UK Stamp Duty revenue up despite fall in transactions

Every September, HMRC publishes its annual review of stamp duty receipts covering the previous financial year.

2 minutes to read

A closer look at the data provides us with a detailed breakdown of receipts by region and price band, as well as more detail on the impact of higher purchase taxes for investors and second home buyers.

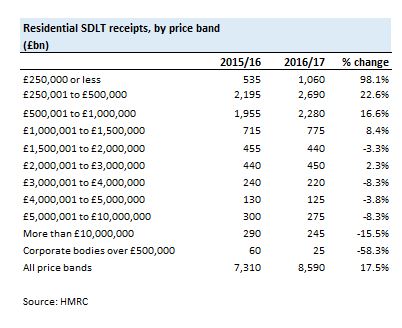

In 2016/17, HMRC collected £8.6bn in SDLT receipts on a total of 1.09 million residential transactions. This was 17% higher than in 2015/16, despite a moderation in transaction volumes, of 8% compared with the previous year.

The largest decreases in terms of sales volumes were seen in price bands between £3 million and £10 million, HMRC figures show.

However, despite a general moderation in terms of activity, higher rates of tax for second home buyers and investors meant that total tax revenue went up.

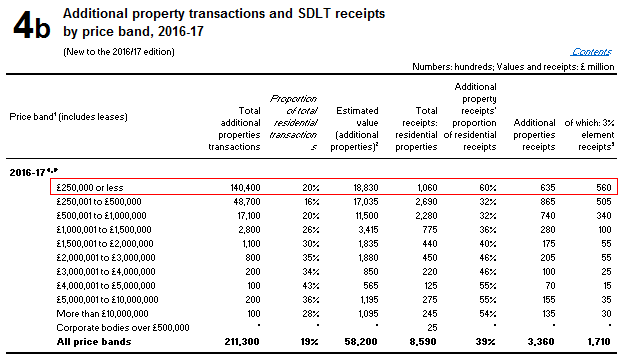

For example, just over £1bn was collected from the sale of properties valued at £250,000 or less in 2016/17, with revenue from the sale of additional properties accounting for 60% of this total. In 2015/16, before the introduction of the additional stamp duty, HMRC collected £535 million from this price band.

Generally speaking, the HMRC figures show that SDLT receipts from residential properties increased for properties valued at less than £1.5 million and decreased for properties over £1.5 million. The biggest decrease in percentage terms coming for properties valued over £10 million.

