UK Residential Market Update: November 2017

Chancellor Philip Hammond is preparing to deliver his Autumn Budget later this month, with housing expected to feature heavily. Meanwhile, the Bank of England raised interest rates for the first time in a decade.

2 minutes to read

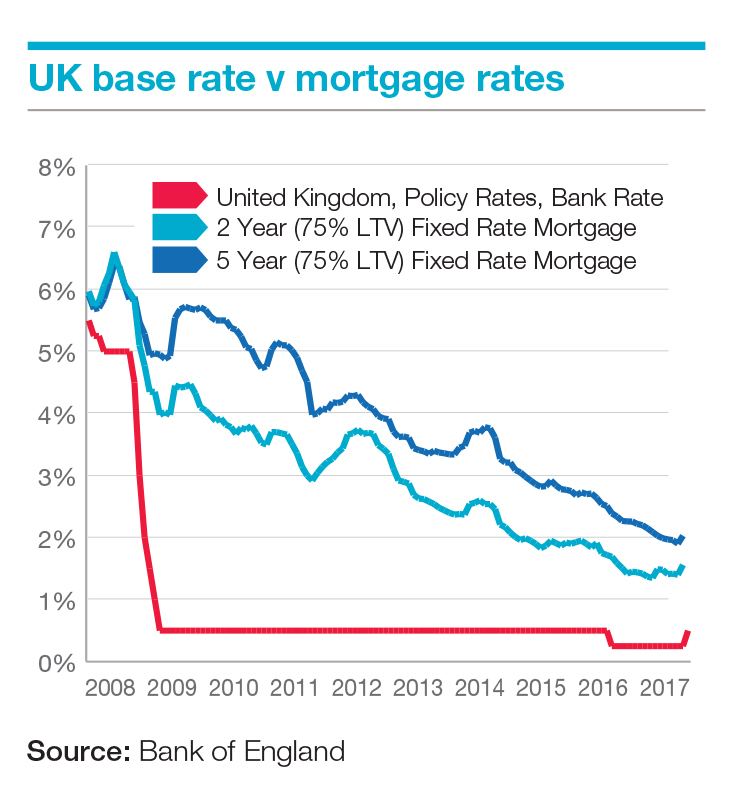

In what was a widely expected move, the Bank of England raised interest rates in November. The official bank rate has been lifted from 0.25% to 0.5%, the first increase since July 2007.

This will be the first time some borrowers will have ever experienced an increase in their mortgage payments.

However, what happens next is likely to set the tone. Last month’s move was simply a reversal of the cut in August of last year following the vote to leave the European Union and means that the base rate is still at a historically low level.

