Brexit & Second Homes in France: What you need to know

The UK’s departure from the European Union will have consequences for Brits with second homes in France, below we set out what these changes are and how we think they will impact the market

4 minutes to read

We spoke with Caroline Cohen of The French law Practice who answered the following questions for us:

If I am looking to buy in France will my purchase costs increase from 1 January 2021?

No, there are no additional taxes for non-residents looking to purchase in France after 1 January 2021. Purchase costs will remain at around 7% for an existing property and 2% for a new-build home.

What changes if I want to sell my second home in France?

There are several factors to consider:

Capital Gains Tax

In France, there are two payments due on a capital gain, a capital gains tax (CGT) and a social levy.

The standard capital gains tax on the sale of a property will remain at 19% and is only payable on a second home, if your French property is your primary residence no CGT is payable.

The standard social levy charge for EU residents with a second home in France is currently 7.5% but this increases to 17.2% for British homeowners from 1 January 2021 as they will be no longer be EU residents. This means total costs will equate to 36.2%, up from 26.5%.

It’s worth bearing in mind that a capital gain is largely a positive for a homeowner, it means a property asset, in the case of most French purchases, one bought for a lifestyle benefit, has also increased in value generating a return on investment.

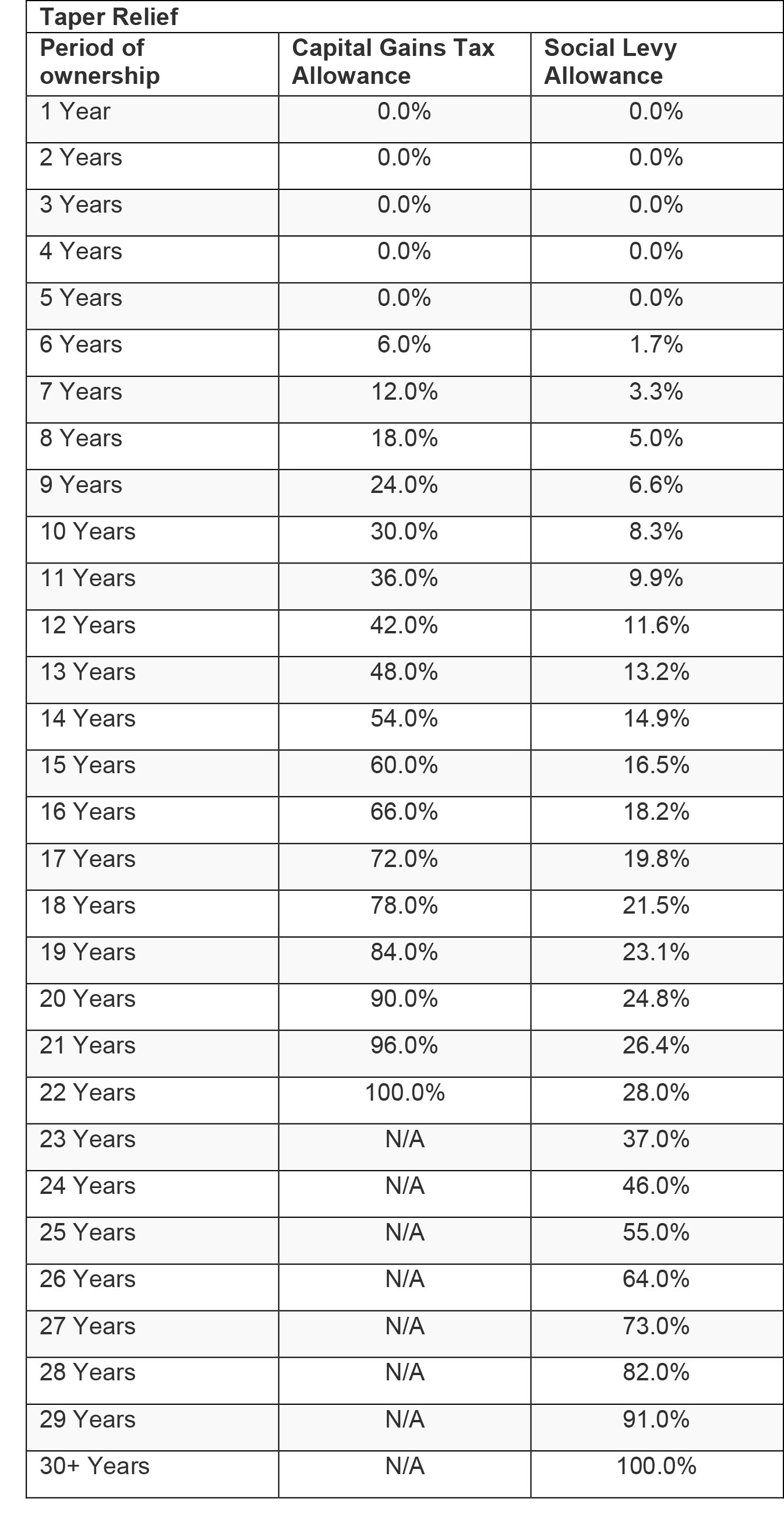

A taper relief also exists for both CGT and the social levy. For CGT the rate decreases after five years of ownership with no CGT owing after 22 years, whilst the social charge taper also starts at year five with no charge applicable after 30 years of ownership.

Fiscal Representative

From 1 January a non-resident selling a second home in France will be required to appoint a fiscal representative, this applies to all sales above €150,000. This will apply whether a capital gain is generated from the sale or not and can range from 0.5% to 1% of the property’s sale price.

How long can I spend at my second home?

From 1 January 2021 a new 90/180 rule will apply throughout the Schengen area of which most EU countries are members. This allows UK residents to spend 90 out of every 180-day period in the European Union. This grants UK residents with second homes in France to spend 180 days a year at their second home but not all in one go.

In some cases, some EU countries offer visas for longer stays to non-Europeans who make sufficiently large investments in property or other assets, it’s possible that similar arrangements could be made for UK residents.

What impact will this have on the property market?

“Inevitably, we are seeing some UK vendors with homes in France push for completion prior to 31 December 2020 to reduce costs, but overall I don’t think we will see the appetite for second homes in France soften as a result of the new rules, second home purchases in France tend to be long-term investments anyway,” says Mark Harvey, Knight Frank’s Head of International Sales.

Mark adds: “The French property tax system is widely considered to be a fair and rational one which promotes long term ownership, stable and steady price appreciation and deters speculation.”

“Sales in 2020 have been strong with buyers looking to spend 2-3 months a year in their new property each year rather than 2-3 weeks and this is still achievable post Brexit. Prime stock levels in France’s key second home hotspots are already low and we may see supply shrink further as owners look to hold onto their property or think more carefully about succession planning.”

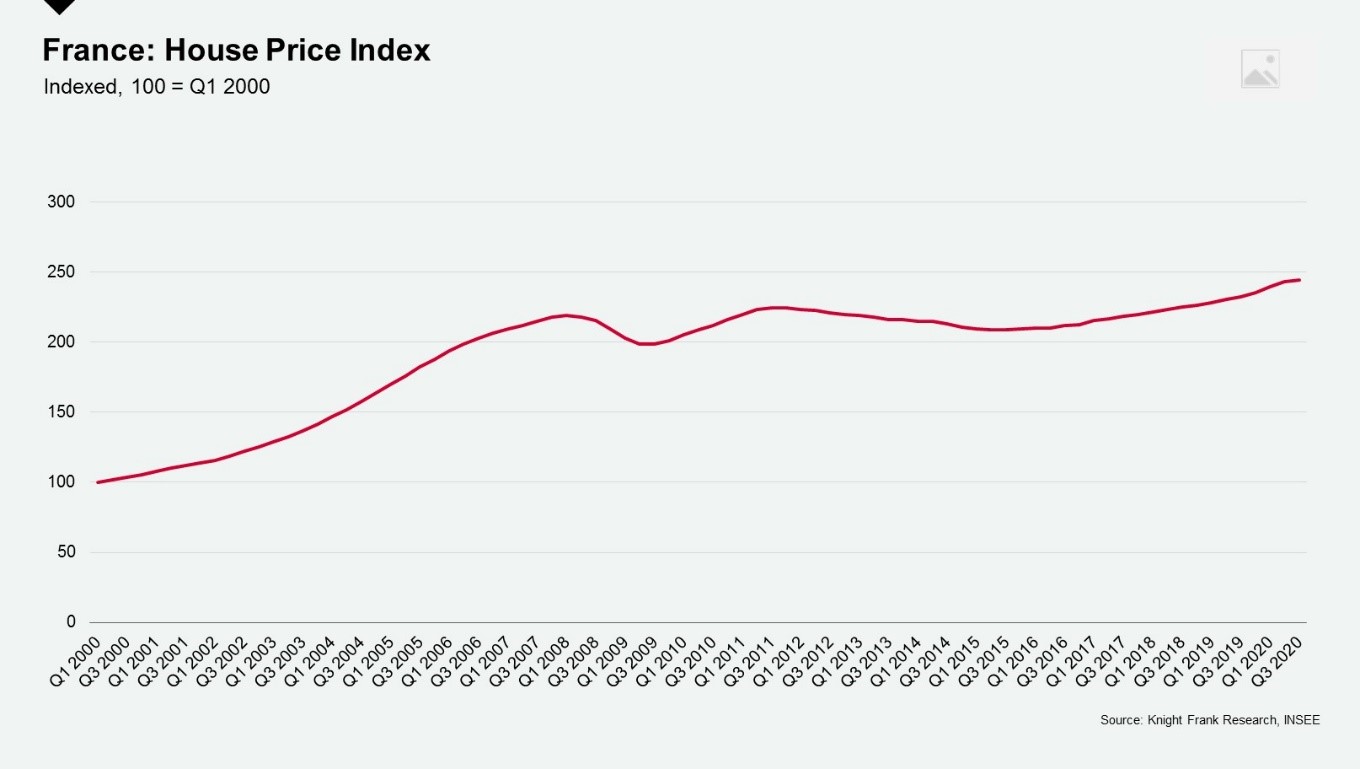

Mainstream prices nationally have seen only moderate growth in the last decade, up 15% in the ten years to Q3 2020 according to INSEE, the French National Statistics Office. Although prime price growth has outpaced mainstream markets none have registered double-digit annual price growth since the financial crisis, limiting the scope for significant capital gain.

Is the tax landscape likely to change further?

France’s wealth tax was previously calculated on all assets (except financial assets for non-residents), in 2017 President Macron reduced this to just real estate assets. With budgets stretched by the pandemic analysts expected this decision to be reversed to help shore up public finances but according to Caroline Cohen of the French Law Practice, an undertaking has been given that the scope of wealth tax will remain only on property assets for the next two years. According to Caroline “It is also very unlikely that the tax rates of the IFI (wealth tax) will increase under the Macron presidency”.

Please note, it is important that you seek independent tax advice before buying or selling.

For more information on how the new rules affect you or to discuss any property requirement in France you may have please contact Mark Harvey