Why prime buyers are paying close attention to currency shifts

In times of crisis, we see safe haven currencies strengthen but it’s not just US dollar-denominated buyers that are seeing some significant discounts in global markets.

3 minutes to read

With interest rates being slashed around the world, the logical assumption would be that foreign investment would decrease and a currency's relative value would weaken. But, in unprecedented times when most advanced economies have seen more than one rate cut in the last few weeks, all bets are off and the flight to safety is paramount for even the most hardened of investors.

What happens in times of crisis?

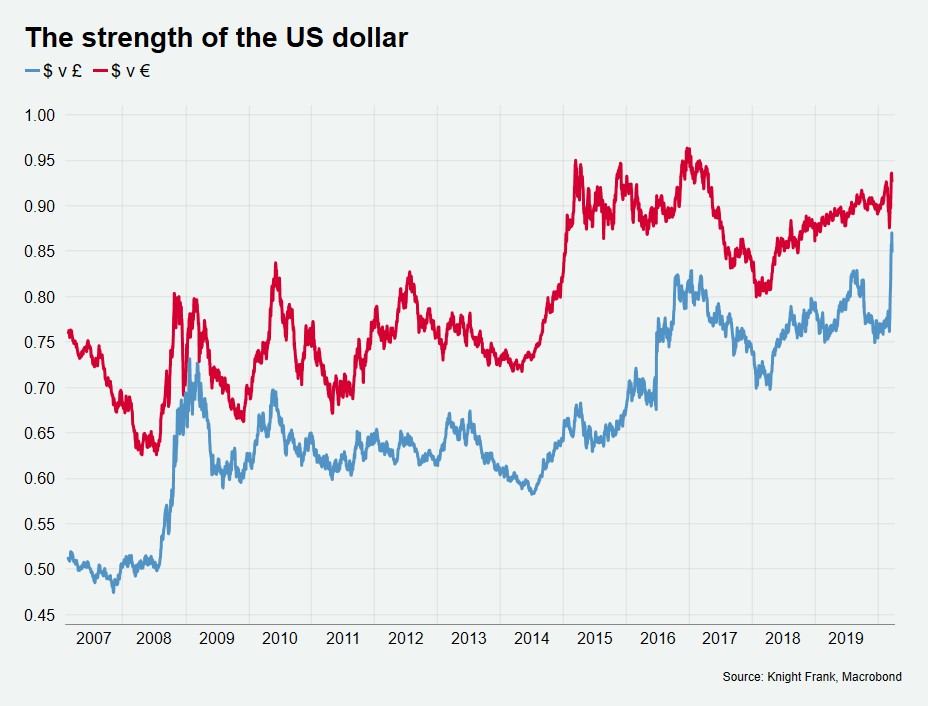

Not surprisingly, investors are targeting traditional safe haven currencies such as the US dollar, Swiss franc and Japanese Yen. The US dollar is up 12% against the pound, and 3% against the euro, compared to 31 December when the first global case of Covid-19 was recorded. Companies are inevitably hoarding dollars to pay off debt and keep business trading.

Why does this matter for prime property purchasers?

According to Knight Frank’s Alasdair Pritchard, “A 12% currency advantage for a US dollar buyer purchasing a sub-£1m property in London may not result in a vast saving but for a £20m property that saving can be a game changer. Such shifts can help mitigate property purchase costs and go some way to reduce significant foreign buyer taxes in markets such as Hong Kong, Singapore and Vancouver.”

Alasdair adds, “In the case of big ticket sales that have been under negotiation for several weeks or even months, a double-digit shift in currency can make a significant difference to buyer sentiment.”

Sterling’s appeal

In the wake of the coronavirus, the pound has slumped by about 12% over the last two weeks to a low of $1.15 on 23 March, its lowest level since 1985. The logical conclusion is that its weakness is due to the dollar’s strength but the pound has also fallen against the yen and has dropped by about 6% against the euro to €1.07, its lowest level since 2009.

Sterling’s weakness alongside record low interest rates - a UK tracker mortgage hit 0.8% earlier this week - may shine a spotlight on the London and wider UK property market once more as my colleague Tom Bill highlights in a recent blog post.

It’s not just sterling that is being monitored closely by global buyers but Australian and New Zealand dollars too as we can see in the tables below.

The graphic show the currency play for ten different buyer denominations across eight prime residential property markets, looking at the change in currency over both one and five years. The data takes into account currency shifts only, not property price performance, which in some cases will increase the discount further. As you would expect with the Hong Kong dollar pegged to the US dollar, buyers in these markets are seeing similar performances.

Knight Frank’s Adam Ross who is based in our Sydney office, says his global clients are looking at Australian property with renewed interest. For Eurozone buyers, the AUD/EUR exchange rate is at its most favourable rate since April 2009 whilst for Hong Kong and Singaporean buyers the rate is at an all-time high.

Winners and losers

What next?

Whether we face a V, U or L-shaped recovery as assessed by my colleague Flora Harley, analysts predict much of the dollar’s strength may unwind in the second half of 2020 lessening the currency advantage for US-dollar pegged currencies.