’s capital value record to date, Lewis adds. Indeed, London has the second highest penthouse premium of our cities at an average uplift of 43%.

Hong Kong, the world’s second most expensive prime property market, has an average premium of 59%, the largest of our cities. Martin Wong, Head of Research & Consultancy, Knight Frank Greater China says that the sales technique tends to be different owing to a higher price.

“Developers sell the penthouse through tendering that also contributes to a higher premium than other units which are sold according to a pre-determined price list on a lottery basis,” he says.

The larger the space differential the smaller the premium. For example, of our cities, Singapore penthouses command the smallest premium, with an average of 7% yet they are, on average, almost three times the size of their counterparts – in Hong Kong penthouses are around 50% larger.

Size matters

“Until the completion of the super-prime Crown Residences at One Barangaroo, Sydney’s prime apartment towers had been traditional in configuration – the penthouse was very much the pinnacle apartment with exclusive features,” states Erin van Tuil Partner at Knight Frank Australia. Sydney’s penthouses command a premium of 22%, on average, compared to others in the development, lower than in other global cities – but the highest size differential at 182%.

van Tuil adds this may diminish “as Sydney’s prime market matures over the next decade, it’s likely we’ll see more super-prime projects where the distinction between being located at the very top of the tower, to lower floors, becomes less, with the exception of panoramic sweeping views.”