Covid-19 in Africa: Focus on Southern Africa

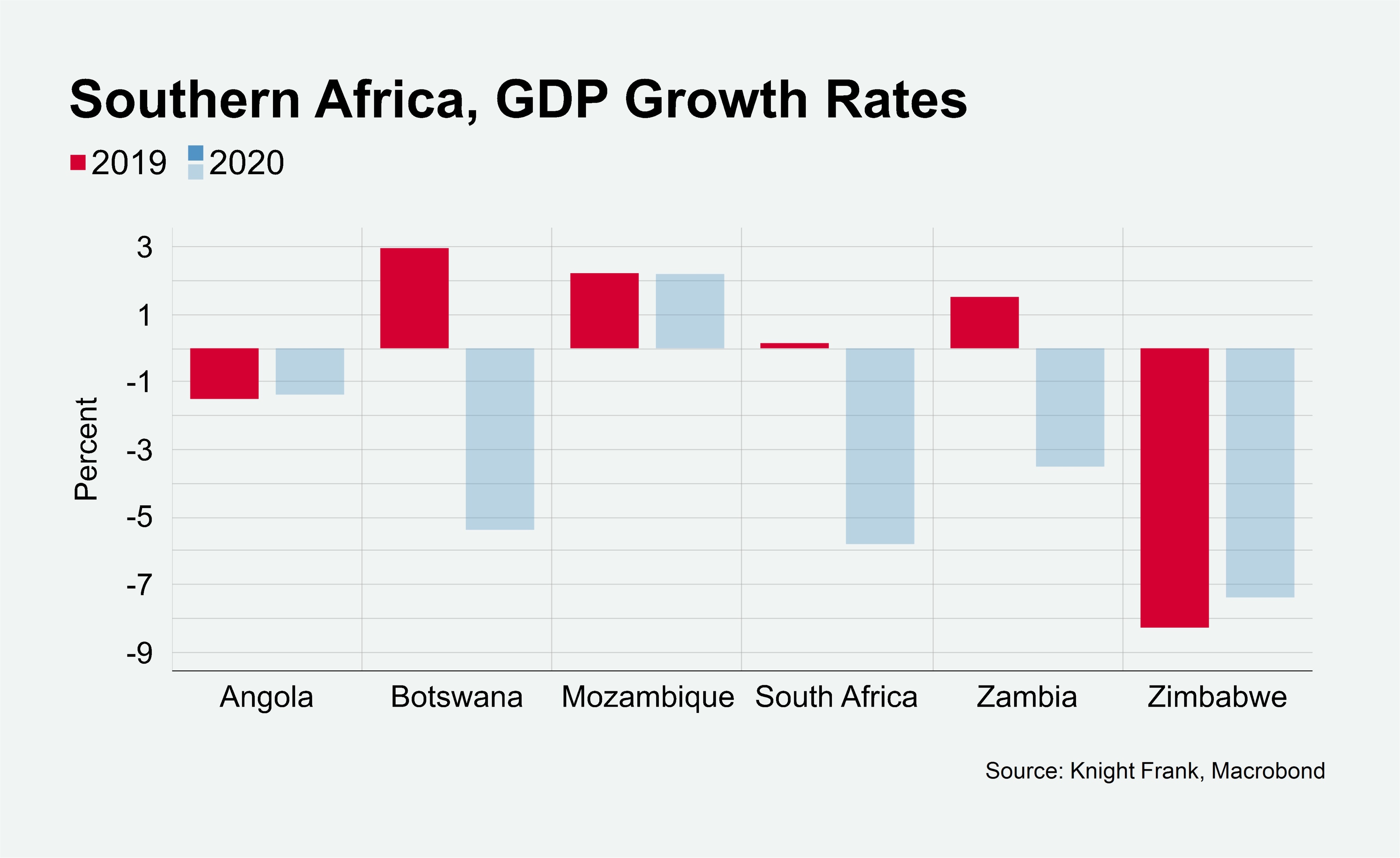

With robust mining and manufacturing sectors, Southern African countries are considered the most industrialised in Sub – Saharan Africa. Therefore, the impact on regional economies as a result of Covid-19 has varied depending on the prevalent sectors in each economy. For example, as global economic growth stalls, demand for safe-haven assets such as gold has surged and has greatly benefited gold traders in South Africa. Whilst as prices of copper and diamonds have trended down, Zambia and Botswana’s economies have struggled respectively. On a more positive note, with most regional economies being net oil importers, the rapid fall in oil prices is likely to ease the pressure on many economies.

