Conversion of offices into housing: a pipe dream or a real opportunity?

Over the past twenty years, technological advances have transformed the way people live and work, forcing the real estate industry to reinvent itself.

8 minutes to read

In the office sector, the digitalisation of companies, the hunt for talent and the increased need for flexibility have transformed leasing conditions, space planning and the services offered to occupiers. The health crisis has further exacerbated this trend, which is now well established, leading to questions about the future of offices in certain areas and the way in which they need to evolve. Indeed, although major regulatory and financial constraints have long held back the conversion of existing assets, it is clear that stock is under pressure to adapt, and even transform itself. Even to the point of changing its use? Possibly.

There is now a real interest in converting offices into housing. It remains to be seen whether this is a pipe dream or a real opportunity. In their latest study, Knight Frank analyses the situation and scrutinises several indicators in order to assess the potential of the Greater Paris Region's office hubs for conversion.

An old, but limited, phenomenon

The movement to convert offices into housing, which began in the early 1990s, has so far remained fairly limited and isolated in the capital. According to the City of Paris, nearly 600,000 sq m of offices have been converted since 2001, resulting in the creation of 400 to 500 homes each year. This is a drop in the ocean compared to the total number of housing units in Paris (approximately 1.4 million) and the capital's office space (16.9 million sq m).

Although it is now at the heart of the debate, and is considered by some as the solution to the obsolescence of offices and the housing shortage, the subject of conversion has returned to the spotlight during every crisis period. This was the case during the financial crisis of 2008, and then during the eurozone debt crisis. As a result, there has been a modest increase in the number of sq m of office space converted to residential use. In recent years, the phenomenon has changed little, both in Paris and on a regional scale. Accordingly, 110,000 sq m of housing resulting from the conversion of offices has been the subject of a building permit application since 2018 in the whole of the Greater Paris Region.

Another observation is that conversions have most often been carried out on an ad hoc basis, covering a relatively limited number of sq m and mainly carried out on behalf of public landlords. Indeed, major obstacles (regulatory framework, financial context, building morphology, etc.) have always hindered the large-scale implementation of these projects, and limited the interest of private operators.

Covid-19: a more favourable market context

In 2020, the Greater Paris Region office market recorded its worst result in over 20 years due to the Covid-19 pandemic. If take-up in 2021 will most likely remain lower than before the health crisis, what will happen in the years to come? The extent of the correction is impossible to quantify. However, several elements indicate that the levels of take-up seen over the last two decades (2.2 million sq m on average per year) may not be reached. The current situation therefore differs from previous crises, after which letting activity gradually recovered before reaching new records, thus side-lining the issue of converting offices into housing.

The number of sq m that companies could vacate in response to this upheaval is still difficult to estimate. Nevertheless, new needs (flexibility, digitalisation, etc.) are already guiding companies in their real estate strategy, confirming the emphasis placed on the quality of the location and work spaces. This will favour the take-up of the best assets and will strengthen the most established office sectors or those with the best access, justifying the regular renewal of their stock through refurbishment projects.

On the other hand, supply will lease less quickly in secondary markets, which suffer from poor access and have a large but ageing office stock, which will increase the proportion of obsolete space and lengthen rental void periods. The volume of office space that has been empty for more than 4 years in the Greater Paris Region already amounts to almost 1.2 million sq m, representing 33% of the total volume of immediate supply. This proportion is particularly high in the Outer Suburbs (48%) and in certain towns in the Western Crescent and the Inner Suburbs. It is these sq m of office space that have been out of use for a long time and are increasingly out of touch with market needs that provide the main source of sq m for change of use or demolition.

Investment: a pool of cash to allocate to residential

After withdrawing from the residential market at the end of the 1980s, institutional investors are once again making it one of their priority targets. This renewed interest was confirmed in 2020, with more than €5.2 billion invested in the French residential market, an increase of 30% year-on-year. Consequently, after having largely favoured offices and retail premises, investors are now seeking to rebalance their portfolios in favour of residential property, which is less correlated to economic crises and less exposed to the structural upheavals associated with the Covid-19 pandemic.