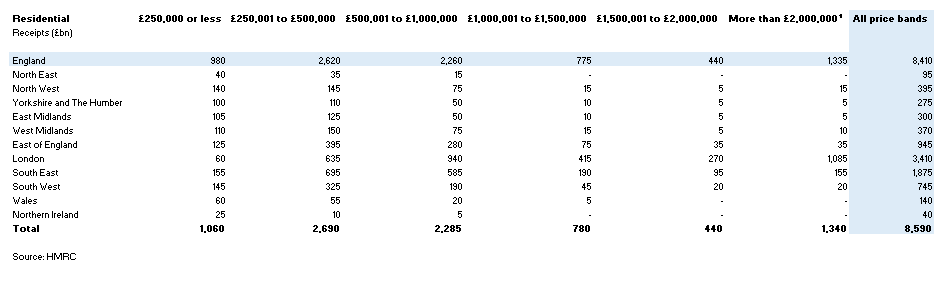

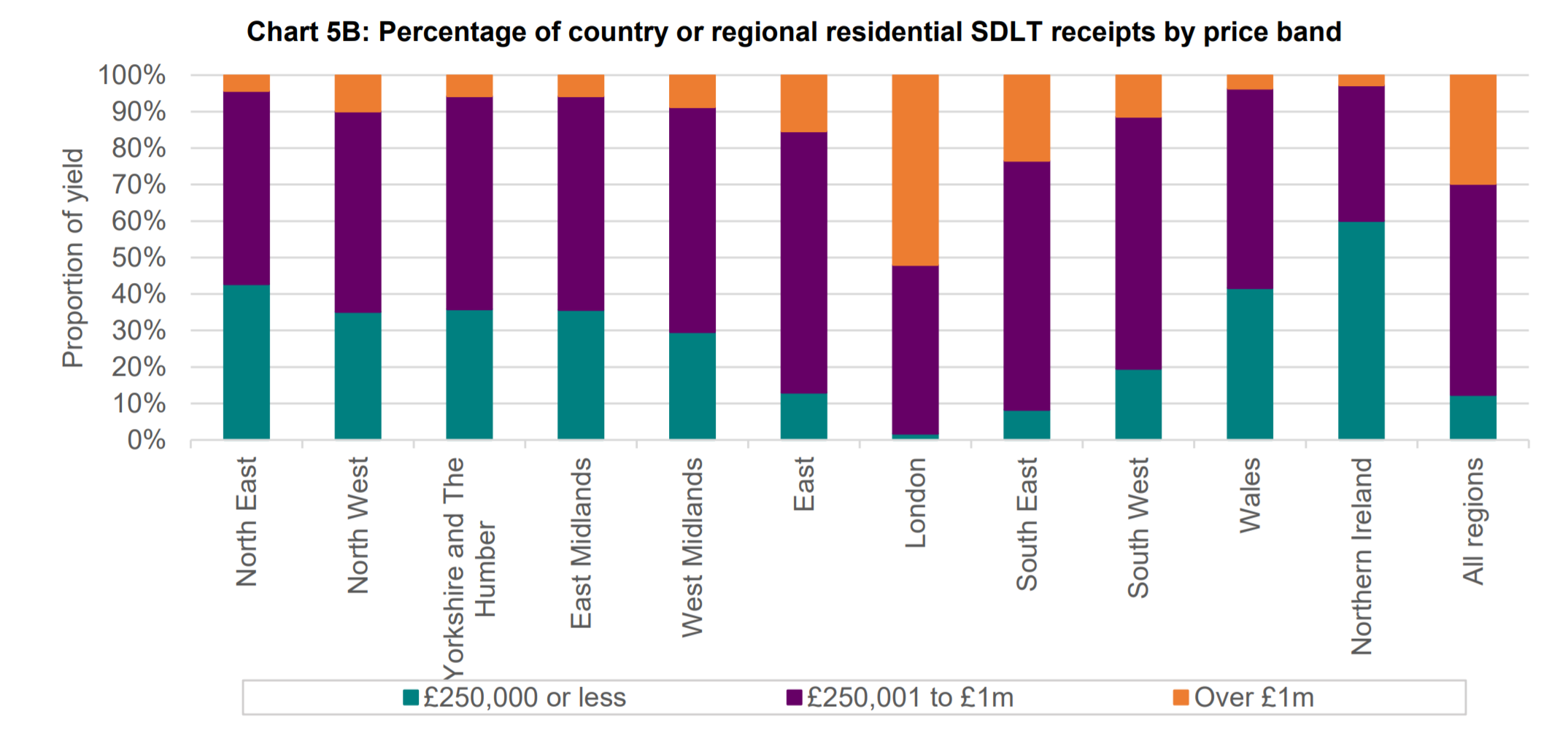

SDLT receipts by region and price band

London accounted for 39.7% of total SDLT revenue in 2016/17, down from 46% the previous year. The South East was the next highest yielding region, at just over 21%

In 2016-17, the local authority with the highest SDLT receipts from residential property transactions was Westminster with £508 million, representing 6% of all residential SDLT receipts. Kensington and Chelsea was next at £413 million, down from £514 million in 2015/16.

Additional properties

There were 211,000 additional property transactions in 2016-17, HMRC figures show, accounting for 19% of transactions. The region with the highest SDLT receipts from additional properties was London (£1.4bn).

Additional properties where the value was £1 million or less brought in £2.2bn. Of the price bands over £1 million, properties valued at over £1 million to £1.5 million had the highest SDLT receipts (£280 million).