Global Residential Outlook: Friday 16th October 2020

Key takeaway:

Unlike the first wave, new restrictions across Europe, Asia and North America are more targeted, regional and time-specific with housing markets continuing to function and properties continuing to transact.

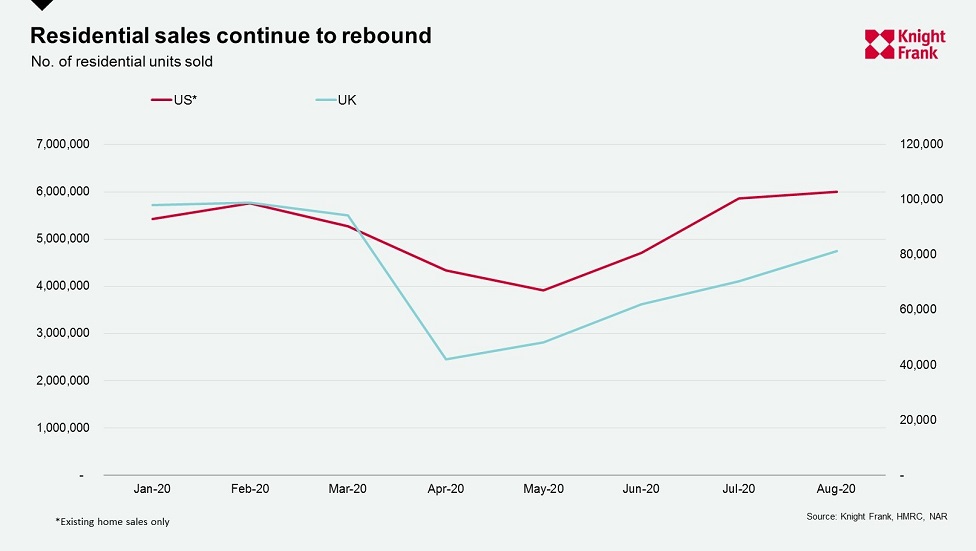

Whether boosted by stimulus or an overarching reassessment of lifestyles and working patterns, demand currently remains strong in markets such as the UK, US, Singapore, Hong Kong, Australia, and Canada. However, this may change as each government’s job and mortgage support measures come to an end weakening consumer sentiment

4 minutes to read

Need to Know:

- Europe and parts of Asia are facing second, third and even fourth waves of the virus. India’s caseload topped 7 million, whilst there are more than 700,000 cases now across Europe, a rise of 34% week-on-week. Countries that were thought to have contained the virus are now seeing spikes. Germany registered its biggest since April and Italy is recording 5,000 new cases a day. The Netherlands has closed schools, the Czech Republic is in partial lockdown, French cities are under a night-time curfew and the UK has adopted a three-tier approach.

- UK banks are calling back staff from abroad due to tax concerns according to the Financial Times. If a worker has a “permanent establishment” in a different country, the employer needs to consider the tax implications and allocate the right amount of profit to the employee. Citigroup and Credit Suisse have started pulling workers back to the UK but other banks are simply making it clear to the employee that the tax liability will be theirs.

- Travel rules to and from Australia looks set to ease. Prime Minister Scott Morrison has confirmed that the government is in talks with Japan, South Korea, Singapore, and Pacific island nations to recommence travel.

- The world’s first coronavirus passport launched last week enabling people to travel without quarantine - United Airlines and Cathay Pacific will be first to test the technology. The scheme aims to create a standardised global testing system that both governments and airlines can trust.

Residential digest

Europe

- Overseas buyers should act now if planning to buy in the UK to avoid the new stamp duty surcharge of 2% for overseas buyers which comes into effect on 1st April 2021 and the end of the current SDLT holiday which finishes at the end of March 2021.

- Despite the pandemic the new Super-Prime London Report Report confirms that the key buyer motivators of capital preservation, the UK education system and cheap debt remain unchanged. Despite lockdown, 56 sales above $10 million were completed in the first eight months of 2020, compared to 57 over the same period in 2019.

