The south east: leading the charge in e-mobility

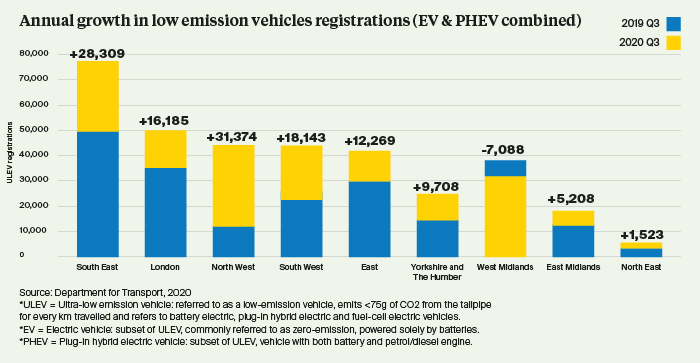

The rise of e-mobility has accelerated significantly over the past year, presenting exciting opportunities for the south east office sector. The region currently leads in e-mobility uptake by a significant margin, boasting the highest number of ultra-low emission vehicles (ULEVs) registered in the UK (78,012 vehicles), yet suffers from a significant undersupply of accessible charge points.

4 minutes to read

Click to enlarge image

Improving charging provision within the workplace has been recognised as a significant element of the e-mobility revolution, with consumers viewing the workplace as the second most important location to top up, second only to the home. According to the Department for Transport’s (DfT) National Chargepoint Registry, just 2.2% of charge points are located at workplaces in the south east, lagging behind locations such as retail and on-street. Given the extent of take-up among the population, the popularity of e-mobility within the region presents an opportunity for the sector to lead the charge in creating a market-leading electric vehicle (EV) amenity provision in the workplace.

Employees have sought smarter modes of transport over recent years as climate crisis awareness increases, but even more so following the global health crisis. This will only accelerate as people return to the workplace. With renewed focus on the environment and wellbeing, the popularity of solitary but sustainable electric cars, e-bikes and e-scooters has spiked as individuals seek to minimise risk of infection through private travel. In 2020, appetite for lower-carbon alternatives saw exceptional YoY growth of ULEVS across the UK (+57%), with the most environmentally friendly EVs registering +102% uplift in the south east, with registrations rising from 18,934 vehicles to 38,174.

Milton Keynes (304%), Slough (296%) and Watford (293%) lead with exponential growth rates in EVs for personal and business use, although all locations experienced robust growth of at least a quarter, presenting a clear direction of travel for car use in the region. Buckinghamshire/ Wycombe, Hillingdon and Hammersmith possess the largest EV communities, registering >1,000 private and commercial vehicles respectively. Bromley, Richmond, Ealing and Croydon possess some of the largest number of privately registered low-emission vehicles. Overall, Buckinghamshire has the highest number of privately owned low-emission vehicles (3,168), significantly outweighing commercial usage (1,394).

Consumers in the south east are clearly able to overcome many of the regularly cited obstacles to EV ownership, such as their high cost and lack of public charging infrastructure, to alleviate range anxiety. Research has found consumer segments most likely to purchase an EV include those who consider themselves “tech savvy”; have on average 30% higher disposal income; long commute times and access to off-street parking. It is evident many of the demographics of the south east align, with consumers possessing the right resources to act on their environmental conscience.

"Just 2.2% of electric vehicle charge points are located at workplaces in the south east."

Offices are uniquely positioned to become market leaders within this space by rising to consumer demand and delivering the environmentally focused convenience amenties expected by the workforce. Incorporating EV charging is one of the simplest ways to improve buildings’ environmental credentials and encourage lease renewal. Providing the amenity also provides a clear signal of a landlord’s commitment to the preferences of tenants’ employees and ESG focused strategy. Catering to enhanced travel choices will become an essential component for businesses in attracting and retaining talent, no matter what sector they operate in, as e-mobility becomes widespread and working practices become increasingly flexible.

With the pandemic highlighting widespread dissatisfaction with the daily commute and an expected increase in dynamic and agile working practices, employers will feel empowered to demand more flexible and networked mobility that seamlessly connects with their home and work lives. Offices will be a core beneficiary of e-mobility’s evolution beyond the product (i.e. the car) to provision of e-mobility services. Some of the top EV models already offer superb digital connectivity capabilities, offering Netflix, YouTube and Spotify services via 4G. Given recent exploration of “over the air” technologies by Micosoft and Apple with various car manufacturers, it’s not difficult to imagine the integration of EVs with smart-enabled office buildings, allowing the user to pre-order their morning coffee, check desk capacity, book meeting rooms and join virtual conferences on the road.

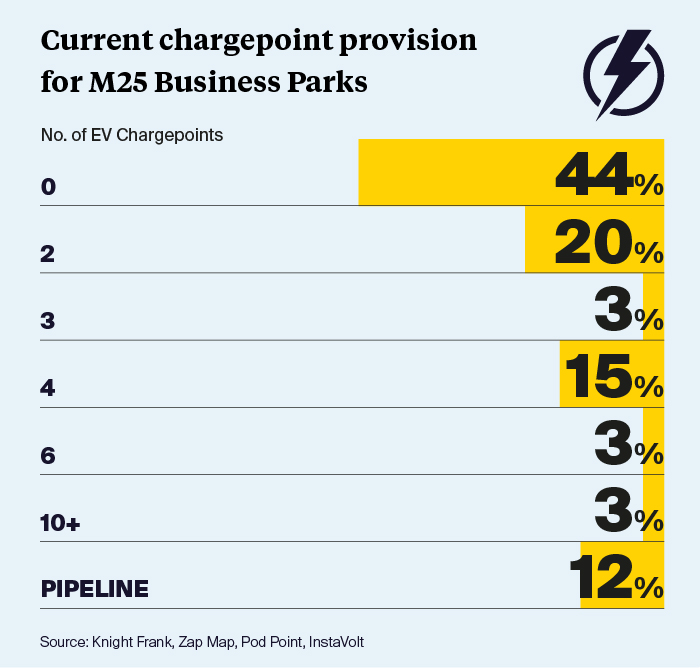

Business parks must be the most active in future-proofing their assets in this way, given that the car is central to their proposition and in light of the current regulatory squeeze on petrol and diesel vehicles. Knight Frank analysis shows a significant proportion (44%) of business parks within the M25 region have no charge point provision and so are vulnerable to obsolescence, vs 56% that currently provide the amenity or have indicated provision in their pipeline. Where the amenity exists, it is often small, with 38% of parks providing between two and four chargers. Just two business parks stand out for their volume of EV provision – Chiswick Park with twelve charge points, and Chineham Park in Basingstoke with ten.

Darren Mansfield

Partner, Commercial Research

darren.mansfield@knightfrank.com

Emma Barnstable

Research Analyst, Commercial Research

emma.barnstable@knightfrank.com