Friday property news update - 26th March

The 'work from anywhere' reality, the clamour for PRS and is the UK housing market out of the woods?

5 minutes to read

Work from anywhere

Nationwide yesterday said it would allow its 13,000 office staff to work from anywhere under a plan it says will give employees more control over their lives. Chief executive Joe Garner said he plans to work from home one to two days a week to reassure staff that they will not damage their own career prospects by choosing not to come into an office.

The news is interesting in-part due to the nature of the business. We talked last Friday about the continuum emerging. Tech companies like Spotify are at one end, adopting permanent 'work from anywhere' approaches, and Goldman Sachs is at the other, having told all its global workforce it wants them back in the office by the end of the summer. Either Nationwide is an exception to the rule or we can place UK building societies alongside the tech giants.

With widespread adoption, the "work from anywhere" approach may have broader implications. As Simon Kuper notes in his FT column, the biggest economic winners of the last 40 years were highly skilled natives living in superstar cities, but could they be the biggest losers of the next era?

"To quote the scary new mantra: if you can do your job from anywhere, someone anywhere can do your job. Lesser-skilled workers in western countries have been through this already, when jobs in factories, call centres and back offices were offshored. Parisian graphic designers and New York bankers may be about to find out what that feels like."

Is the UK housing market really out of the woods?

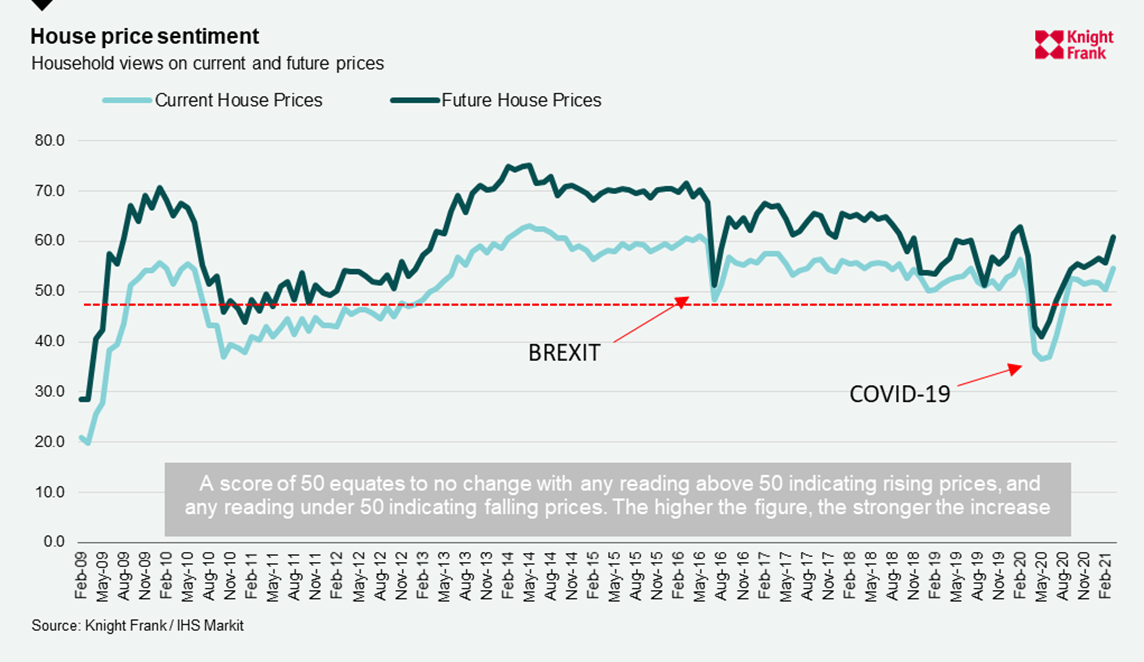

Consumer expectations of future house price growth surged to pre-covid levels in March - see the chart below courtesy of Oliver Knight. That follows weeks of brighter economic indicators and comments from Bank of England officials suggesting a rapid economic bounce back is imminent - chief economist and resident voice of optimism Andy Haldane was back in the news this week.

But is the UK housing market really out of the woods? For this week's podcast, Patrick Gower asks Tom Bill what can still go wrong. Their discussion covers sentiment, new variants, the prospects of global travel, uncertainties over the details of post-pandemic life and London's evolving future as a global financial centre.

Patrick also speaks to Flora Harley about New Zealand's plan to target speculators, runaway asset prices and the tough choices faced by global governments grappling with inequality. Listen to Intelligence Talks here, or wherever you get your podcasts.

US growth is set to surge...

In his first presidential press conference yesterday Joe Biden doubled his goal for coronavirus vaccinations to 200m in his first 100 days in office. On the same day, the US Labour Department said new claims for unemployment benefits fell to 684,000 last week, the lowest number since the start of the crisis.

The economic outlook in the US has transformed in a matter of months. The Fed now expects economic growth to surpass 6% this year, with unemployment falling to 4.5% by the end of 2021, compared to its previous outlook from December of 5%. By way of comparison, Capital Economics expects UK unemployment to peak at around 6% in early 2022.

...almost as much as China

It's all still little match for China, however. China’s official growth target for 2021 is “above 6%,” though economists predict much higher expansion of more than 8%.

That will increase the prospect of inflation, which is a growing concern of central bankers globally. In a working paper published yesterday (see link above), China’s central bank estimated the maximum the economy can expand without fueling inflation, known as the potential growth rate, is under 6% in the next five years.

Meanwhile, in a glimmer of hope for the travel industry, domestic airfares in China are recovering to pre-pandemic levels. The news will be closely watched by European operators concerned that discounting may have to become permanent. In fact, it looks like levels of pent-up demand could fill planes pretty quickly.

The clamour for PRS

Each year, we try to find out what's at the top of the shopping lists of the world's ultra-high-net-worth individuals - those worth $30m+. This year we analysed responses from more than 600 private bankers, wealth advisors and family offices across 50 countries, representing combined wealth of more than US$3.3 trillion.

There are changes at the top: purpose-built rental homes supplanted offices for the top spot, writes Flora Harley. Logistics and development land take up second and third place.

Part of the appeal is the non-cyclical nature of the rental sector during times of economic stress. The sector is generally more insulated from external forces compared to other commercial investment assets - making it increasingly sought-after in periods of economic downturn. In the UK, for example, our monthly income survey suggests rent collection rates have averaged 96% since March 2020

In other news...

In a new agents' diary, Chris Druce finds out how the extension of the stamp duty holiday and the approach of spring is playing out in local markets.

Plus, John Lewis says some towns cannot support a large store, Silicon Valley’s new bet on start-ups fighting climate change, UK online job adverts rise as firms prepare for lockdown exit, Suez Canal could be blocked for weeks, the big boat and the bank effect, EU leaders cautiously back vaccine curbs that invite retaliation, China and Vietnam lead three-speed Asian recovery, and finally, a vaccine passport is the new golden ticket.

Photo by Lauren Mancke on Unsplash