Startup GPS: A New Geography of Innovation

The race to attract innovation is intensifying. Cities are competing hard, but the rules are changing.

5 minutes to read

Innovation is becoming more specialised, artificial intelligence is influencing every sector, and rapid policy shifts can now make or break a location. For occupiers, this brings more opportunity, but also more complexity. Making the right decision calls for a revised playbook for location strategy rooted in forward alignment.

Ranking startup ecosystems: The dominant, ascendant and emergent

For startups, the decision of where to locate is becoming more complex. As the 2025 Global Startup Ecosystem Report (GSER) makes clear, the geography of innovation is being reshaped.

Silicon Valley still tops the global leaderboard, drawing in $90 billion in venture capital last year and hosting over 330 unicorns. It remains unmatched in its AI-native strength, housing 22 per cent of the world’s AI-focused startups.

But elsewhere in the top five, changes are happening. New York has overtaken London for second place. Boston has re-entered the top five, underpinned by its excellence in life sciences, artificial intelligence and the presence of globally renowned academic and research institutions. Tel Aviv ranked fourth, continues to outperform its size, driven by a potent mix of state backing, deep sectoral focus and a culture of entrepreneurial agility. Meanwhile, Beijing has surged into the top tier. Nearly two-thirds of startup investment in the city now goes into AI, making it the second-largest recipient of AI venture funding globally over the past two years, at just under $5 billion.

Yet the most interesting movements are found just below the surface. Paris has climbed two spots from last year to twelfth, fuelled by AI momentum, public-private alignment, academic and research strengths and a supportive ecosystem. Madrid has broken into the top 40 for the first time. Philadelphia leapt 12 places to thirteenth, marking the steepest North American rise, supported by coordinated investment in life sciences, advanced manufacturing, and robotics.

GSER 2025 top ten locations split by emerging and established

In Asia, China’s cities, including Shenzhen, Hangzhou and Guangzhou, are asserting themselves as innovation centres. Bengaluru and Hong Kong have also made dramatic leaps, the latter entering the top 40 for the first time. The former has seen a surge in venture capital, deal activity, and a growing skilled talent pool.

And in emerging ecosystems, the disruptors are arriving. Wuxi tops the GSER’s emerging ecosystem ranking, having seen a 67 per cent surge in exits over $50 million. Istanbul jumped ten places from last year, thanks to improved funding, performance, and global reach. Jakarta, Copenhagen and North Carolina’s Research Triangle complete the top five, signalling that high-growth potential is now distributed far beyond the traditional tech capitals. Riyadh has also made a notable leap, rising into the top 30 after significant exits, including a $1.1 billion deal involving rasan.co.

These shifts present new opportunities and greater complexity, as the expanding and changing array of viable innovation hubs makes choosing the correct location more strategic and challenging than ever.

Plotting your path

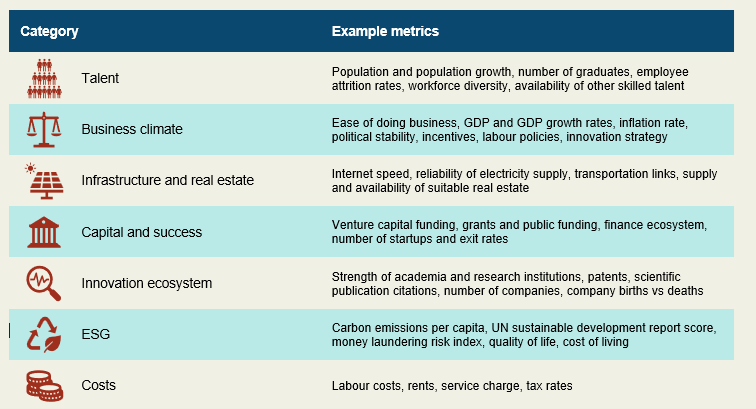

While rankings such as the GSER provide valuable insight into the shifting innovation landscape, occupiers need a more tailored approach. Robust location decision-making demands a calibrated framework that integrates a diverse set of current, historical and future metrics aligned to specific organisational needs, including:

Incorporating location quotient and per capita metrics into location analysis helps uncover high-performing smaller markets that may be overlooked in absolute rankings, revealing places that punch well above their weight.

This data-led approach should be reinforced through primary research, including site visits and direct engagement with stakeholders such as inward investment agencies, innovation partners, local recruitment specialists and occupiers that have recently moved to the shortlisted locality or localities.

The new startup success formula: Specialisation, stability, and skills

Beyond the traditional headline metrics, analysis of leading and fast rising innovation hubs reveals three factors that are increasingly critical for startups and occupiers focused on innovation when shaping location strategies: proactive investment in talent pipelines, long-term stable policy frameworks focused on future growth and deep sector specialisation, particularly in artificial intelligence.

Proactive investment in talent pipelines

Many startups evaluate locations based on the availability of talent today. However, there is also a need to ensure that a location generates the talent needed for tomorrow. This is especially true in frontier fields like AI, quantum computing, and advanced manufacturing, where skill requirements shift rapidly, and demand often outpaces supply.

Example: Singapore, long a model for human capital development, continues to expand its investment through national programmes like SkillsFuture and the TechSkills Accelerator.

Example metrics: Government-led upskilling and reskilling programmes, public investment in digital and technical training, availability of apprenticeship schemes in innovation-intensive sectors, Strong links between universities, innovation districts and industry to develop training programmes, visa strategies aligned to talent needs, targeting scholarships to attract the world’s best and brightest.

Long-term stable policy frameworks

In volatile times, policy is both a differentiator and a risk. A location’s attractiveness can surge or collapse due to sudden shifts in innovation policy, particularly when political cycles or global events trigger regulatory overhauls, changes in investment incentives or new restrictions on talent mobility. Occupiers should seek locations with durable strategies that transcend election cycles.

Example: Vision 2030, a long-term strategy aimed at diversifying the Saudi economy, strongly emphasising digital transformation, entrepreneurship and industrial innovation.

Example metrics: National or regional documents that outline multi-year goals for science and technology that have cross-party consensus with defined budget allocations, consistent year-on-year public R&D investment as a percentage of GDP.

Deep sector specialisation and AI focus

Cities that cultivate deep, strategic expertise in specific high-growth sectors now outperform more diffuse ecosystems. These locations can offer occupiers tailored support, talent and infrastructure, which is often needed in the science and deep tech world. Given that artificial intelligence is becoming foundational across all sectors and innovation domains, locating in regions with proven strengths in AI capabilities, talent and ecosystems will offer a growing competitive advantage for occupiers seeking to future proof their operations.

Example: Shanghai has articulated a formal roadmap to develop five priority sectors: healthcare, smart devices, energy, advanced materials and aerospace.

Example metrics: Funding by sector, employment and GVA by sector, patents, active companies by sector, presence of specialist institutions and academic focus, sector-led industrial strategy and national or local AI plan.

One final thought

The smartest founders and innovation occupiers are recalibrating their coordinates to navigate the changing geography of innovation. They are challenging established hubs to adapt to future forces, while also looking beyond legacy centres toward ecosystems with sharper elevation and clear direction. These are places that in part specialise in high growth sectors including AI, legislate with long term intent, and invest in developing the talent required for what comes next.