Kicking the Can Down the Road?

Are companies delaying the inevitable by borrowing too heavily now?

2 minutes to read

While we have seen several large Asia-Pacific companies file for bankruptcy in recent months including Virgin Australia and Thai Airways, many have managed to stay afloat by entering the bond market and borrowing heavily to ease their cash crunch.

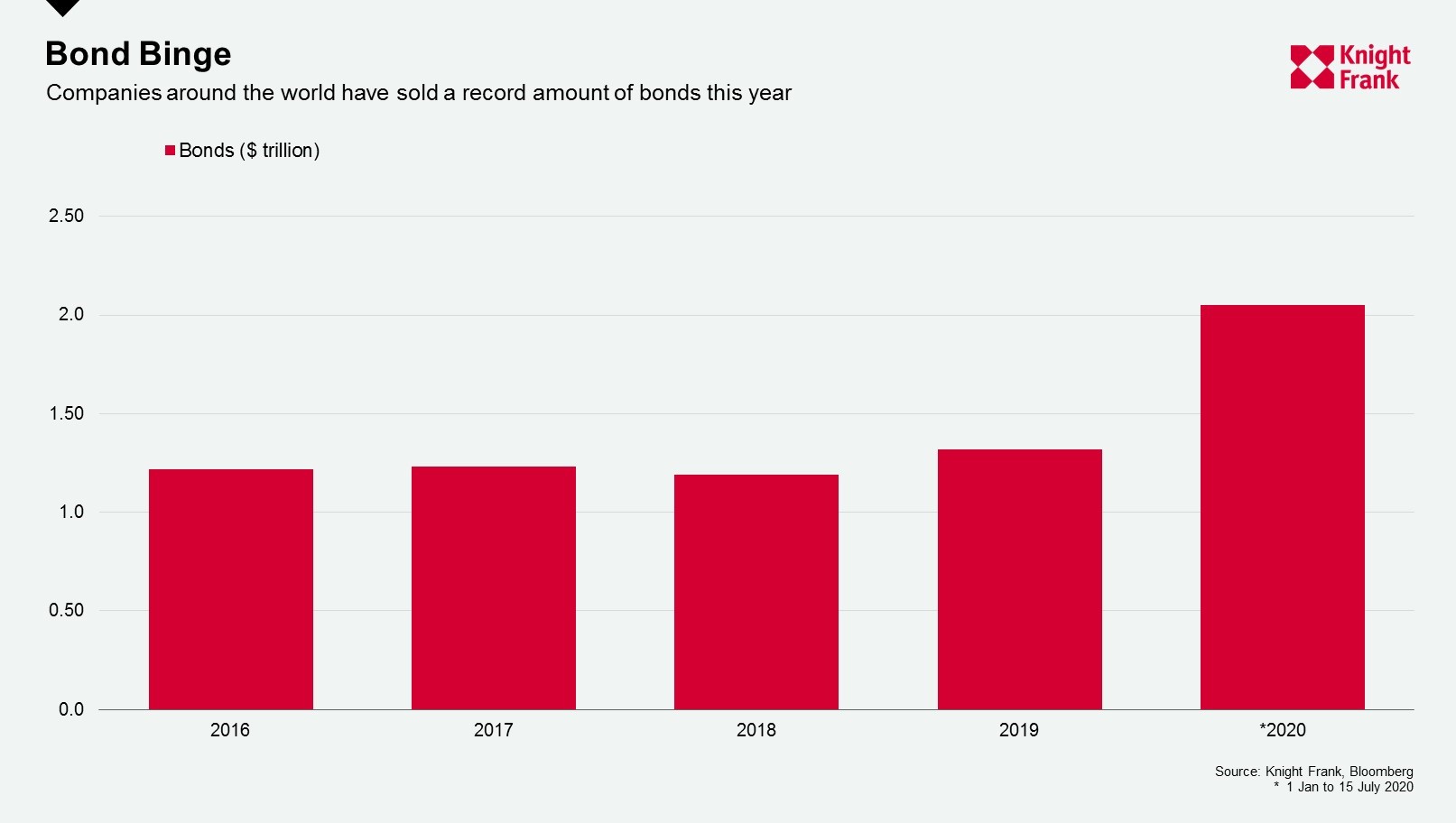

Since the start of the year, companies across the globe have sold a record US$2.1 trillion worth of corporate bonds across varying grades as at July 15th 2020. This far exceeds the amount of bonds issued within the same seven-month time frame over the preceding four years which averaged around US$1.25 trillion annually.

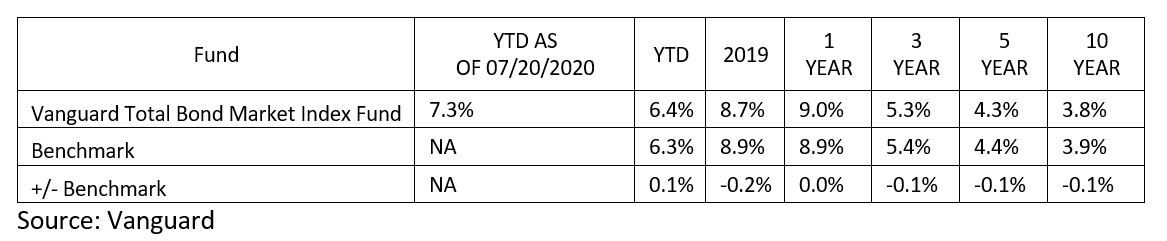

This coupled with the combined weight of aggressive monetary easing by the world’s central banks has fuelled a credit market bull rally since the start of 2020 - the like of which has not seen over the past decade. Using Vanguard’s Total Bond Market Index Fund, one of the world’s largest bond funds, which has an AUM of US$116 billion as a proxy, the fund has returned 7.3% year-to-date for its investors as of 20th July. This is on top of the 8.7% return it recorded last year and far exceeds its annual averages over the past three-, five- and ten-year periods.

As many economies came to an abrupt standstill in recent months, companies were faced with sudden tremendous stress on their revenues and operations and understandably, with readily available cheap credit, had to resort to borrowings to reduce their cash crunches and keep paying their employees.

However, with the IMF recently downgrading its 2020 global GDP forecast to -4.9% in June, this was down -1.9% from their earlier prediction in April, companies around the world will need to be prepared for a much longer period of stress. While there will be those who are able to weather the ongoing storm and emerge from the rubble, many will likely succumb to the challenges ahead. However, by borrowing heavily and building their hopes upon weak fundamental foundations (e.g. consumer demand returning strongly in the coming months), it will only save them today but heighten the risks of tomorrow and potentially serve only to delay the inevitable.