Housebuilders highlight supply chain issues as growing problem

UK housebuilders have raised concerns around supply chain shortages, as well as ongoing issues with securing land to build new homes.

3 minutes to read

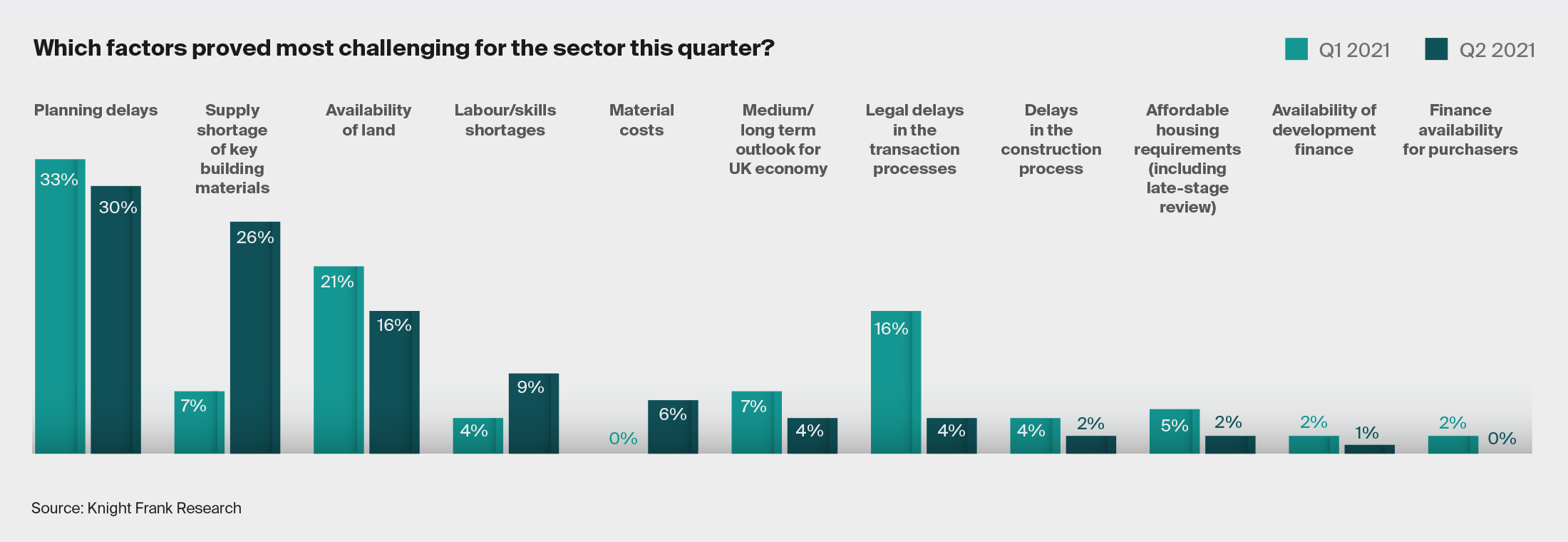

Our survey, of nearly 40 of England’s leading volume and SME housebuilders, found that supply chain shortages were a far greater concern in the second quarter compared with Q1. In Q2, over a quarter of all respondents pointed to ‘supply shortages of key building materials’ being a challenging factor this quarter, up from just 7% in Q1. They also suggested that delays and shortages are likely to run into the third quarter.

Supplies of materials and labour for construction work have become less resilient in recent months due to a surge in new orders in the face of Brexit-related concerns, Covid-19 disruption, and the delivery of major infrastructure projects such as HS2.

The problem was reported by SMEs and volume housebuilders alike, with over a quarter of both groups reporting supply shortages of key building materials. Looking ahead, they also said supply chain delays would have the greatest impact on the housebuilding sector in Q3.

Overall, 40% of respondents said they had been forced to reduce their profit margins in Q2, which have come under pressure as house prices moderate and build costs increase, with supply shortages driving material cost inflation.

Availability of land also remains a key issue, with 70% of the respondents describing the current supply of land available for development as either ‘limited’ or ‘very limited’, with a third citing planning delays as a concern.

However, respondents were divided about whether the government’s zoning plans would increase the supply of land. Under the reforms, councils will use a zoning system to assign 'growth', 'protection' or 'renewal' zones in their local plans.

