Supply shortage set to define the 20s

An ongoing shortage of supply – particularly of high-end office space – is keeping vacancy rates relatively low, despite the Covid-19 pandemic.

7 minutes to read

- Businesses continue to secure pre-lets, eroding the supply pipeline further

- Even if take-up levels for new and refurbished space were to fall to 2020 levels for the next two years, London would still face a development shortfall

- Rents for the very best offices are likely to continue rising, creating a greater disparity between the prime and secondary markets

Development shortfall to persist

The persistence of an acute shortage of Grade A space in London’s office market has helped to lift pre-let levels to 44% of all development stock under construction. In tandem, on average, prime headline rents for best-in-class office space have continued to hover just shy of record highs achieved prior to the start of the pandemic in all of London’s office sub-markets.

As the Covid-19 crisis plays out, construction programmes have been extended, while other complications stemming from supply-chain delays for raw materials are further compounding efforts to complete schemes on time. As occupational demand begins to stabilise and recede amongst certain occupier groups who are taking a “wait and see” approach, extended completion time-frames mean that the supply dynamic that has shaped London’s office market since the global financial crisis is being prolonged, shielding the market from a potential glut of new stock.

“Even if take-up levels for new and refurbished space were to fall to 2020 levels for the next two years, London would still face a shortfall of 1.6 million sq ft.”

In fact, even if take-up levels for new and refurbished space were to fall to 2020 levels for the next two years, London would still face a shortfall of 1.6 million sq ft. By comparison, if take-up were to fall to the levels recorded during the global financial crisis for the next two years, the development shortfall would be nearer 2.3 million sq ft through to the end of 2022.

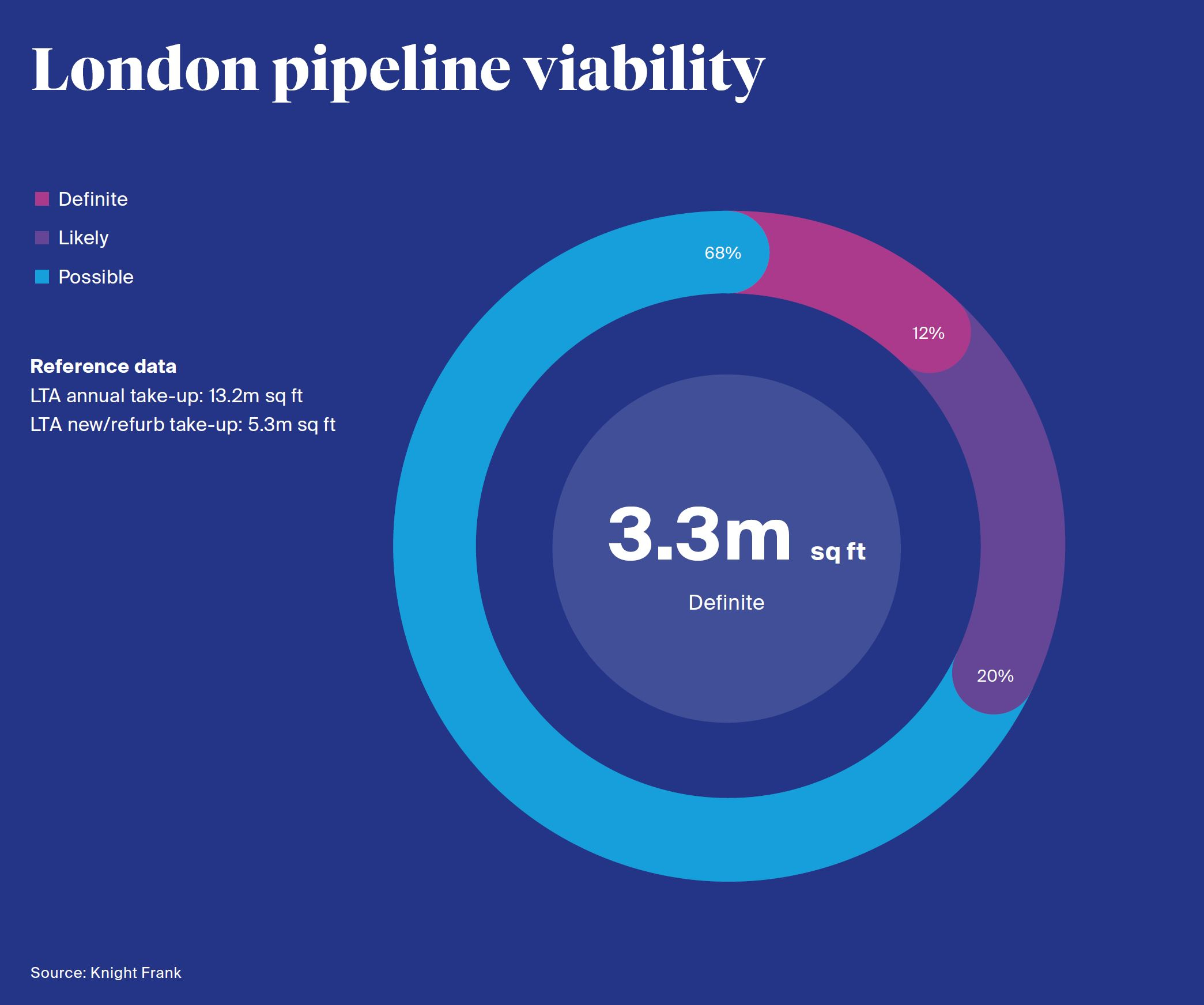

In order to analyse the development supply dynamic more forensically, we have developed the Knight Frank Development Viability Index. This assesses potential developments in five key areas:

- Planning status.

