UK Residential Market Update - March 2017

House prices ticked up in February in both the wider UK market and in prime central London. Meanwhile, the Office for Budget Responsibility laid out its outlook for the market in the years to come.

2 minutes to read

This month’s Budget made little mention of housing. This was perhaps less surprising given the recent Government Housing White Paper, which laid out the Government’s ideas on how to address the pressing issue of boosting supply across the country.

The likelihood is that the outcome of this White Paper, which is essentially a consultation document, will be shared at the Budget in the Autumn.

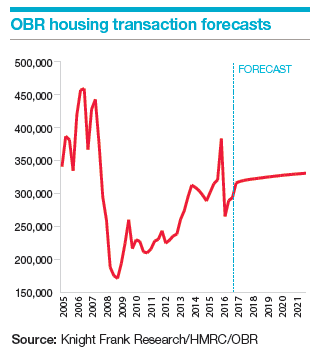

However, the recent Budget did highlight some of the assumptions the Office for Budget Responsibility (OBR) is making about the future direction of travel in the housing market, which in turn serve as the basis for policy decisions. We have explored these in more detail in our most recent UK Residential Market Update.

At present, price growth is at around 4.5% in February according to the Nationwide. The ONS measure of house prices shows 6.4% growth in the year to January.

Meanwhile, during the month, house price sentiment remained broadly steady, with both the current and future readings above 50. This means that households across the UK perceive that the value of their home rose during the month, and that they expect its value to rise over the next 12 months.

The higher the index reading, the stronger the rise. As the chart below shows, while the index is steady above 50, it remains on page one the readings seen before the vote to leave the EU in June last year.

Prime market update

Values in prime central London (PCL) fell by 6.6% over the year to February 2017, as the market continued to adjust to stamp duty increases.

This process appears to have led to a rise in transaction levels, as prices begin to align with buyer expectations. Knight Frank sales volumes in PCL, for example, were higher in the six months to February 2017 than over the equivalent period in each of the previous two years.

In the prime country market, values remained broadly stable in 2016, falling by 0.4% on the year. But the picture is highly localised, with prime markets in cities including Winchester (5.8%) and Exeter (5.2%) outperforming.