What happened to London’s Tall Building pipeline in 2020?

The disruption brought by the Covid-19 pandemic had a significant impact on the London development market in 2020, and the tall buildings pipeline was no exception.

3 minutes to read

As expected, the data points to a slight slowing in the delivery of new tall buildings last year, defined as being at least 20 storeys in height. That includes a decline in both the number of new planning applications put forward by developers and new construction starts - bellwethers for the state of the market.

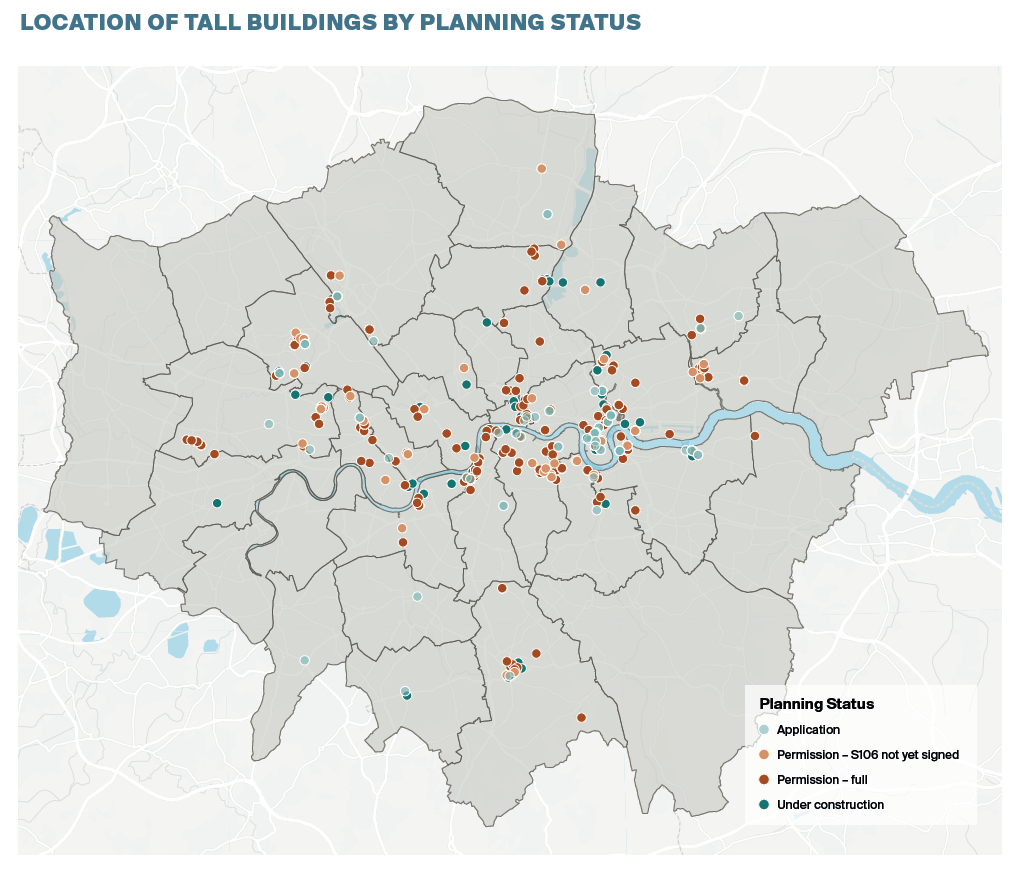

Yet there were also signs of resilience. The overall pipeline remains significant, with 587 tall buildings at various stages of the planning process at the end of the year, some 7.9% higher than in 2019. Most of the planned towers are residential, accounting for almost 90% of the pipeline.

The planning system also proved robust with an increase in the number of planning consents granted in 2020. A total of 35 residential and commercial tall buildings completed over the course of the year, a marginal 5.4% fall compared with 2019.

Applications

Developers submitted 78 planning applications for tall buildings in 2020, down 27.1% on a year earlier. Submitted applications remain around 36% lower than the market peak in 2018. That said, 2020 was still a bumper year for planning applications being lodged, the third highest on record.

Of the applications submitted in 2020, 57 (73%) were submitted in the second half of the year, suggesting developers were happy to push ahead with long-term plans, in spite of the disruption caused by the pandemic. Of the applications made in 2020, six were granted full planning permission the same year and a further nine were approved at Planning Committee but were yet to sign s106 agreements by 31st December.

Permissions

The number of planning permissions granted in 2020 was 10.8% higher than in 2019, with 72 full permissions granted. This compares with 65 the previous year as the high number of applications submitted in 2018 and 2019 continue to work their way through the system. This was the highest ever recorded volume of planning approvals for tall buildings.

Rising permissions for tall buildings suggests an increasing willingness of Planning Committees to approve proposals, either as standalone schemes, or as part of a larger masterplan. Some 11% of permissions were for commercial buildings, down slightly from 12% the previous year.

Starts

In 2020, just 24 tall buildings commenced construction, a decrease from 44 the previous year and the lowest number of new starts for tall buildings across London since 2013.

A drop in new starts is consistent with the decline seen in the wider London development market over the last couple of years, but the more uncertain economic backdrop of last year, site shutdowns, rising build costs, as well as increased affordable housing obligations, will have contributed to a reduced appetite for risk.

Given an average build time of around four years for the tall buildings completed in 2020, future surveys will register a slowing in delivery rate as the pipeline works its way through over the next three to four years.

Completions

In total, 35 residential and commercial tall buildings were completed in 2020, slightly below the number completed the previous year but still a relatively high volume when compared with previous years.

As in previous years, the data suggests that tall buildings are an increasingly deliverable form of development outside of the historically ‘prime’ areas, with nine buildings completed in outer London in 2020, up from six in 2019.

The data suggests that 2021 could be a bumper one for completions, with 52 tall buildings expected to complete this year - a 49.6% increase on the 2020 total, though much will depend on the medium-term performance of the property market and the economy.

Follow the link to download the full Tall Buildings report via the NLA website

Photo by Nick Page on Unsplash