8 minutes to read

Over the past year, the South African recession, natural disasters in Mozambique and high debt levels in Zambia have hampered economic growth in the region. This has been exacerbated by the slump in tourism, supply chain disruptions and reduction in consumer spending due to the pandemic. As a result, the IMF has revised GDP growth forecasts downward for all countries in the region.

Regional Policy and Government Initiatives Tracker

Across the region, governments have adopted various initiatives towards curbing the spread of the virus and softening the impact on their economies. Below, we provide a summary of a range of government policies and interventions and briefly analyse the potential impacts that these may have on the real estate sector.

|

South Africa

Fiscal & Monetary Policies

- Establishment of a new loan guarantee scheme for companies with a turnover below a certain threshold to get bank financing for the payment of operating expenses.

- The central bank (SARB) reduced the policy rate to 4.25%. It further announced measures to ease liquidity conditions by: a) Increasing the number of repo auctions to two to provide intraday liquidity support to clearing banks at the policy rate; b) Reducing the upper and lower limits of the standing facility to lend at repo-rate and borrow at repo-rate less 200 bps; c) raising the size of the main weekly refinancing operations as needed.

- The government announced the launch of a unified approach to enable banks to provide debt relief to borrowers.

- The Central bank has further reduced the liquidity coverage ratio from 100 to 80 % to provide additional liquidity and counter financial system risks.

- The SARB also issued guidance on dividend and cash bonuses distribution to ensure bank capital preservation.

Government Interventions

- Declaration of state of emergency.

- Local and international travel restrictions.

- Closure of learning institutions and recreational facilities.

- Phasing out of the national wide lockdown put in place.

- Social distancing measures in place.

|

|

Botswana

Fiscal & Monetary Policies

- The government established a Covid-19 Relief Fund with a 2 billion Pula contribution from the government that will finance a wage subsidy for a period of three months, finance a waiver on training levy for a period of 6 months, fund a government loan guarantee scheme of one billion Pula for businesses that are tax compliant and guarantees to cover a period of 24 months with a max of 25 billion Pula per borrower.

- Reduction of the VAT refund period (from 60 days to 21 days).

- Financial institutions have agreed to offer loan restructuring (including for mortgages and vehicles) and payment holidays for affected sectors.

- The Bank of Botswana (BoB) relaxed rules to meet capital requirements and introduced measures to improve liquidity.

- Capital adequacy ratio for banks has been reduced from 15% to 12.5 %, and regulatory forbearance for non-performing loans.

- Overnight funding costs were reduced, access to repo facilities broadened, and collateral constraints for bank borrowing from the BoB extended to include corporate bonds and traded stocks.

Government Interventions

- Adoption of social distancing measures

- Local and International travel restrictions.

- Declaration of state of emergency

- Lockdown imposed.

|

|

Zimbabwe

Fiscal & Monetary Policies

- Companies have been allowed to extend the payment of corporate taxes (waiving interest and penalties); and duties.

- The authorities returned the multi-currency system allowing both Zimbabwean dollar and US dollar to be legal tender.

- The central bank has reduced bank policy rate from 35 % to 15 % per annum; it has further reduced the statutory reserve ratio on bank deposits from 5 % to 4.5 %; introduced a ZW$5 billion medium-term bank accommodation lending facility at 10 % per annum; and increased private sector lending facility by the central bank from ZW$1 billion to ZW$2.5 billion.

Government Interventions

- State of emergency declared.

- Level 2 lockdown currently in place.

- Suspending gatherings of more than 50 people.

- Closure of Schools and Learning Institution.

- Launch of domestic and international humanitarian aid.

- Suspending prayers at churches and mosques.

|

|

Zambia

Fiscal & Monetary Policies

- The Zambian government has announced a release of 2.64 billion-kwacha (0.75 % of GDP) to clear arrears and pay contractors.

- Import duties on mineral concentrate and export duties on precious metals were suspended to support the mining sector.

- The government has waived tax penalties and fees on the outstanding tax liabilities resulting from Covid-19, suspended customs duties and VAT on some medical supplies and medical-related commodities, removed provisions relating to claim of VAT on imported spare parts, lubricants and stationery to ease pressure on companies.

