Identifying the next innovation-led locations

Innovation has long been regarded as an essential driver of long-term economic growth, and is the aspiration of many national or local authority. Innovation is really quite simple: knowledge drives innovation, innovation drives productivity, and productivity drives economic growth.

3 minutes to read

Increasingly, the influence of innovation on real estate markets is being better

understood, with innovation generative of the new activity and wealth required for a well-functioning market. Innovation frequently underpins healthy tenant demand, and maintains robust rental and capital value levels even during periods of economic uncertainty. Cambridge offers clear evidence of this in action. Globally renowned for its university and extensive research foundation, the city has registered stable yields and rental growth, both during the global financial crisis and, latterly, amid the Covid-19 pandemic.

Where should investors target?

Innovation-led ecosystems have typically spawned from large urban centres with universities such as London, Cambridge, Oxford, Brighton, Reading and Guildford. Locations such as these benefit from the agglomeration and clustering of economies and a magnetism that attracts young, creative and entrepreneurial populations.

Many innovation indices focus on scale as a consequence, taking a global view. Very few adopt a regional approach to consider characteristics beyond clustering – such as the level of private/ public sector collaboration and access to “knowledge spillovers” (i.e. integration with a neighbouring locations’ innovation labour pool).

Quantifying innovation in the south east

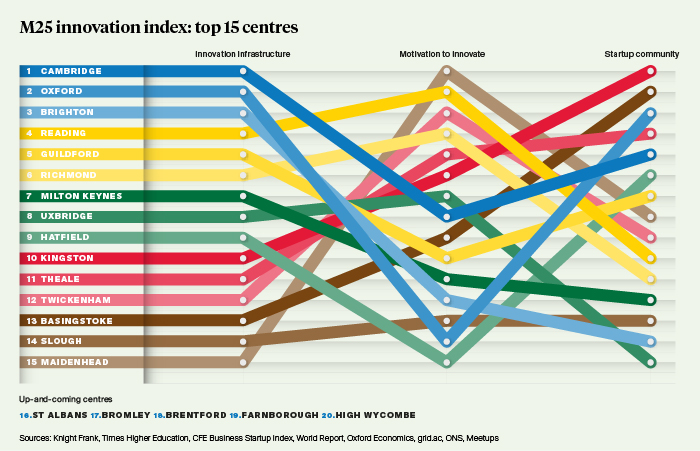

Expanding on our Active Capital research, the Knight Frank M25 Innovation Index examines key factors to identify innovation-led locations in the south east, that offer the greatest prospects for resilience. The index combines 34 variables and 1,500 innovation data points across 43 locations to identify innovationled locations creating the south east’s first innovation index. Using principle component analysis, 11 metrics were identified as statistically significant drivers of innovation. These were then clustered into three core factors: a) “Innovation infrastructure” b) “Motivation to innovate”; and c) “Start-up community”, generating an overall innovation score and rank.

Click to enlarge image

The results - Cambridge, Oxford, Brighton... next stop?

It is little surprise that Cambridge, Oxford and Brighton top our index. Innovation is well-embedded in these locations, with superior innovation infrastructure alongside well-established, entrepreneurial populations.

The next layer of our top 15 are all able to demonstrate excellent innovation assets, ensuring global prominence. Reading, Uxbridge, Milton Keynes, Guildford, Hatfield, Kingston and Richmond all have at least one university benchmarked against UN Sustainable Development Goal 9, relating to industry, innovation and infrastructure. This indicates strong patent generation, spin-off company formation, and high research income from industry. Additionally, all have above-average lifesatisfaction scores, which forms a solid bedrock for start-up communities to survive and thrive.

Beyond the top 15 is arguably the most interesting layer. This is indicative of the next-up-and-coming locations, where innovation, while embryonic, is being fostered. High Wycombe is one such location ranking 20th overall, it has a standout number of research institutions (13 including Wycombe Hospital, Buckinghamshire New University, Altera, FIRA International, Monodraught and Janssen) when compared with its peers. Such a strong research focus has attracted a significant amount of investment. Weybridge similarly boasts an impressive number of research institutions (ten), with major names including Sony, Procter & Gamble and Toshiba.

Click to enlarge image

"2020 was our biggest year of innovation. There is no single formula for innovation. We have a culture of creativity and collaboration. These two things together, when they cross, create a huge innovation."

The last word

Innovation thrives on disruption and change. Gaining exposure to locations that support innovation growth helps shield the investor from some of the disruptive effects that large-scale innovations can have. This is because the locations creating disruptive innovation are the ones monetising it. Knowing that innovation often arisesout of economic dislocation, and that innovation is a key driver of growth, means that identifying innovation-led locations becomes ever more important for real

estate investors.

Our M25 Innovation Index provides unparallelled insight and recognises that

innovation usually starts on a smaller scale before the full benefits are realised and diffused.

Darren Mansfield

Partner, Commercial Research

darren.mansfield@knightfrank.com

Victoria Ormond, CFA

Partner, Commercial Research

victoria.ormond@knightfrank.com