The bumpy road to revitalising Asia’s tourism sector

Could Thailand be the first to open for overseas tourists?

2 minutes to read

In 2019, Thailand welcomed almost 40 million overseas tourists who spent a total of 1.93 trillion baht (US$62 billion), or the equivalent of 11% of the country’s GDP that year. Unsurprisingly, the Covid-19 outbreak has halted this trend, with only 6.7 million foreign arrivals recorded in the first five months of this year, 60% below last year’s level. The drop-off in activity facing the tourism sector will have a negative multiplier effect on the wider economy, due to the domino effect on the wide variety of supporting industries. As such, the government has introduced two tourism initiatives, with the focus on boosting domestic tourism first and subsequently targeting international.

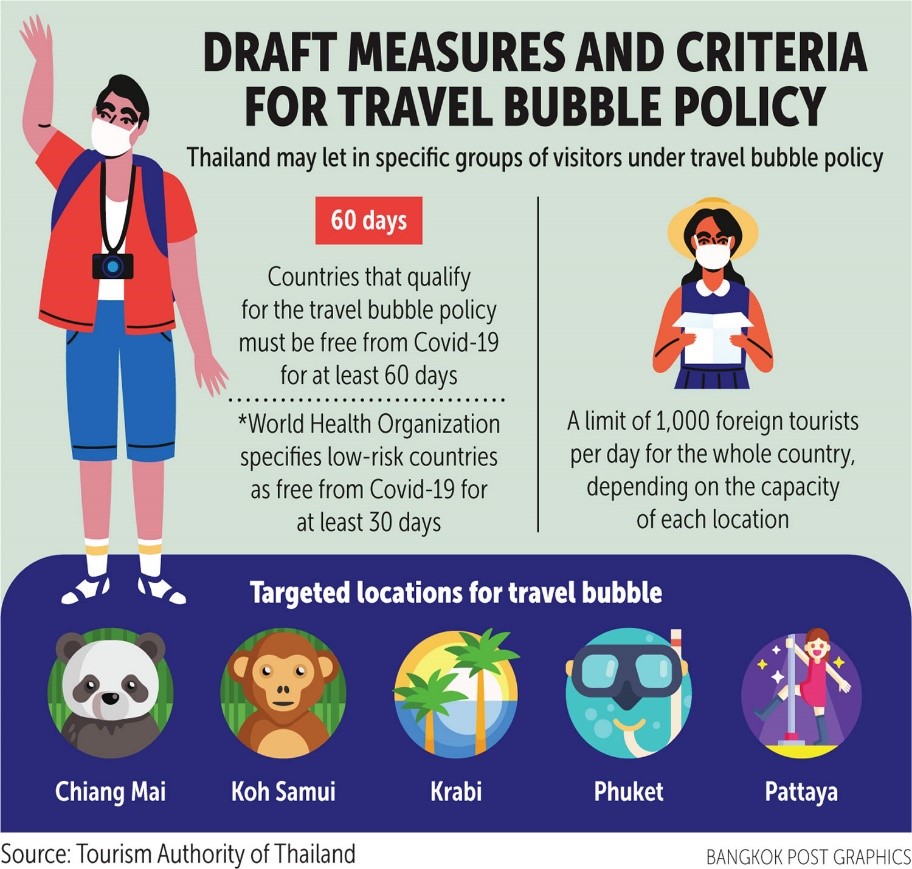

The first initiative dubbed “We Travel Together” aims to drive domestic tourism by providing cash incentives on lodging costs for local travellers. However, the response since the launch in early July has been lukewarm. The second initiative is a three-phased gradual reopening of Thailand’s borders which started in June, with the third phase seeing travel bubbles for foreign leisure travellers from selected low risk countries; making Thailand one the first countries in Asia to reopen for international tourism.

The third phase was initially set to launch on August 1st but has since been delayed until October given that a number of the selected markets it was looking to approve, such as Vietnam and Hong Kong, have recently recorded new waves of infections. Vietnam recently locked down the popular resort city of Danang after three months of no new infections, whilst Hong Kong is battling a third wave of infections following a recent spike of cases in mid-July.

The other major challenge is to maintain the country’s current excellent track record in battling the virus. Thailand has not recorded any new local infections for the past two months, with all new cases being imported from returning residents. However, as the recent outbreaks in Vietnam and Hong Kong have shown, the risk of a sudden rapid outbreak remains high. This is likely to weigh on tourist sentiment, even from those selected countries, despite all the precautions being put in place. Going forward, while hopeful, our expectations are for Thailand’s upscale hotels to record occupancies below 50% for the remainder of this year with average daily rates to fall between 5 to 10%.

Photo by Sumit Chinchane on Unsplash