Residential sales volumes recover to pre-Covid levels across Saudi Arabia

At a glance:

25,700 mortgage contracts issued in April across The Kingdom

38,285 mortgages issued for purchasing villas and townhouses in Q1; the highest level in at least five years

SAR 48 billion worth of residential mortgages for homes and land issued in Q1 – the highest level in at least 5 years

1 minute to read

The number of residential mortgages issued in Saudi Arabia during April has hit a five-year high.

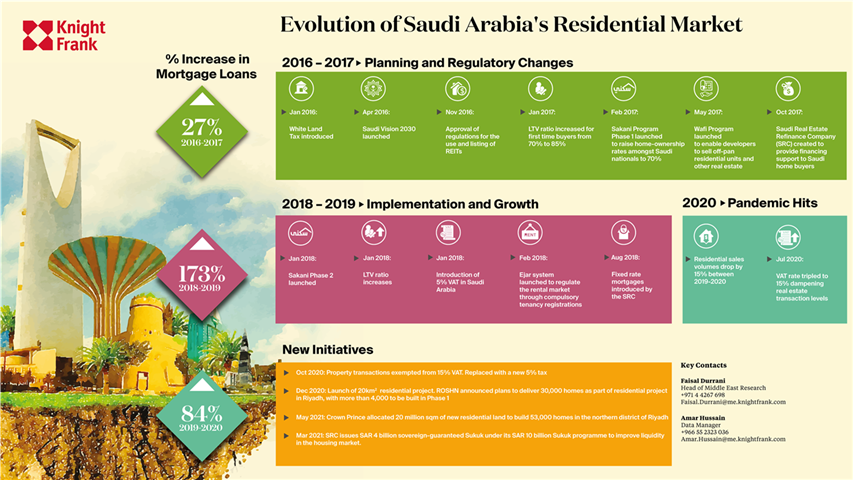

Faisal Durrani, Head of Middle East Research at Knight Frank notes: "The vast apparatus that is Vision 2030 is percolating through to the Kingdom's residential market, with rising residential mortgage rates, helping the government to realise its ambitions of higher home ownership rates. Indeed at 60% at present, the government has already surpassed its 2020 target by 8% and is well on course to achieving 70% home ownership by 2030."

"Indeed, at 115,000 transactions, sales volumes between January and May are on par with the same period in 2019 and are in fact 49% higher than January to May 2018. Home buyers and lenders are clearly feeling more confident about life as the post-Covid recovery starts to bed in"

Faisal Durrani, Head of Middle East Research

It's also important to highlight that 1.1 million families have benefitted from the Sakani program since its launch five years ago.

For more information on the Saudi Arabia Residential market, please contact Faisal Durrani

Banner image by David Mark from Pixabay