Hotel Dashboard – Budget 2021: The impact on the UK Hotel Market

The long awaited budget has brought temporary relief for the UK Hotel sector, providing the clarity critically needed, whilst the protracted closure of UK hospitality continues.

2 minutes to read

Confirmation of the extension of the furlough scheme and the reduced 5% VAT remaining in place until the 30th September 2021, bring a welcome relief - but does the total package of financial aid go far enough to support the sector’s early recovery, and safeguard it’s future growth?

In our March edition of the Knight Frank Hotel Dashboard, we provide insight into the likely impact the Government’s Budget 2021 will have on the UK Hotel market. Plus, we provide a more detailed analytical review of regional UK trading performance throughout the months of lockdown, analysing in greater detail the performance of two hotel datasets - Upper Upscale Hotels and Select Service Hotels.

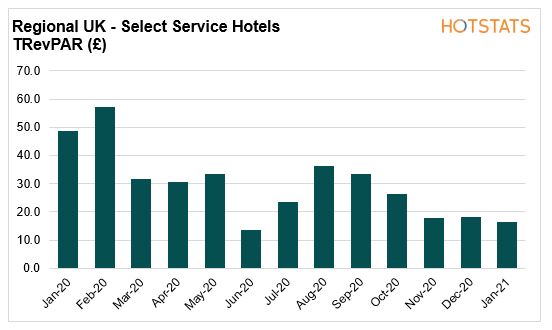

- Regional UK hotel trading performance data for the three month period Nov-2020 to Jan-2021, shows the devastating impact of the ongoing lockdown on the sector. As at the end of Jan-2021, Regional UK RevPAR averaged £10.90, a decline of 56% since the start of the November. Under more normalised trading conditions an average 30% decline in RevPAR is expected when comparing January’s performance to that of the previous October.

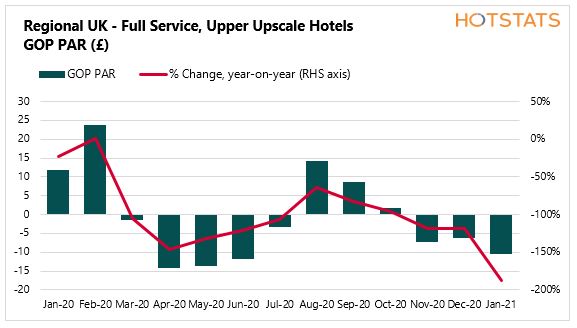

- The severely restrictive trading conditions have caused the UK hotel market to become loss making since November 2020. Only Serviced Apartment remain profitable as at end of January.

- The continued success of the vaccination programme and pace of the rollout are critical for each stage of the economy to reopen and for Hotels to resume trading on 17th May 2021, with fewer restrictions in place. Vaccination passports and the use of lateral flow testing are key for the sector to reopen more rapidly and for allowing larger events to take place.

- Employers will once again be required to make a contribution from July towards the furlough scheme. In addition, a further level of expense comes from the planned increase of the National Living Wage (NLW), rising by 2.2% to £8.91 per hour and following the lowering of the NLW age threshold, a rise of 8.7% for workers aged 23+.

- Despite the welcomed extension to the business rates holiday until 30 June 2021, many larger corporates are likely to be negatively impacted by the relief being capped at £2 million, during the transitional period from July 2021 until the end of March 2022. For those businesses that are unable to take advantage of the additional relief, cash reserves will be further stretched.

- With increasing concern of a low skilled worker shortage evolving as the UK Hotel sector recovers, opportunities for apprenticeships will become vital to develop the home grown, multi-skilled talent the sector requires.