- The Bank of Zambia (BoZ) plans to provide 10 billion kwacha (3% of GDP) of medium-term liquidity support to eligible financial services providers and scale up open-market operations to provide short-term liquidity support to commercial banks.

- In addition, BoZ implemented several measures to stimulate the use of e-money and reduce the use of cash, revised the rules governing the operations of the interbank foreign exchange market to support its smooth functioning, strengthening market discipline and providing a mechanism to address heightened volatility, revised loan classification and provisioning rules, and extended the transitional arrangement to IFRS9.

Government Interventions

- Closure of schools and recreation joints.

- Social distancing.

- Mandatory quarantine for all foreign travellers.

- International travel restrictions.

- Delivery and take out regime for restaurants.

- Restrictions of public gatherings to a maximum of 50 people.

|

|

Mozambique

Fiscal & Monetary Policies

- To ease liquidity conditions, on March 16, the central bank reduced reserve requirements by 150 basis points for both foreign currency and domestic currency deposits (to 11.5 % and 34.5 % respectively).

- The Government has further announced measures to support financial markets and encourage prudent loan restructuring by a) Introducing a foreign currency credit line for institutions participating in the Interbank Foreign Exchange Market, in the amount of US$ 500 million, for a period of nine months; b) Waiving the constitution of additional provisions by credit institutions and financial companies in cases of renegotiations of the terms and conditions of the loans, before their maturity, for clients affected by the pandemic, until December 31.

- The central bank announced measures to easy payment system transactions and liquidity conditions by a) Lowering fees and charges for digital transactions through commercial banks, mobile banking and e-currency, for a period of three months; b) Waiving specific provision on foreign currency loans, until December 31; c) The central bank further reduced the policy rate by 150 bps to 11.25 %.

Government Interventions

- All schools and learning institutions closed.

- Social gatherings of more than 50 persons banned.

- International travel restrictions imposed

- A 14 day quarantine for all travellers entering Mozambique

- Declaration of a state of emergency for the month of April.

- Imposing limitations on movements within the country and border entry.

- Ban on all types of public or private events.

- Closure of non-essential shops or, where applicable, their reduction in activity.

- Monitoring prices of essential goods to prevent price gouging.

- Introducing job rotation (or other forms of organization.

|

|

Angola

Fiscal & Monetary Policies

- Delays on filing taxes for selected imports were granted.

- Financial institutions that carry out credit operations were requested to grant their clients a moratorium of 60 days for servicing debt.

- The National Bank of Angola (BNA) instructed banks to provide credit in local currency to assist importers of essential goods.

- (BNA) reduced the rate on its 7-day permanent liquidity absorption facility from 10% to 7%.

- BNA announced that the minimum allocation of credit to promote the production of a set of priority products would increase to 2.5 % of the commercial banks’ net assets.

- BNA further announced the equivalent of 0.5 % of GDP to be provided as liquidity support to banks and created a liquidity line (in local currency, equivalent to US$186 million) for the purchase of government securities from non-financial corporations.

Government Interventions

- State of emergency declared.

- Sanitary restrictions put in place.

- Adoption of Social Distancing.

- Closure of all learning institutions and recreational facilities.

