Quantifying e-commerce demand - is online spend hype a fallacy?

As part of a series of posts focussing on the often misinterpreted impact of e-commerce on traditional high street stores and logistics sector, Stephen Springham, Head of Retail Research, challenges the populist view that online has supplanted store-based retail.

4 minutes to read

There are also misconceptions as to the overall size of online spend. Online is a relatively immature retail channel, so reported annual growth is invariably very high in percentage terms.

Retailers too report far higher growth figures for their online operations than they do their store-based ones. Impressive as this growth is, it is always worth stressing that it is being leveraged off a relatively low base.

Retail Channels of Distribution

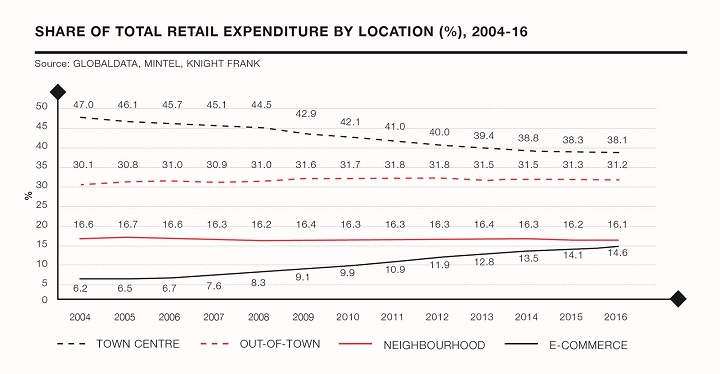

Be that as it may, industry analysts such as Mintel and Verdict estimate that total online sales totalled between £43 billion and £47 billion in 2016, which accounts for between 13% and 15% of all retail sales in this country.

This share has more than doubled over the last decade (from between 6% and 7% in 2006), largely at the expense of town centre spend – retail warehousing and neighbourhood have seen some erosion, but have generally been more resilient. But flipping these figures on their head, around 85% of all retail spend is still made through traditional, non e-commerce channels.

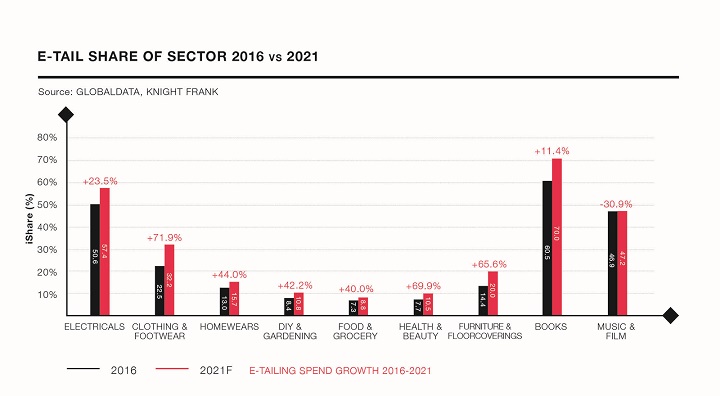

The level of online penetration does vary by retail sub-sector. The most mature retail e-commerce markets are books and recorded music/films, by no co-incidence also the product categories that were first espoused by Amazon.

Online now accounts for 60.5% of all UK book sales according to Verdict and 46.9% of recorded music/films. But with maturity comes lower growth, and these categories are not forecast to be online trailblazers going forward – indeed, online sales of recorded music and films is expected to decline, squeezed between more digital streaming and a slight resurgence in high street sales of physical product, such as vinyl.

Heavily branded, commodity-based retail sub-sectors such as electricals also lend themselves to e-commerce and online penetration is correspondingly high (50.6% in 2016, rising to 57.4% over the next five years). In contrast, online penetration in grocery remains relatively low at 7.3% (according to Verdict), or just 5.5% (according to Mintel).

Online by Retail Sub-sector

Large as many of these figures are, they need to be treated with caution. Online does not mean ‘non-store’, as we will go on to discuss.

Understanding multi-channel

For many, Amazon is the standard-bearer for online retailing and its business model (PC/mobile/tablet ordering – central DC order fulfilment – home delivery) the epitome of e-commerce. For all Amazon’s pioneering of e-commerce, this is just one permutation of online shopping - and indeed one that is diminishing slightly as the market matures.

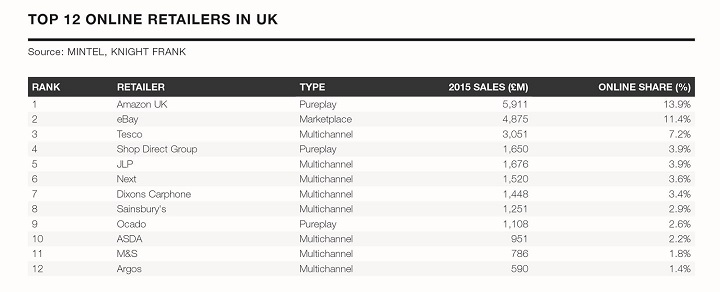

In basic terms, the online market sub-divides into two categories – ‘pure plays’ (Amazon, ASOS, BooHoo, AO World) and ‘multi-channel operators’ (traditional store-based operators who have developed e-commerce capabilities). Whereas pure-plays have traditionally adhered to just one model, multi-channel operators have a number of online permutations and combinations.

"The notion of online being in conflict with stores is increasingly tenuous – online works in collaboration with stores, rather in competition. Statistics heralding the ongoing rise of e-commerce at the expense of stores are largely meaningless."

Key ones include PC/mobile/tablet ordering – central DC order fulfilment – store-based pick up, which tends to go under the banner of click & collect. But this is by no means the only online model they employ. Even if a customer places an order instore and returns to the same store the following day to pick up this item, most retailers would classify this as an online sale, even though the shopper has had no recourse to a PC at all.

Factoring in all these permutations gives a somewhat alternate view to the populist one. Pure-play online retailing accounts for less than half of all e-commerce, the rest being made up through multi-channel models. Pure-play online makes up less than 6% of all retail sales – expressed another way, stores play a fundamental role in nearly 95% of all retail sales in this country. Indeed, of the top 12 online retailers in the country, only three are pure-plays (Amazon, Shop Direct and Ocado).

Online – Pure-Play versus Multi-Channel

The reality is that the dividing lines between channels are blurring to the point of becoming meaningless. The hackneyed term ‘bricks & mortar retailers’ is still used but is largely redundant as most are multi-channel operators, with an embedded online business. Nor is this a one-way street – pure-plays are tentatively also entering the physical space and opening stores of their own.

Examples include Sofa.com and Missguided, which recently took on the former Forever 21 unit at Westfield Stratford City. Amazon has opened a few stores in its native US and may well ultimately follow suit here in the UK. But, by and large, it is more difficult for pure-plays to make the transition to multi-channel that it is (was?) for store-based retailers, on account of inherent costs involved in establishing a physical presence.

Top 12 Online Retailers in UK

The notion of online being in conflict with stores is increasingly tenuous – online works in collaboration with stores, rather in competition. Statistics heralding the ongoing rise of e-commerce at the expense of stores are largely meaningless.

To discuss any of the issues raised in this article, please contact Head of Retail Research Stephen Springham or: