London – city of innovation

London is a world leader in innovation and education. These are key drivers of growth, fundamental to attracting and retaining the wealth and population needed for well-functioning real estate markets.

8 minutes to read

- London’s global significance is in large part underpinned by innovation

- Successful innovation clusters monetise ideas and generate strong local economic growth

- Innovation attracts and retains the population and wealth needed for well-functioning commercial real estate markets

London ranked number 1 Innovation-Led City

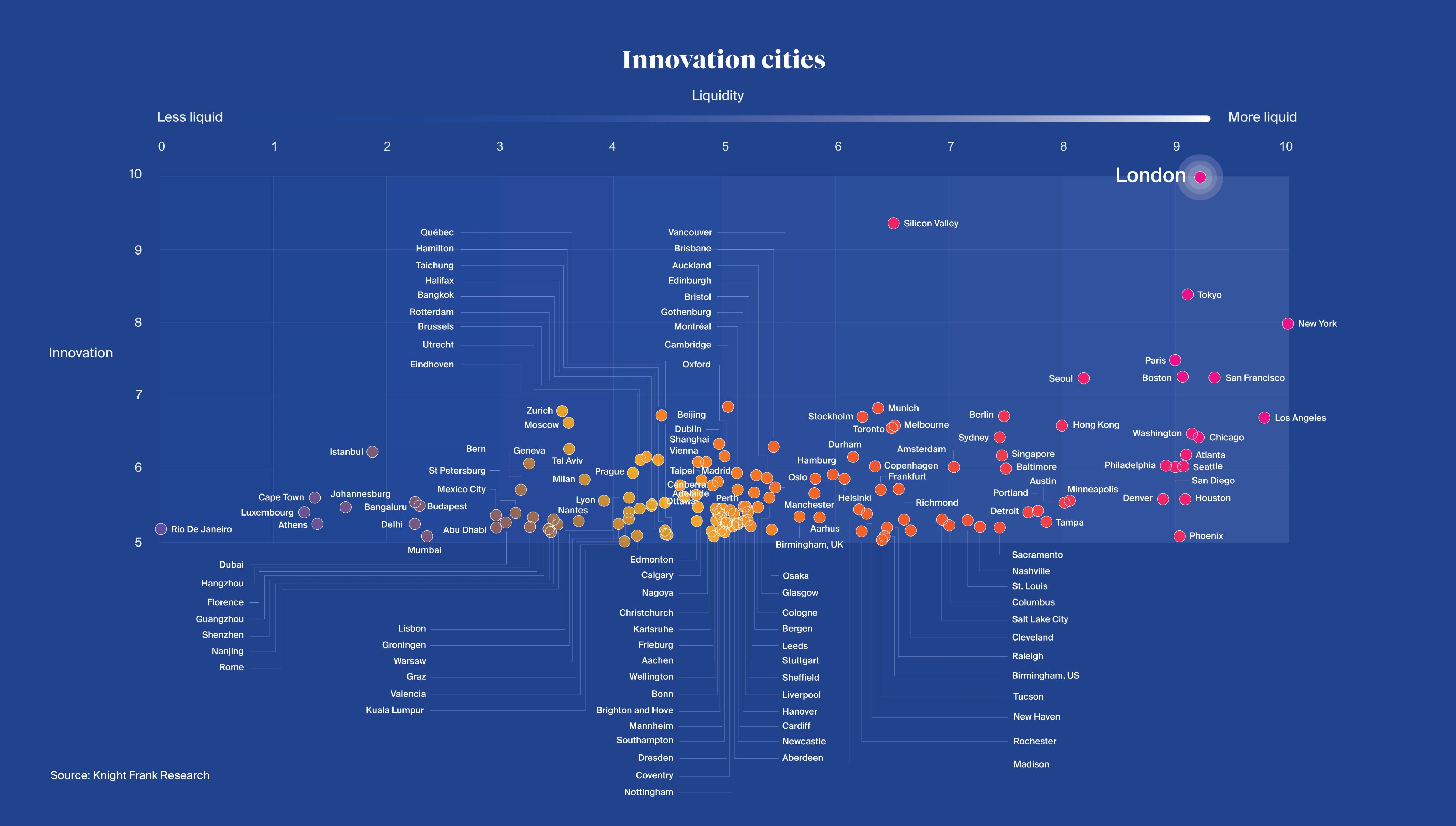

In the current environment, innovation is both a key driver of growth and a protective force against the worst of the global economic shock that has resulted from the Covid-19 pandemic. Recognising that innovation is an essential feature of cities with robust real estate markets, we identified the top global innovation-led cities in our recent publication Active Capital The Report – 2020, which saw London emerge as the world’s most innovative city of the 288 assessed worldwide.

View Active Capital

We analysed hundreds of thousands of data points, including information on almost 100,000 research institutions and 450,000 biomedical funding programmes. This was combined using a model that we created to produce an “innovation score” of between one and ten (ten being highest) for each of the 288 cities we examined.

Click to view image

The cities in the upper half of the rankings are those with above-average innovation and liquidity scores. London leads the charge for innovation, followed by Silicon Valley, Tokyo and New York. These cities’ ability to attract cross-border investment is at least in part driven by their world-leading research facilities and strength of innovation. This is particularly true for London.

“The high level of innovation drivers also positions London well as a city to benefit from rapid growth.”

London’s global significance is in large part underpinned by innovation. This enhances the resilience of the city and helps support its real estate markets, even in the face of the complexities that have arisen not only in the wake of the Covid-19 pandemic, but also in an environment where we were already seeing moderating global growth and geopolitical headwinds.

The high level of innovation drivers also positions London well to benefit from rapid growth as we move through the worst of the pandemic and into a phase of recovery.

“For seven out of the last ten years London has been the number one metro globally for cross-border office investment.”

London is a top city for cross-border capital

