Does a ski home make a good investment?

From Aspen to the Alps we highlight some key considerations for owners looking to rent their ski home

2 minutes to read

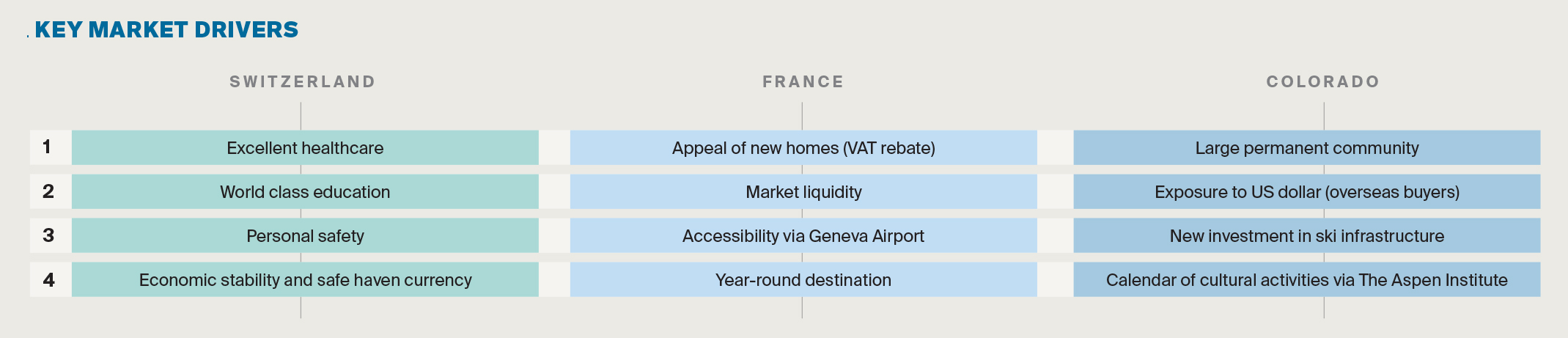

Ultimately, the motive behind buying a ski home is spending quality time with family and friends on the slopes. But there is always a bottom line that needs considering.

Regardless of an owner’s level of wealth, most financial advisers or family offices will emphasise the importance of generating an income from all assets rather than leaving them sat empty.

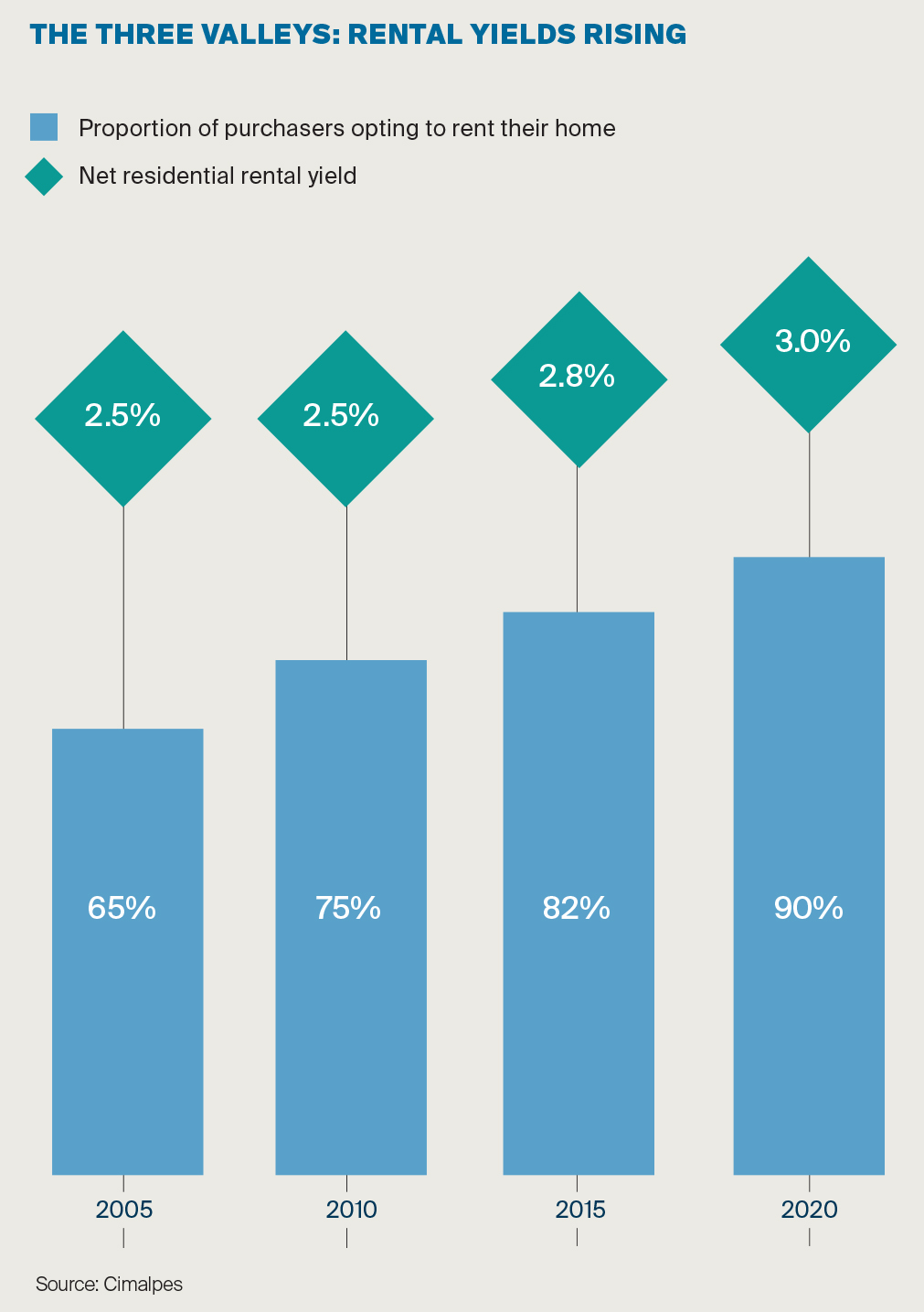

This logic is not being lost on Knight Frank’s buyers, with around 90% now opting to rent their ski home, up from 65% in 2005.

