Want 10% off a central London property? Know how to time your purchase

At the end of August of we highlighted currencies and shifting buyer power as one of our five key influences for property markets in the near-term. Timing a purchase well can yield significant discounts and the volatility this year only heightens the possibilities.

2 minutes to read

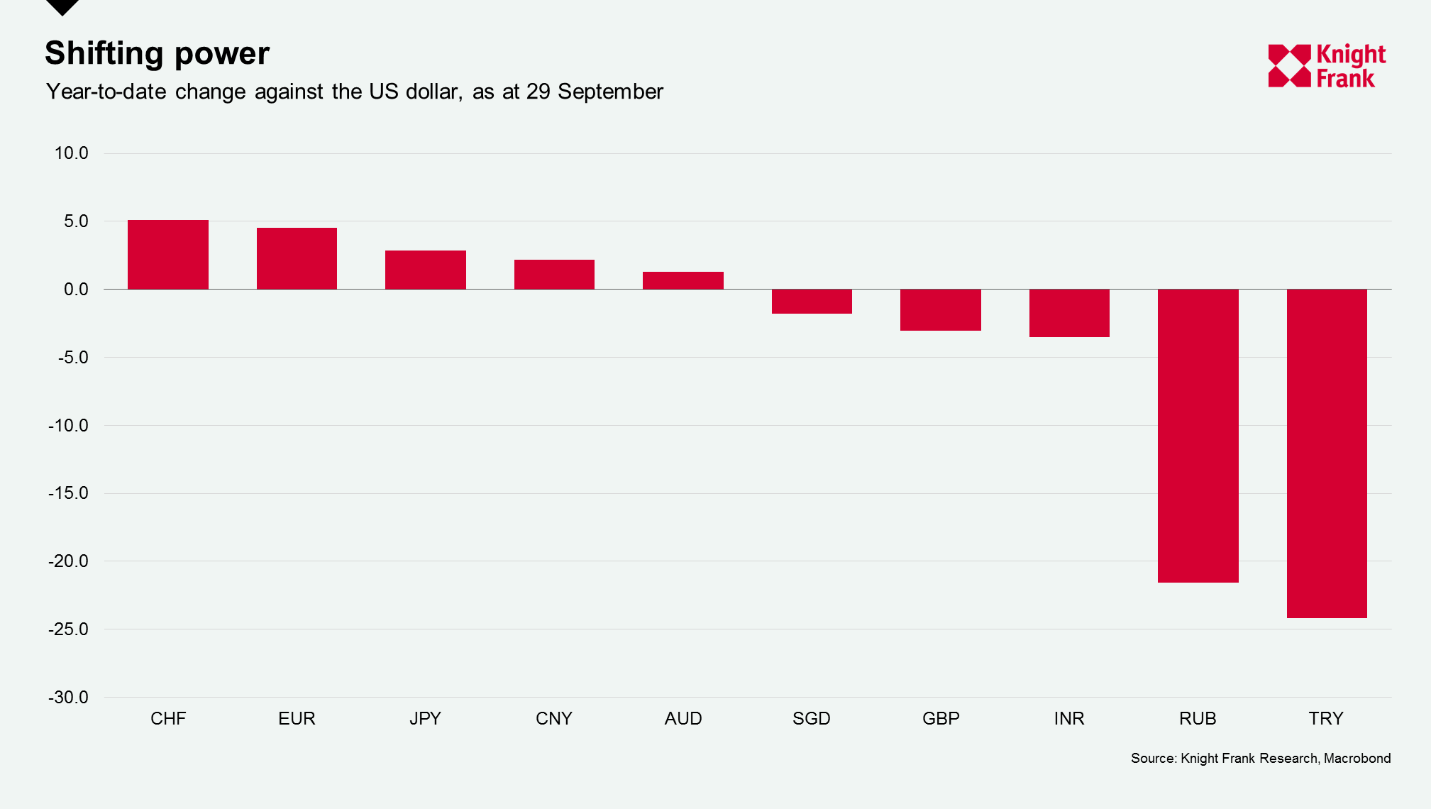

Most markets have been volatile in 2020 and currencies are no exception. We have seen multi-year lows and highs for many currencies against the US dollar – the pound reached a 35 year low in March before rebounding, and the Euro saw a two-year high, within touching distance of $1.20.

All this creates substantial shifts in buying power for overseas real estate purchasers, particularly when you throw movements in capital values into the mix. A US dollar or dollar-pegged currency buyer looking to purchase in Singapore, for example, would have enjoyed a discount of 6% at the end of June relative to the end of 2019 when taking into account both price and currency movements.

There is evidence of buyers capitalising on this in Turkey, where the lira is down more than 20% from its 2020 opening against the dollar. House price growth here topped our Global House Price Index (26% annual growth) and the top three spots in our Global Residential Cities Indexfor the year to Q2 as overseas buyers, particularly those from US dollar-pegged locations, sought to capitalise on the weakened local currency.

Timing is key, however. A holder of Swiss francs seeking property in prime central London would have had a 10% discount at the end of August relative to the end of December 2019 – yet when comparing the end of August to the low point in March, average properties have become 3% pricier.

Knowing some key dates and drivers can help with timing a purchase.

Central Bank action and setting intentions can play a part. The Swiss National Bank has signalled intentions for ultra-expansionary monetary policy for the foreseeable future in an attempt to limit the upwards pressure on the franc – the currency hit a five-year high in May this year. The pound also responded positively this week when the Bank of England deputy governor spoke out against setting negative interest rates.

Yet for sterling, and others, key dates and political action are likely to have a more sizeable impact. Many will be looking to Brexit crunch dates in October and the end of the year, and for the lead up to and results of 3 November for swings in the dollar.