It is clear that London’s innovation credentials are proving attractive to investors. Not only did London office investment volumes reach almost £5 billion in Q4 2020, but for seven out of the last ten years London has been the number one metro globally for cross-border office investment and number two globally for the other three years, according to Real Capital Analytics. This league-topping performance reflects the high investment score achieved by London in our innovation-led cities rankings.

A world leader for academia

As an example of the British capital’s strength in innovation, London has two universities in the top 100 (of 494) universities ranked globally against the United Nations Sustainable Development Goal 9 of Industry, Innovation and Infrastructure by Times Higher Education.

These universities – Imperial College London (ranked 7) and King’s College London (ranked 88) – are recognised for their ability to produce research relevant to industry innovation and infrastructure, generate patents, create spin-offs and undertake research with the support of industry.

Knowledge clusters continue to grow

And it is universities such as these that are spawning and accelerating the growth of new submarkets – think White City and Stratford – and knowledge clusters across London, each of which is emerging as a magnet for talent and therefore, businesses.

The Global Research Identifier Database has identified almost 2,000 research institutions in London – the highest level in the world, further underscoring the position of the city as a global hub for innovation. Indeed, one of the city’s fastest growing business sectors, the biomedical sector, has been granted about £1.5 billion for research from 2021 onwards. This has come from seven funding bodies, including the Medical Research Council UK, the Wellcome Trust and the Bill & Melinda Gates Foundation.

While hinting at continued expansion of the sector, this funding also fosters spill-over effects, supports the continued diversification of London as a city into new growth sectors and also benefits the wider life sciences ecosystem.

So what does this mean for London’s office market? Quite a lot. As the life sciences sector evolves, supported by funding such as this, technology and life sciences are not only merging together, but also leading to the emergence of computational R&D. This will inevitably create new demand for office space across the multiple innovation clusters in London.

More organic growth in London is occurring through natural population growth, which is being supplemented by the creation of science, technology, engineering and maths (STEM) related roles, which are, in turn, driving an influx of talent. The number of STEM roles is not only forecast to continue rising, but is expected to support further expansion of innovation and knowledge clusters around the city.