In total, 40% said they would not, while 30% said they would.

The UK construction sector saw activity surge last month after another steep rise in new orders for firms.

In June, the IHS Markit/CIPS UK Construction PMI rose to 66.3 in June 2021, signalling the strongest rate of output growth since the index began in 1997 following the reopening of the UK economy.

House building activity increased at the fastest pace since November 2003. Suppliers' delivery times also lengthened to the greatest extent since the survey began. And purchasing prices rose at record pace on the back of severe shortages of construction products and materials.

Land values

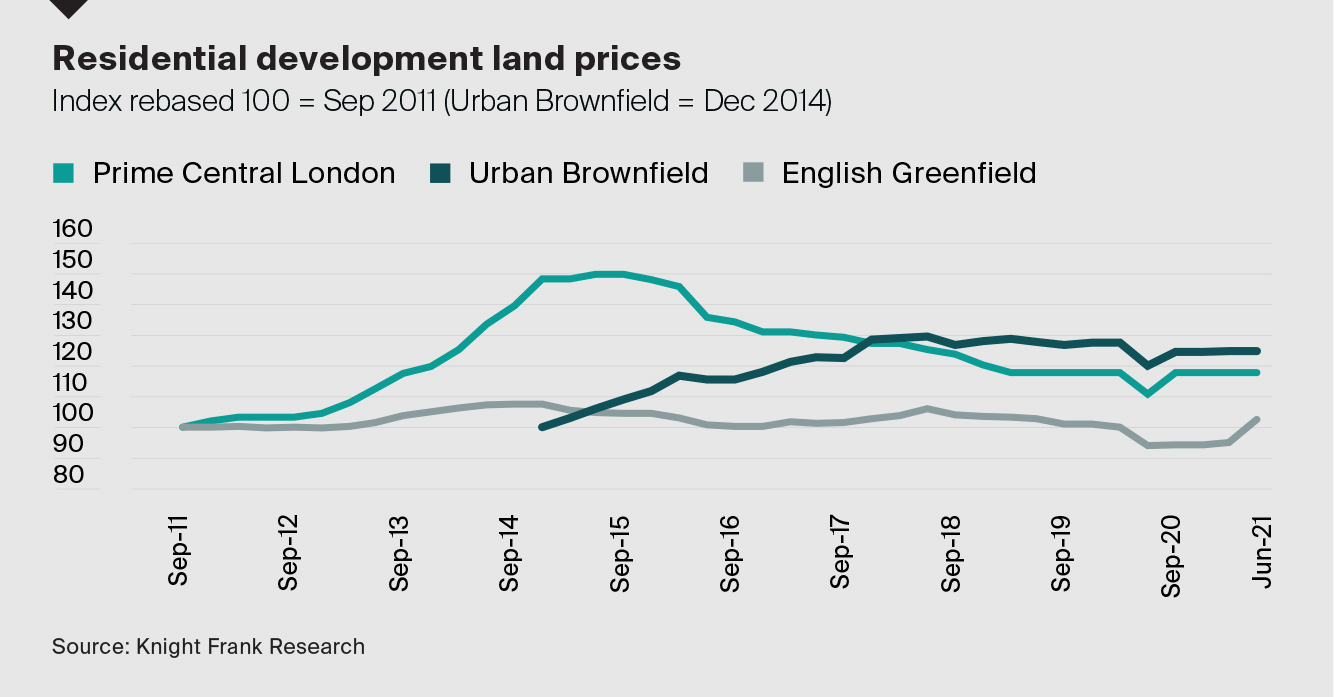

Despite supply chain issues and rising build costs, housebuilders are seeking to replenish their pipelines after scaling back from investing in 2020. The rise in demand for land is in some cases causing prices to increase, particularly greenfield sites as housebuilders are focused on building housing schemes with access to open space.

Greenfield land prices in Q2 have strengthened, rising 8% as housebuilders focused on increasing their pipelines of land. Annually, greenfield values rose 9.1%.

Average land prices in Prime Central London (PCL) were flat on a quarterly basis but increased by 4.7% across the year.

Values were largely flat across regional cities and Greater London, where slower demand and tighter margins were weighed up against rising build costs. Brownfield land prices were flat on the quarter but up 4.3% compared to a year ago.

Image by analogicus from Pixabay