- Financing status.

- Third party rights.

- Vacant possession.

- Construction status.

We have then rated each development as Possible, Likely or Definite.

Click to view image

Click to view image

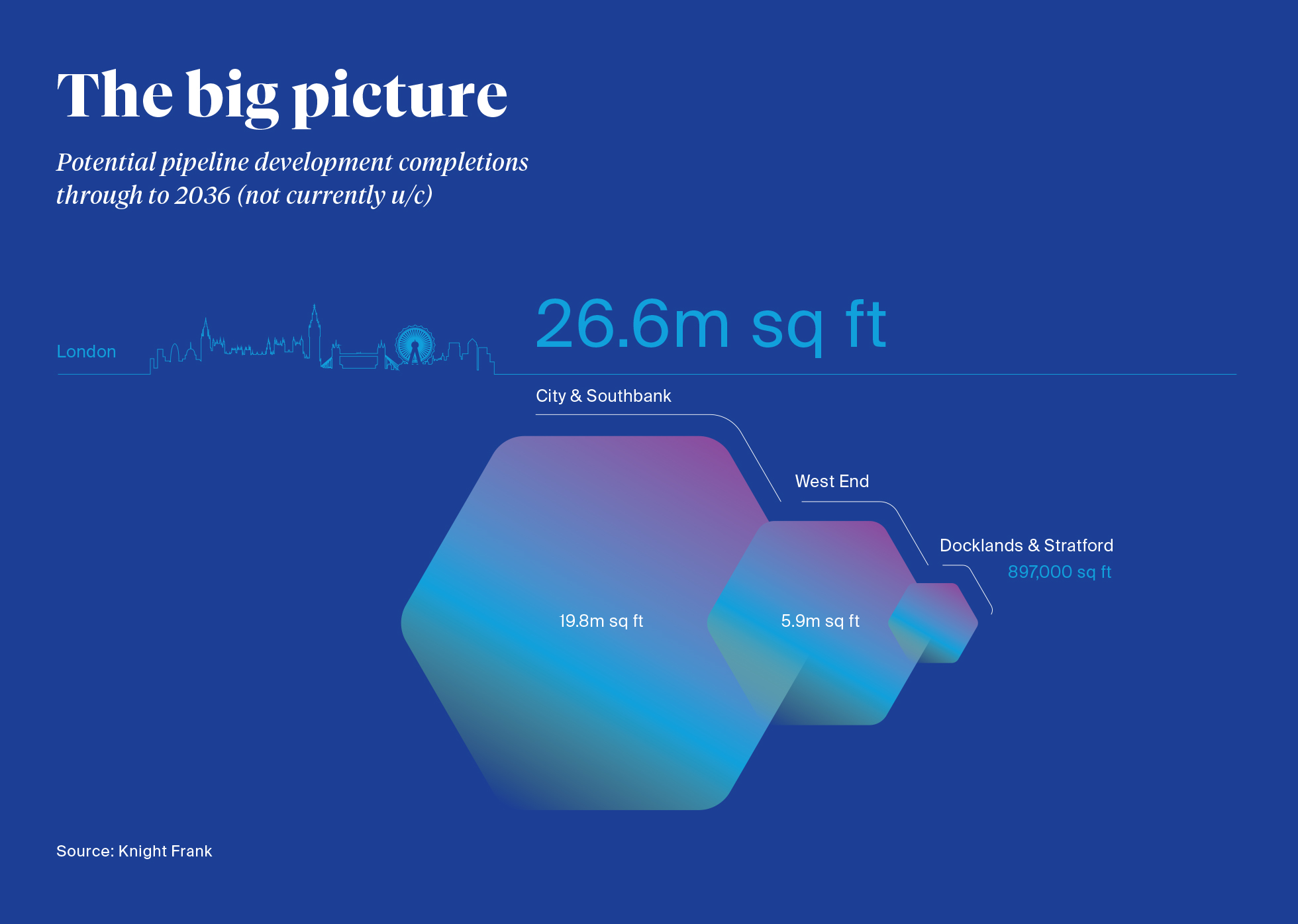

Based on an assessment of 26.6 million sq ft of pipeline stock, i.e. schemes not currently under construction across London and due to complete by 2036, we found that just 12.3%, or 3.2 million sq ft, fell into the “Definite” category; meaning that just 12.3% of the potential pipeline is likely to be delivered in the envisaged timescales. To put this into context, the long-term average take-up level for new and refurb space is 5.2 million sq ft.