Locations expected to benefit include King’s Cross and Euston – an established centre, with a range of innovation generators ranging from University College London (UCL) and The Wellcome Trust, to Google and Facebook. The area is also well linked with multiple fast trains an hour to the Cambridge Cluster which houses more than 1,500 technology companies, employing more than 17,000 people and 25 science parks, reachable in under an hour.

Other knowledge clusters are emerging from White City in the west to Whitechapel in the east, anchored by Barts Health NHS Trust, Queen Mary University of London and the Department of Health and Social Care. These examples illustrate just how far-reaching and pervasive innovation hubs are across London, from the fringe to the core and even to areas beyond London, such as Cambridge and Oxford.

Why innovation matters for London’s future

Considering the above factors, it becomes easier to understand why London takes the global top spot in our innovation-led cities league table. London is a leading global player, with cutting-edge research establishments and an actively growing innovation sector. The gap between the strength of the drivers that make up London’s innovation score and that of other global cities means that even in the face of shocks, there is a long way for London to fall before another city takes its innovation crown.

Innovation is the amplification and, in the commercial arena, monetisation of ideas. Knowledge, combined with creativity, leads to innovation, innovation to productivity and productivity to economic growth and resilience. The in turn helps underpin well-functioning real estate in innovation-led cities.

Innovation rarely happens in isolation, and agglomeration effects arise from innovators clustering together. These clusters are often centred around one or more universities. This is to London’s advantage, enjoying 18 universities with campuses and innovation hubs not only across Zone 1 in the centre of the city, but also in locations such as White City and UCL’s Here East in Stratford. Successful innovation clusters monetise ideas and generate strong local economic growth.

“Innovation attracts and retains the population and wealth needed for well-functioning commercial real estate markets.”

This innovation also attracts and retains the population and wealth needed for well-functioning commercial real estate markets, benefiting investors and supporting resilience of assets in the local area against the worst of any downside, while creating potential to capture the upside from growth.

Our research also indicates that in innovation-led cities, tech and life sciences businesses are looking for an educated workforce as well as reputable universities that can work closely with industry to innovate and generate commercial benefits from their research. And London is well positioned to offer both. The city’s wide range of highly reputed educational institutions are nurturing next generation talent that businesses can draw from.

Indeed, London has been positioned in second place, behind New York, in the World Economic Forum’s 2020 Global Talent Competitiveness Index for cities, a measure of a city’s ability to grow, attract and retain talent. With the war for talent expected to remain a critical issue for businesses, London’s strong ability to foster talent means that it will continue to be a hub for businesses, with office space in and around knowledge clusters around the city expected to remain highly sought after.

Read: Themes shaping London’s office investment market

Read: Private wealth remains focused on London

Methodology

Starting with a long-list of 750 global cities, we excluded those that had seen fewer than ten commercial investment deals, or less than US$75 million-worth of real estate transactions over the previous 12 months. Cities with fewer than 150,000 households, a population of less than 250,000, and total employment growth less than 200,000 forecast in five years, were also excluded. That left 288 cities, for which we collected data on more than 100 variables relating to innovation, comprising hundreds of thousands of individual data points.

As innovation is intangible and difficult to measure directly, we used statistical modelling techniques to find which observable variables best represented innovation and so created an innovation score for each city.

This comprised four components:

- Quality of innovation; including the quality of academic research, the international repute of universities and the quality of life in the city to attract talent.

- Innovation infrastructure; the quantum of different research organisations and groups.

- Funding; biomedical research funding.

- Motivation to innovate; grassroots motivation to innovate.

To analyse the practicalities of investing in innovation-led cities, we created a liquidity score based on factors including the number of commercial real estate assets, the average annual transaction volume and the ease of doing business in every location. The same rating was used. The innovation-led cities of note are those that score above average for innovation.

Sources include Oxford Economics, Numbeo, Meet-up, Grid.ac, World RePORT, startupblink, Real Capital Analytics and The World Bank.