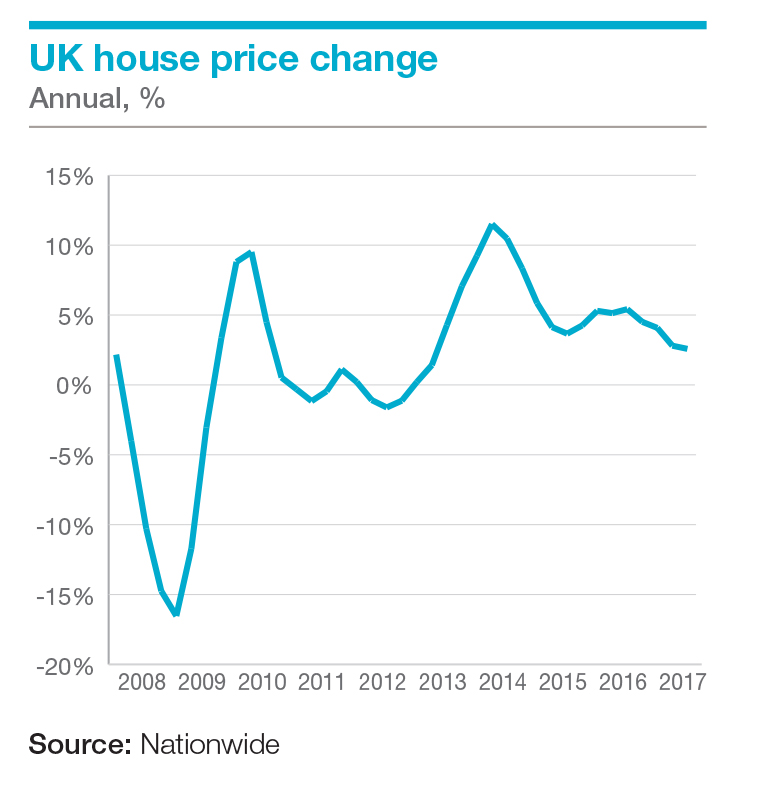

Across the UK, average house prices rose by 2.5% over the year to October, according to the latest data from Nationwide. This was a slight pick-up from September, but notably below the near 5% growth reported a year ago.

"All eyes will now turn to the Chancellor, Philip Hammond, as he prepares to deliver the Autumn Budget on November 22nd, the first major set piece following this year’s snap General Election in June."

All eyes will now turn to the Chancellor, Philip Hammond, as he prepares to deliver the Autumn Budget on November 22nd, the first major set piece following this year’s snap General Election in June.

Housing has leapt up the political agenda in recent months and is likely to feature heavily. The Budget may be the opportunity for the Government to announce additional changes or support to further boost supply.

Official housebuilding figures released by DCLG showed annual housing supply in England amounted to 217,350 net additional dwellings in 2016-17, up 15% on 2015-16.

Prime market update

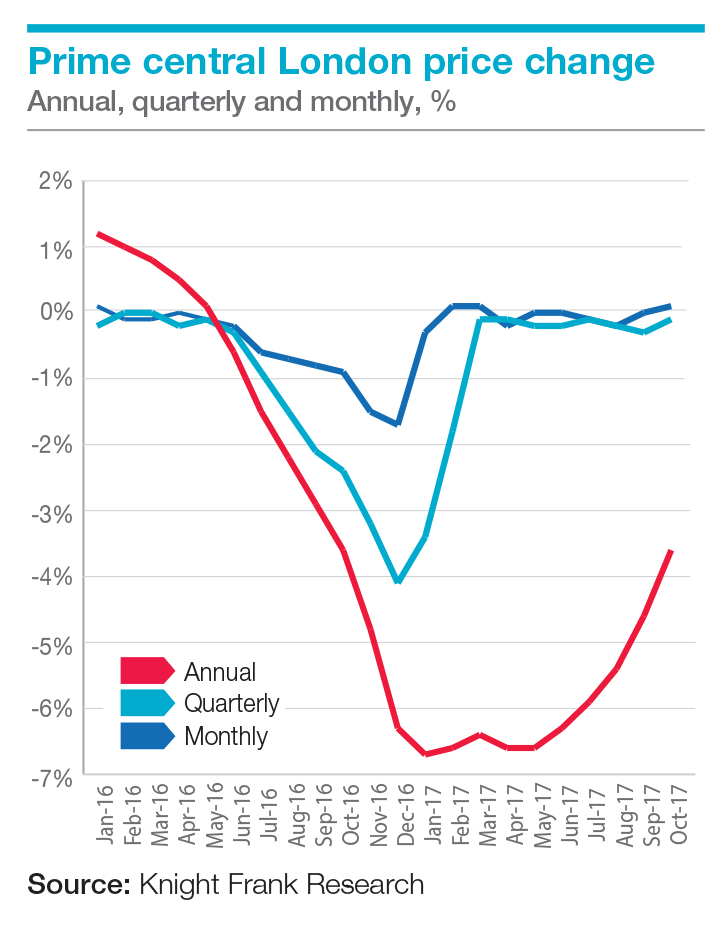

Average values in prime central London edged up by 0.1% in October, taking the annual change in prices to -3.6%. In a sign that price falls have bottomed out, this was the most modest rate of decline seen in a year. Knight Frank data also indicates an uplift in activity, with both transaction levels and viewings rising year-on-year.

This pick-up in activity has been mirrored in the prime country market, where sales volumes were 7% higher in the first ten months of 2017 compared with the previous year, Knight Frank figures show. Prices remain broadly flat, however, with a 0.2% uplift on the year in Q3.

There are pockets of outperformance in a number of urban prime markets however, reflected by strong price growth in our town house category.

Click here to read the full UK Residential Market Update