Below, we investigate current office supply in London and how the future pipeline could be affected by a delay in construction starts and development activity as a result of the Covid-19 pandemic.

Backdrop

There is currently approximately 6.5 million sq ft of office space being developed or refurbished speculatively across London, due to complete within the next four years. The long-term average take-up of new and refurbished stock stands at 5.3 million sq ft. As we ended 2020, the supply of new and refurbished stock stood at 8.7 m sq ft.

A defining feature of the market prior to the pandemic was expansionary activity amongst occupiers, set against a backdrop of limited market options, particularly for larger scale requirements (over 100,000 sq ft). This forced some decision-makers to commit to new space on a pre-let basis well in advance of lease events, putting further pressure on supply, particularly of new and refurbished stock. Interestingly, this trend persisted throughout 2020 as some occupier groups continued to take a long-term view on London.

At the close of 2020, there were just 81 units available over 50,000 sq ft. This compares with 46 units available over 50,000 sq ft in 2019. The highest number of 50,000 sq ft+ units available over the last ten years was during Q4 2013 (72 options). At the end of 2020, this figure stood at 81 units.

“The development pipeline seems to be in check and as historical ‘shocks’ have occurred, each time this has led to a rationalisation of the developments and each time a more robust development model has occurred.

“In the current environment developments are only likely to proceed if they have the necessary development enablers resolved such as planning and financing and a clear and workable construction package. An issue with any one of these factors is likely to stall and defer development, and that in turn will have a long-term impact on the office market.

“Companies are rightly looking to create efficiencies through greater flexible and home working once the pandemic is over. As the number of available developments has fallen after successive ‘shocks’ the reality is that will lead to a supply shortage in the coming years and occupiers may have little choice, with little space available and rents remaining robust.”

- Andrew Tyler, Head of London Development

Downside scenarios still show a development shortfall

Looking at one downside scenario, even if demand for new and refurbished space were to decline to levels last seen in 2009 during the global financial crisis, the current stock under construction (excluding pre-lets) and due to complete this year, would be unable to satisfy requirements. The shortfall in would equate to 186,000 sq ft across London. Indeed, construction delays would only exacerbate this issue further.

“Assuming take-up levels hold at 2009 levels between 2021 and 2022, the development shortfall, excluding pre-lets, would be 2.3 million sq ft across London.”

Looking ahead still further and assuming take-up levels hold at 2009 levels between 2021 and 2022, the development shortfall (excluding pre-lets) would be 2.3 million sq ft across London as a whole, albeit occupier movements across London have changed this dynamic over the past ten years.

Another way of assessing the development shortfall is to assume varying construction delays. The chart below looks at developments over 100,000 sq ft currently under construction and how a delay could potentially affect future supply.

New and refurbished supply equivalent to 9 months’ supply

The majority of developments that are due for completion this year have already started construction, totalling 7.8 million sq ft with a further c.1.0 million sq ft yet to start. Looking to 2022, there is currently 2.2 million sq ft already under construction.

But at end of 2020, there was a total of 8.7 million sq ft of new and refurbished stock on the market, equivalent to just over 9 months’ supply according to long-term average levels of take-up.

Looking back: office vacancy rates

The global financial crisis permanently altered London’s development landscape, with restrictive commercial development financing emerging as its single biggest legacy. Vacancy rates in London’s office market currently stand at 7.4%, compared with a peak of 13% following the dotcom crash and almost 11% at the end of the global financial crisis. The fundamental difference between previous crises and today is the acute shortage of prime grade A stock, in addition to a very limited development pipeline.

Falling levels of speculative development completions

The demand-supply imbalance has been a key driver behind the rising volume of pre-lets, which has resulted in falling speculative development completions. These accounted for just 29% of all stock completed last year, compared with a long-term average of 49%. At the same time, for those unable to secure space to suit their requirements, re-gearing remains one of a very limited number of options.

Read: Re-gearing points to deferred demand

If we look a little closer at the future pipeline over the next five years, the scarcity of supply is clear.

The bottom line: supply will remain tight

We have run various scenarios to assess the impact of a permanent change in occupier take-up behaviour. In every case, the amount of supply planned and indeed currently under development, falls short.

Assuming take-up of new and refurbished space remains in line with historic levels through to 2024, there would be a development shortfall of 13.6 million sq ft. And, even assuming take-up fell by 30% over the next five years, the market would still experience a shortfall of close to 7.4 million sq ft.

“Rents for the very best offices are likely to continue rising, creating a greater disparity between the prime and secondary markets.”

Given the sharpened focus on high-quality offices, a trend that has been accelerated by the pandemic, it’s clear that rents for the very best offices are likely to continue rising, creating a greater disparity between the prime and secondary markets. The supply dearth that has defined our market for almost 13 years looks set to persist and it is our expectation that this will be a critical factor in re-mobilising growth in prime rents as the national vaccine roll-out gathers pace and demand makes a steady return.

Click to view image

Read: Why prime headline rents are set for continued growth