However, unlike a city apartment in Berlin or Lisbon where annual price increases have nudged double-digits in recent years, a ski home, as a discretionary purchase, is unlikely to compete in terms of short-term capital appreciation, instead buyers need to focus on location and specification to maximise rental income.

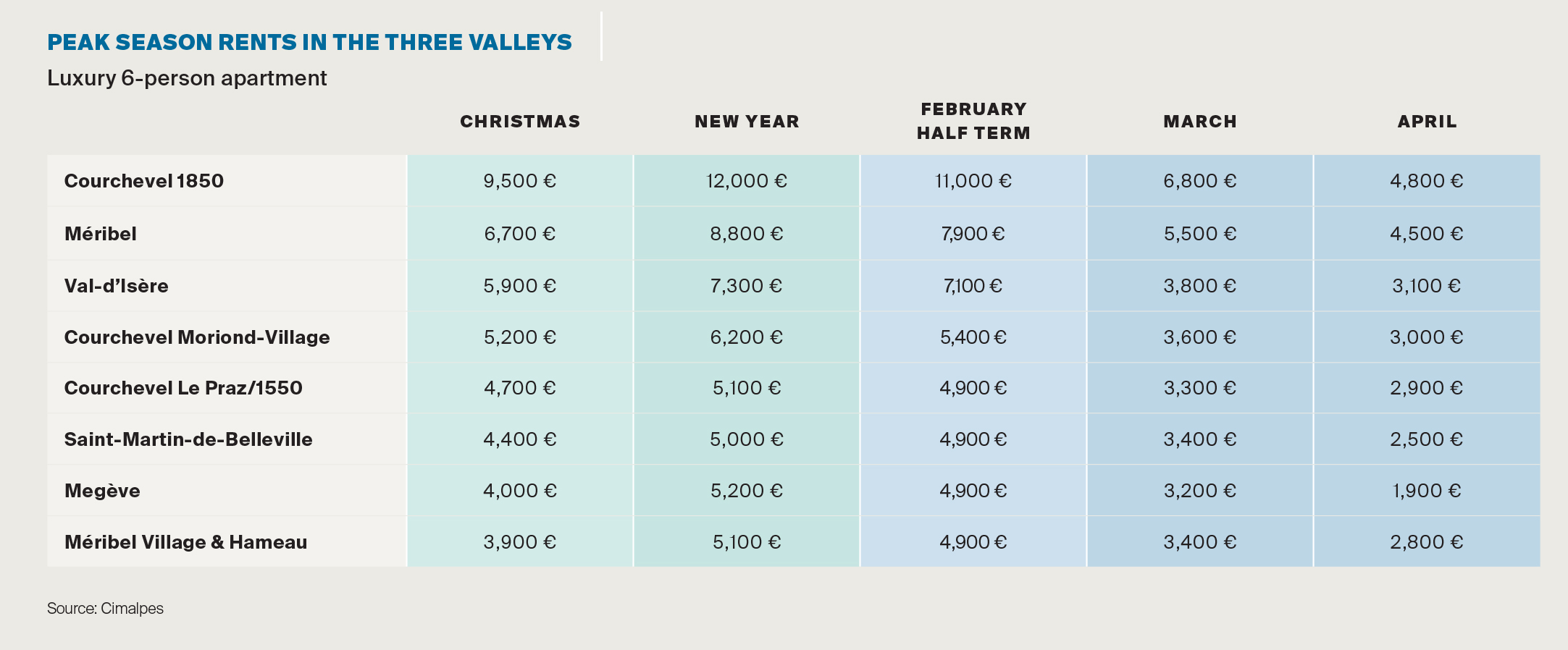

In the Three Valley resorts such as Courchevel and Val-d’Isère the net residential yield for a two-bed apartment has increased in the last decade from 2% to 3% due in part to stronger summer tourism and hence reduced void periods.

In Chamonix it’s a different story, here yields have remained flat in recent years given the resort’s long-term appeal as a year-round destination. According to Andy Symington, Director of Mountain Base, Knight Frank’s partner in Chamonix:” Those homes that generate the highest yields tend to be the smaller properties, one, two- and three-bedroom apartments although the mid-range chalets also deliver good returns. Occupancy levels vary between 20 and 30 weeks with most owners reserving the property for two to four weeks a year for their own use.”

The decision on where and what to buy will ultimately be determined by the owner’s own preference and the time of year they plan to visit. In the Three Valleys, Gstaad and Verbier owners will see higher weekly rental values and a longer winter season whilst resorts such as Chamonix, Villars, Champéry and Grimentz offer more affordable rental values in the winter but higher summer occupancy levels.

Things to consider

- New-build or resale (VAT rebate in France for new homes)

- Location – target resorts with a strong investment plan for the next 5-10 years

- Events – does the resort regularly host sporting, food, music or cultural events (source of rental demand)

- Proximity to airport • Season length – higher altitude resorts will have longer ski seasons but lower altitude may have more amenities and cater better for summer tourism (dual season) • Operational, maintenance and letting costs

- Is the resort accessible by road/rail from major conurbations appealing to locals wanting a weekend rental

- Does the resort have a truly international profile and is not overly reliant on one nationality/economy

Photo by Daniele Buso on Unsplash