-

In the UK, demand for income-producing assets continues to grow. The Knight Frank/HomeViews Multihousing Report forecasts that 2020 will be a record year for investment in Build to Rent (BTR) stock with £2.7 billion spent in the year to date and a record £4 billion anticipated by year end. With around one in five households now renting privately, up from one in ten in 2001, and the proportion of owner-occupiers down from 70.4% to 63.8% the sector looks primed for growth.

Asia Pacific

- Singapore saw non-landed private homes sales more than double in Q3 2020 to 5,895 units. Pent-up demand from buyers who deferred their purchases coupled with low interest-rates drove the pick-up in sales according to the new Singapore Residential Market Update.

The city state launched a legal structure in January called the Variable Capital Company (VCC), in a bid to become the region’s leading financial centre. Anecdotal evidence suggests this is fuelling demand from hedge funds, private equity firms and family offices.

- Despite the resurgence of Covid-19 in Hong Kong and the subsequent tightening of social distancing restrictions, the market recorded 5,025 sales transactions in September, a 15% increase month-on-month, and a 46% increase year-on-year.

US and Canada

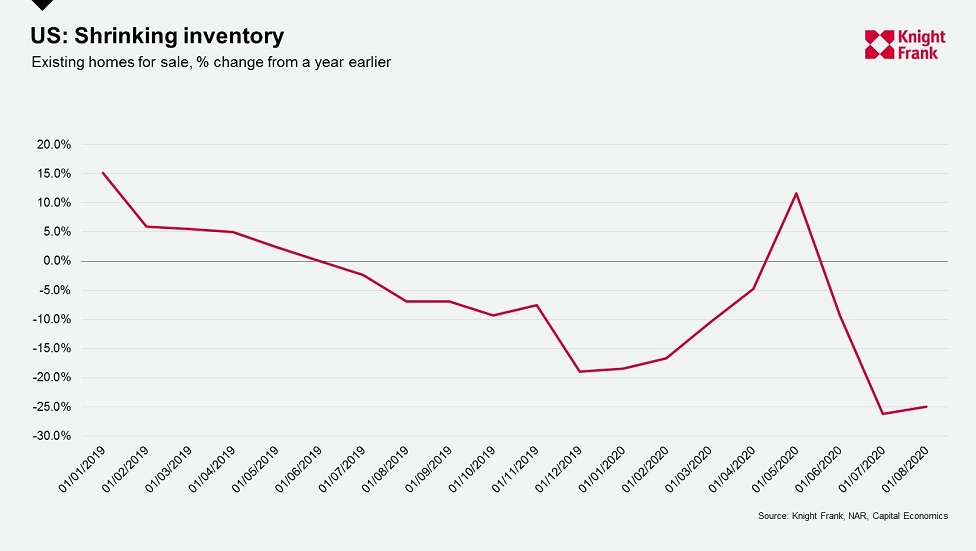

In the US, surging demand has led to a sharp drop in the number of new homes for sale, with the fall driven by a collapse in the inventory of completed homes. Although an uptick in building permits for single family homes will provide some support, completed inventory is expected to remain tight. Capital Economics forecasts new home sales will fall back from over 1 million annualised in August to around 900,000 by early next year.

Middle East and Africa

- A total of over AED3.7bn (US$1bn) of property was sold in Dubai’s Palm Jumeirah during 2019 according to the new Dubai Inside View. The report explores Dubai’s position as a global hub and why now is a good time to invest in the UAE. The publication also features Dubai community guides to both established prime locations such as Downtown and the Palm Jumeirah, as well as new neighbourhoods such as Dubai Hills Estate.

Recommended listening

This week our Head of Asia Pacific Research, Nicholas Holt, catches up with The Economist Intelligence Unit’s Tom Rafferty, who is regional director for Asia and an expert on politics and economics in the region.

Tom believes the worst is over for Asia Pacific economies and expects GDP across the region to bounce back to 5% growth in 2021. For property investors, he says exposure to the region makes sense but there are still lingering issues – momentum for economic growth will not be that sustainable until a vaccine is found, and governments’ withdrawing state support could have a dampening effect.

Click one of the links below to listen: