Established brands in Student Accommodation sector emerge victorious as rents rise

Rental growth in the UK purpose-built student accommodation sector was positive in 2018/19, despite significant development activity. However, a gap has opened up between owner/operators with the strongest brands and the rest of the market.

2 minutes to read

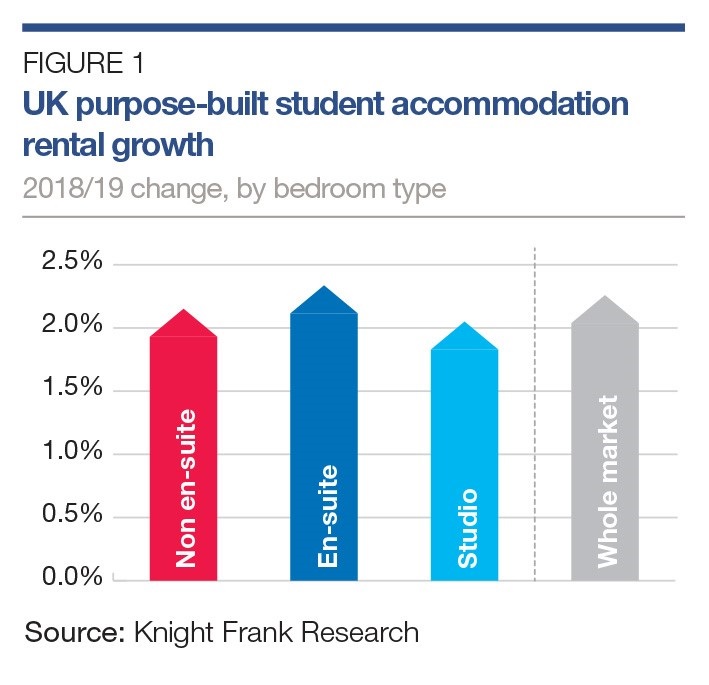

Headline rental growth for purpose-built student accommodation (PBSA) increased by 2.26% for the 2018/19 academic year, down from 2.55% in 2017/18.

This slight moderation is in line with our expectation that rental growth will slow as the sector matures.

While the macro picture shows steady rental growth, individual markets are seeing varying levels of performance, largely dependent on the balance between supply and demand.

"Location and individual supply and demand dynamics may be the primary drivers of performance, but the data also highlights the importance of an operator’s brand."

Generally speaking, cities with large, growing student populations and modest delivery pipelines, such as Manchester, are outperforming the wider market. Cities with a high level of existing PBSA stock and stronger development pipelines, such as Plymouth, are reporting more modest growth.

While markets have experienced different degrees of new supply relative to demand over the last year, it is worth noting that the change in rental values across the sector has been positive in 95% of the cities covered by the index, and that occupancy rates remain high.

In a handful of markets, such as Cardiff, where a significant volume of new beds have increased supply in the last year, rental growth has been flat or negative for some room types. The opposite is true for markets where delivery has been scarce, such as studios in Brighton.

Location and individual supply and demand dynamics may be the primary drivers of performance, but the data also highlights the importance of an operator’s brand. Schemes owned by occupiers with operational stock of over 10,000 beds in multiple markets reported rental growth in excess of 3% on average.

“In a transparent market, stronger brands resonate more with students, who as consumers, demonstrate a clear preference for a quality product and will make recommendations based on their experience."

These owner/operators have developed distinctive, recognisable brands built upon location, high quality stock and a sophisticated approach to customer service and care.

The trend for stronger rental growth for ensuite and non en-suite rooms with shared kitchen facilities compared with self-contained studios continued in 2018/19.

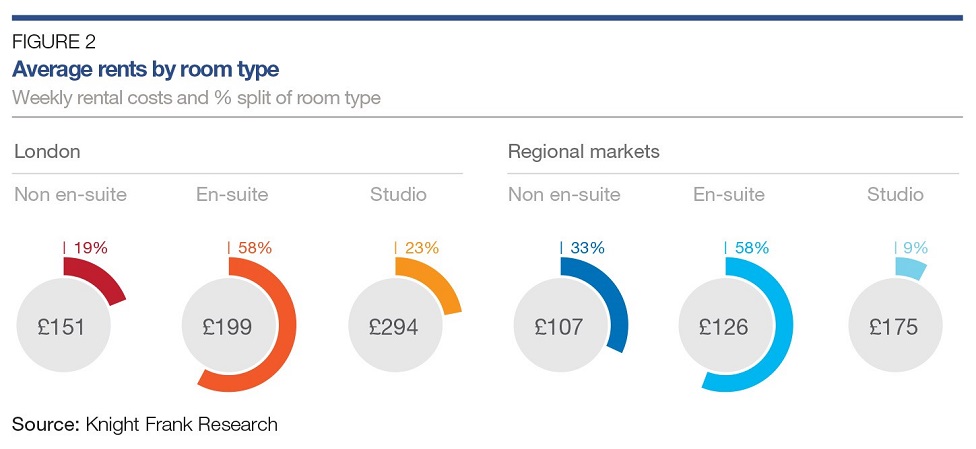

This reflects the higher level of demand for more affordable bed spaces. Indeed, the top 10% of en-suite bed spaces by price (excluding London) saw little or no rental growth (less than 1%), whilst bed spaces with the lowest 10% of rents have increased at an average of 3.7%.

Whilst we are beginning to see a movement away from the development of studios, it is still the case that most recent new development has been at the premium end of the market.

The lack of new affordable direct let accommodation relative to demand is underpinning the outperformance of lower quartile priced stock compared with the rest of the market.

To discuss any of the points raised in this article or to contact Knight Frank's Student Property Team visit: