Friday property news update 9 July

The two track recovery, movement on cladding and how buyers plan to tackle the stamp duty taper

3 minutes to read

Markets dip

At a meeting of US central bankers on Tuesday participants discussed the "elevated" uncertainty over the global economic outlook.

Investors are jittery over the spread of the Delta variant and early signs that growth may begin to slow in both the US and China. Those concerns spilled into markets yesterday, with the US S&P 500 and Nasdaq falling from record highs, led by Covid sensitive stocks across the transport and services sectors. Shares in Asia fell to a two-month low overnight.

Euphoria over the efficacy of vaccines is calming as investors weigh the realities of uneven growth and the challenges of a global vaccination roll out. On Wednesday, the IMF issued a warning that the world is facing a worsening two track recovery, driven by dramatic differences in vaccine availability, infection rates, and the ability to provide policy support.

Supply and demand

In the housing market new buyer demand eased during June as the tapering of the stamp duty holiday neared, however there remained a clear imbalance of supply and demand, according to the latest RICS Residential Market Survey.

Participants said the supply of homes coming to market worsened for a third consecutive month. There are several reasons for the supply pinch, which Tom Bill lays out in detail here, however we expect the issue to ease soon, though perhaps not until after the summer. We'll have more on that in Monday's note.

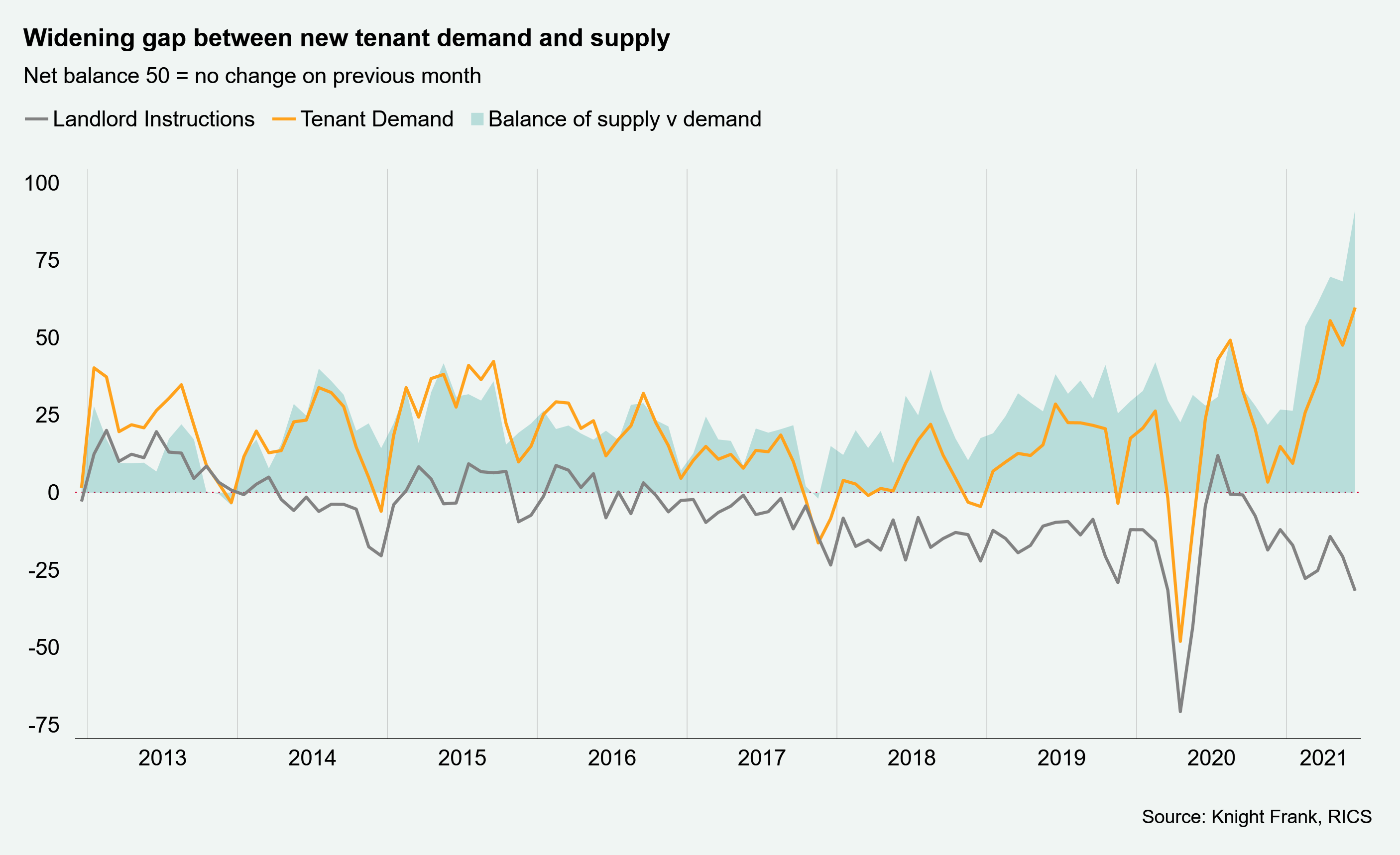

Demand from tenants in the rental sector is accelerating as landlords continue to rationalise their portfolios (see chart below). We talked earlier this month about research suggesting almost a million landlords intended to review their portfolios this year. There are few signs this trend will ease and rents are likely to climb as a result.

Stamp Duty

Most buyers would rather renegotiate than walk away after missing stamp duty deadline, according to Knight Frank's latest sentiment survey, conducted before the taper began on July 30.

Just 5% of respondents said they would pull out of their purchase. While most said they’d simply continue with the deal (59%), with a third (36%) saying they would look to renegotiate the purchase price.

See the full results for participants' views on the trajectory of house prices, which types of properties are in demand and the outlook for changes in working habits.

Cladding

The FT has details of a meeting attended by the Prime Minister and executives from the UK's biggest mortgage lenders to discuss ending the cladding crisis.

Attendees discussed the possibility of a government guarantee on mortgages issued to flats that could be identified as dangerous. The report suggests the PM has taken the reins and, "after personal pressure" from Mr Johnson, a follow-up call with the Ministry of Housing, Communities and Local Government will be held as early as this week.

Housebuilders'

Trading updates from Redrow and Vistry reveal that demand for new homes surpassed expectations during the first half of the year - FT write up here. Rising house prices are more than offsetting cost inflation and demand is holding despite the arrival of the stamp duty taper.

Sales rates are holding at about 10% higher than 2019, despite most buyers gaining no stamp duty benefit.

Meanwhile, Help to Buy was used by 50% of Redrow's buyers last year - a figure that has fallen to 13% in the wake of the introduction of price caps.

In other news...

Michael Connolly dissects the findings of the latest English Housing Survey.

Elsewhere - London finance job vacancies trebled in June, inflation might be easing in China, the ECB to allow inflation to overshoot it's 2% target, payouts for families to offset green energy bills, UK and EU clash over £40bn Brexit divorce bill, and finally, Pfizer will pursue booster shots and a new vaccine to combat the Delta variant.

Image by Pexels from Pixabay