|

Source: IMF Policy Tracker

Impact on Real Estate Sectors

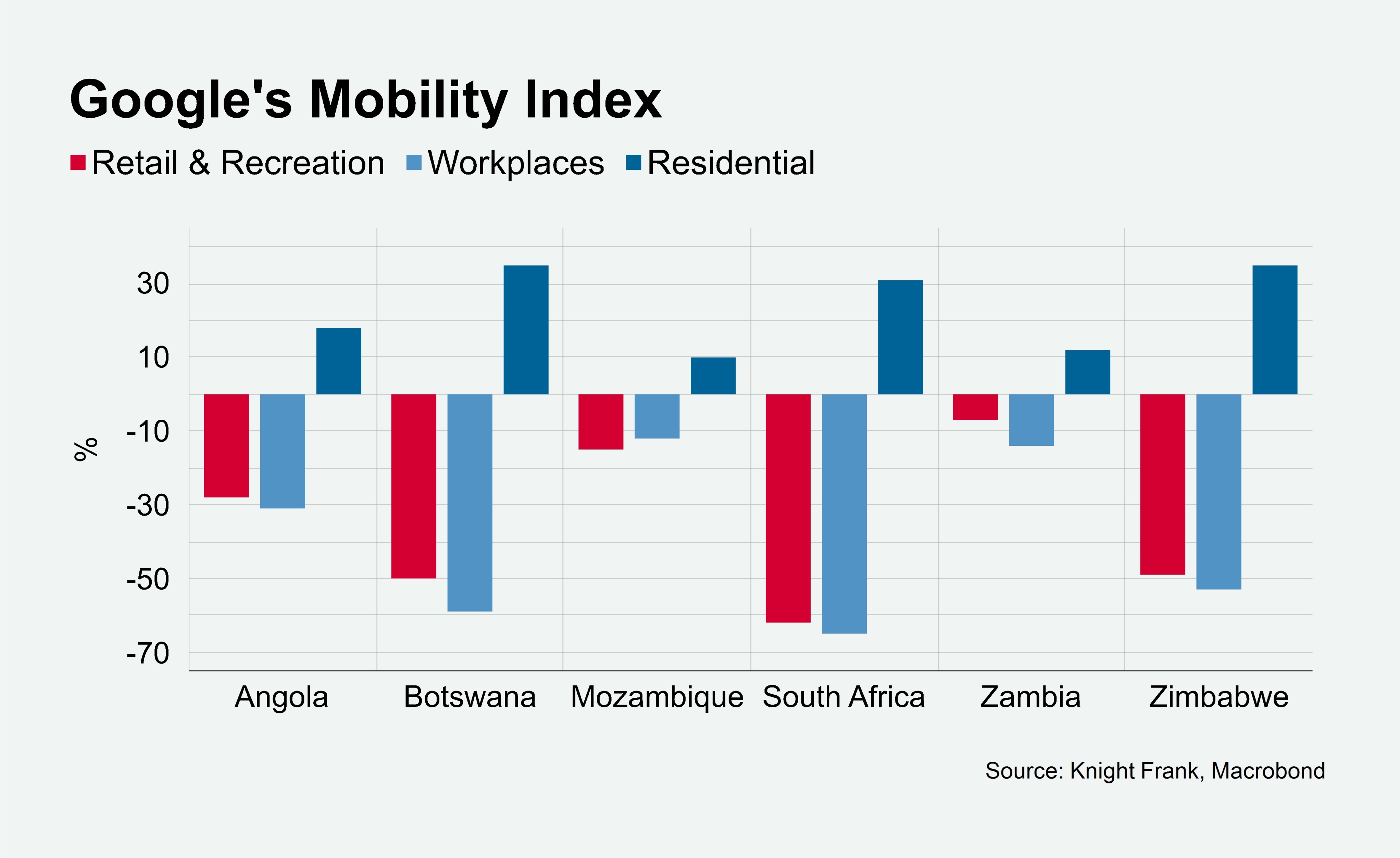

Google’s Covid-19 community mobility index, which tracks changes in visitation and time spent at various locations compared to a baseline from January 3rd to February 6th 2020, shows that as a result of government interventions to restrict mobility we have seen a decline in activity in areas associated with workplaces and retail and recreational destinations. However, these trends are not uniform across countries and are dependent on the severity of government interventions

Across the Southern Africa region, workplace activity declined the most as residents adhered to lockdown and stay at home measures adopted by governments. This in turn has led to a slowdown in economic activity, which is already impacting occupancy levels in the office sector across the region. For example, in Angola, multinational companies are adopting downsizing measures due to the pandemic, with expatriate staff most impacted by such consolidation activity. Due to the existing weak economic backdrop in the region, rental rates in the office sector are already at multi-year lows which provides little room for rates to shift further down as a result of the pandemic. Formal retail and recreational activity in the region also witnessed a decline in activity. Due to its dominant retail presence, South Africa’s retail sector has been the most affected by the lockdown measures enacted by the government. Despite a slowdown in the retail sector, demand for warehousing and logistics space is expected to increase as we see e-commerce activity surge, albeit from a low base. In Angola, upcoming retail developments have stalled with currency devaluations and supply chain disruptions impacting the import of construction materials.

As expected, activity in residential areas saw a marked increase in the period between March and April compared to a baseline. This trend has been particularly prevalent in Botswana, South Africa and Zimbabwe due to the strict lockdown measures in place in these countries. As a result of the economic downturn and social distancing restrictions currently in place, transaction volumes are expected to continue to decline. Residential prices, both mainstream and prime, are likely to also come under further pressure.