In this context, large real estate companies, some of which have significant expertise in residential property, are fast-tracking the conversion of part of their portfolio. This is the case for COVIVIO, who has identified nearly 150,000 sq m of obsolete offices for conversion and plans to undertake five such projects in 2021, notably in Bobigny, Antony and Fontenay-sous-Bois. Meanwhile, GECINA plans to deliver 5,500 sq m of residential units in rue Dareau (Paris 14th) as a result of the refurbishment of an office building.

Which are the most promising office sectors?

The Greater Paris Region is the most densely populated region in Europe and also has the largest office stock, with 55 million sq m, 80% of which was built over 20 years ago. Although hundreds of thousands of sq m have been refurbished since then, there is still a huge amount of work to be done in terms of renovation and reconversion.

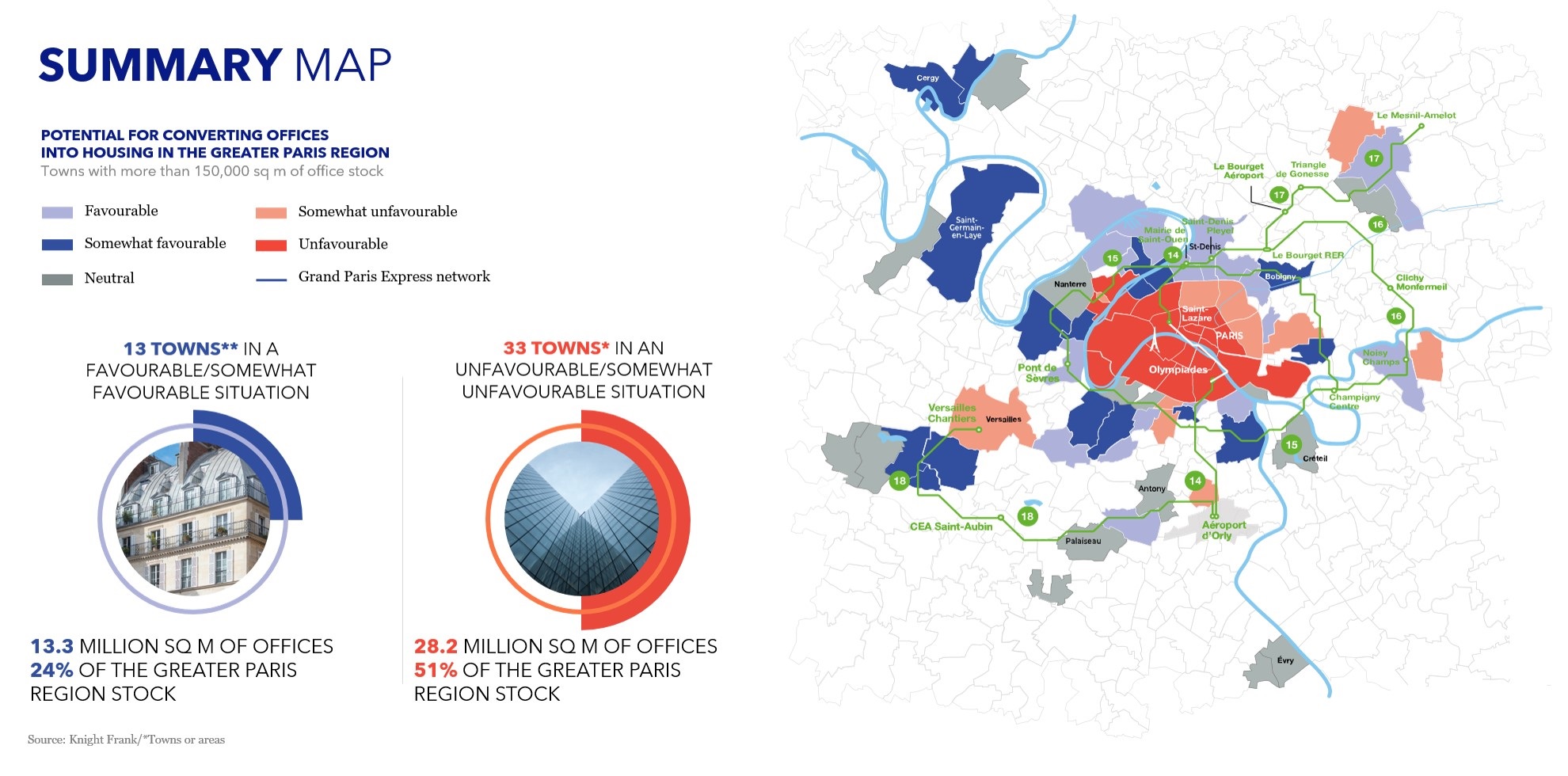

While the recycling of existing buildings is currently the focus of attention, Paris and its region are characterised by a wide range of situations, not always favourable to residential conversions. In order to determine the current state of affairs, Knight Frank has scrutinised the Greater Paris Region's office hubs using fifteen residential and office indicators to objectively assess the potential of each of these markets in terms of conversion. Only those with a significant office stock (> 150,000 sq m) are included in this analysis, i.e. some sixty towns and areas (La Défense, Paris CBD, etc.).

Generally favourable situation for conversion in the Outer Suburbs

First conclusion: new towns (Cergy, Saint-Quentin-en-Yvelines), predominantly residential towns (Saint-Germain-en-Laye) and towns with a mixed economic base (offices, light-industrial premises), where the need for housing is increasing due to sometimes sustained demographic growth, are undoubtedly sectors where market conditions are favourable to the conversion of offices into housing.

These Outer Suburb towns have a large but ageing office sector stock that is less and less suited to the needs of occupiers. This mismatch between office supply and the expectations of companies is reflected in the relatively modest volumes of office space let, and a reduced ability to attract new occupiers. In these areas, the difference between the value of housing and offices is generally, and increasingly, in favour of residential.

Changes favourable to conversion in some Inner Suburb markets

In certain towns close to Paris, or the established hubs in the West, there is a large amount of office space available, while the demographic situation is dynamic and justifies the increase in residential supply. Unlike most of the towns in the Outer Suburbs of Paris, these sectors are seeing - or will see in the short term - their accessibility improved by the commissioning of the Grand Paris Express. In the North, this transport project, as well as the 2024 Olympic Games, will encourage the marketing of the best office space. However, the increasingly high level of vacancy rates and the growing competition between the Greater Paris Region office sectors raise questions about the market's capacity to absorb an abundant stock, which for several years has comprised a large proportion of available space.

Furthermore, certain towns in the West, such as Rueil-Malmaison, Suresnes and Clamart, which are traditionally popular with executives, could take advantage of the conversion of offices into housing to increase the residential supply and encourage closer links between living and working areas.

Limited potential in the most established business sectors

The most established office hubs, especially Paris, have only limited potential for large-scale conversions. The dynamism of office lettings in Paris, the high level of market and rental values (particularly in the CBD, which has a rent differential of almost €300/sq m in favour of offices), fairly low supply, the fall in housing prices and the decrease in the population all point to a market context that is less favourable than elsewhere for an increase in conversions.

Conversions also seem less relevant in La Défense and in certain communes of the Hauts-de-Seine (Neuilly, Courbevoie, Puteaux, Boulogne-Billancourt). Office values are high there, movements of large occupiers regularly drive the market and the buildings are often less suitable for such conversions. However, the context is favourable to the development of serviced accommodation, which would thus meet the objective of a mixed-use business district and the needs of the many students and young workers who frequent it.

The conversion of offices into housing can therefore, in certain sectors, contribute to solving the problem of obsolescence of the office stock and can increase the residential supply, whilst at the same time encouraging a closer connection between living and working areas, in a virtuous circle favouring both the residential and commercial property markets.