Peaks And Prices

We assess prime prices across leading alpine resorts, looking at how they compare and their performance over the past year

1 minute to read

Market Leaders and Growth Champions

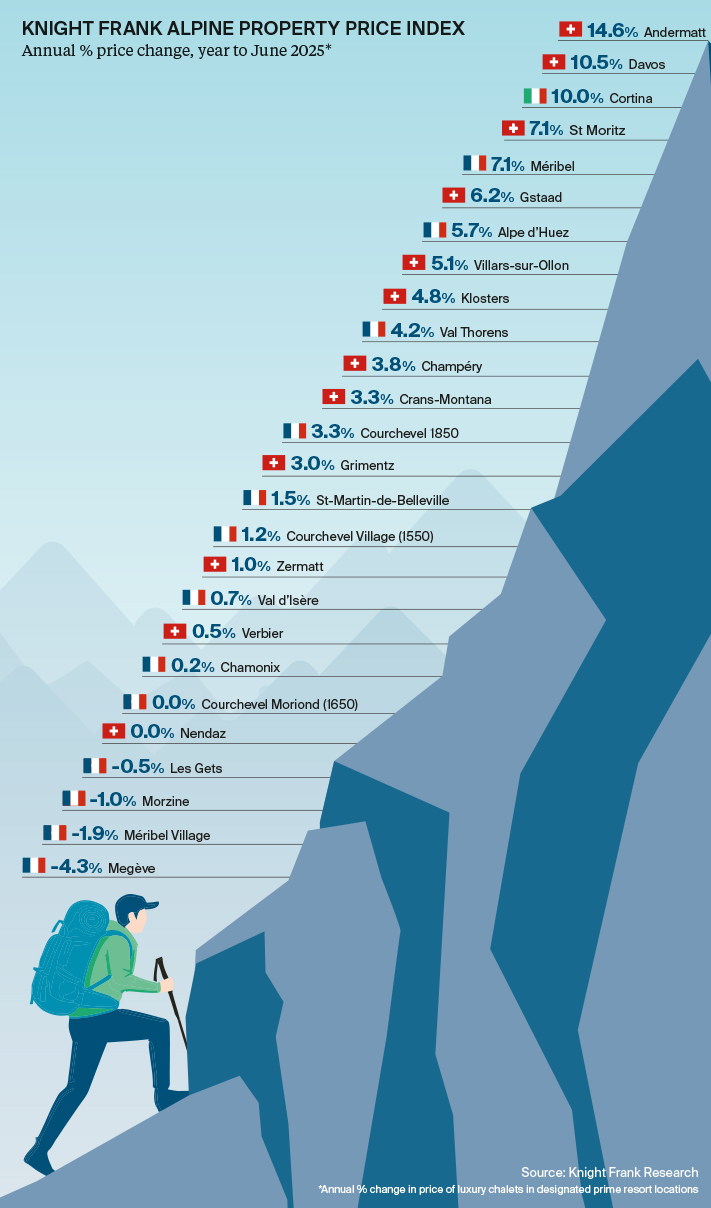

Andermatt leads the price rankings at 14.6% annual growth. The resort sits outside the restrictions of Lex Koller and Lex Weber and is attracting a lot of international interest, particularly from US buyers.

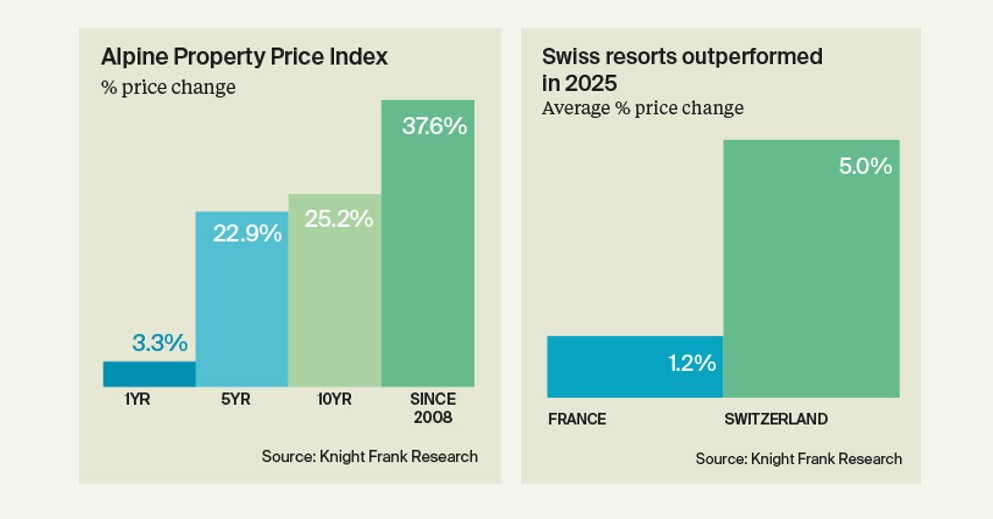

French resorts registered steadier gains: Méribel matched St Moritz at 7.1%, and Alpe d’Huez reached 5.7%. Overall, the Alpine Property Index rose 3.3% in the past year, with Swiss markets outperforming at 5% annual growth on average versus France’s 1.2%. The index now stands 23% higher than five years ago, underscoring a renewed era for alpine living.

Price Positioning

Prime price bands reinforce the established hierarchy. Gstaad remains the costliest alpine destination, followed by St Moritz and France’s Courchevel 1850. Verbier and Zermatt complete the top tier of Swiss markets. Investor value varies sharply across resorts. Our “Where does €1 million go furthest in prime resorts?” analysis highlights some striking contrasts: in Morzine, €1 million buys 102 sq m of prime property, more than four times the 22 sq m it will fetch in Gstaad. Mid- tier markets such as Chamonix (70 sq m), Méribel (55 sq m) and Davos (44 sq m) combine prestige with relative space.

The Pandemic Transformation

Historical performance highlights the pandemic’s lasting impact. Between 2017 and 2019, alpine markets declined slightly, with annual falls of –1.5% and –0.5%. A turning point came in 2020 with 1.7% growth, followed by a surge in 2021–2022, when prices jumped 4.7% and 5.8% – the strongest gains of the recorded period.