How Asia-Pacific is defying global trends in the prime office market

5 minutes to read

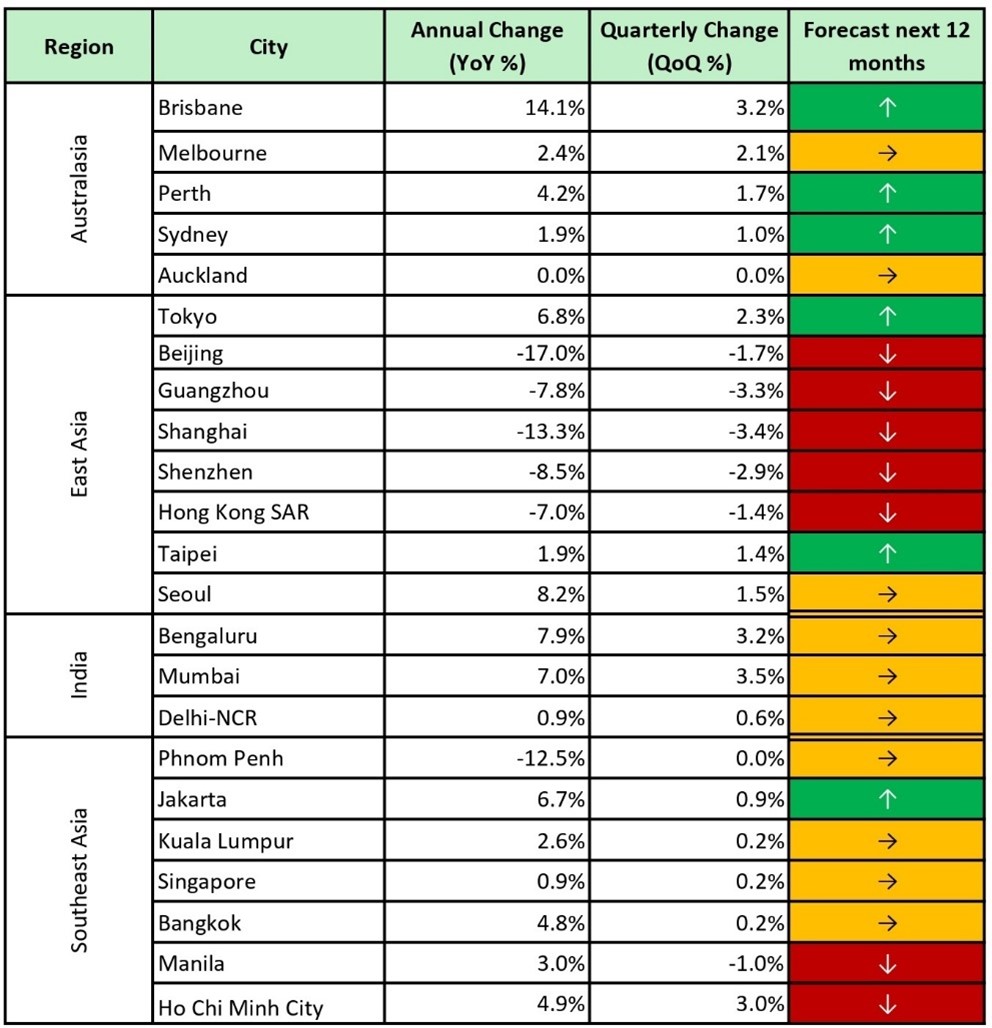

Asia-Pacific's prime office market is finally showing early signs of recovery, after almost three years of market uncertainty. Prime office rents in the region saw their first positive quarterly movement since 2022, with a slight upturn of 0.2% according to Knight Frank’s Office Highlights Q2 2025.

The expansion is modest, but it signals a change, indicating that tenant demand for high-end office space is gradually building. However, this rebound is also highly uneven within the region. This disparity highlights a “tale of two markets” in Asia-Pacific, as domestic shock-absorbers, policy responses, and strategic positioning are generating divergent outcomes for office real estate investors and occupiers.

The numbers that tell the story

The most striking figure comes from India, where leasing volumes across the country’s three largest markets, Bengaluru, Mumbai, and Delhi-NCR, reached a record-breaking 1.2 million square meters in Q2 2025 alone. This not only marks the highest-ever second-quarter volume but also reflects an impressive 20% year-on-year increase from the previous year, showing that despite global headwinds, some markets are seeing unprecedented demand.

At the same time, Hong Kong is going through its own transformation, with rents now 34% below their Q4 2019 peaks. This drop has created an unlikely upside: the city has become increasingly attractive to international firms, with US quantitative trading firm Jane Street taking one of the territory’s largest-ever prime office deals with a massive 220,000+ square foot lease.

Regional market breakdown

East Asia: The Chinese mainland's stability and opportunity for Hong Kong

The Chinese mainland's office market is showing signs of bottoming out after years of weakness. Prime rents across tier-one cities fell just 2.9% quarter-on-quarter in Q1 2025, a significant improvement from the 4.3% decline in the previous quarter. Policy support has played a crucial role in this moderation, particularly in Beijing, where vacancy rates have stabilised.

Shenzhen is emerging as a success story, driven by technology and professional services firms. The government's drive for technology self-reliance is translating into real demand, highlighted by Huawei Technologies taking up 10,000 square meters in a prime office tower. Shanghai is also seeing improvement, with some occupiers upgrading their spaces in the current down market, taking advantage of lower rents.

Hong Kong's office market tells a story of reinvention. Despite ongoing rental falls, the territory is benefiting from US-China financial decoupling, positioning itself as a key centre for Chinese mainland firms seeking offshore funding. The premium Hong Kong offices once held over Singapore has narrowed dramatically from 105% in Q4 2019 to just 24% today, making the city increasingly competitive.

Tokyo, meanwhile, has overtaken Seoul as the region's tightest office market, while South Korea's capital saw vacancy rates rise slightly due to new supply delivery and delayed negotiations amid national elections.

Australasia: Strong growth across Eastern markets

Australia's office markets are experiencing broad-based rental growth across the Eastern, with prime net effective rents rising 4.3% year-on-year. Brisbane remains in front of the pack with a stellar 14.1% annual growth, which has been buoyed by the fierce battle for quality space, largely from legal firms and government tenants.

The Australian market is showing healthy fundamentals with average incentives falling over the past two years from 40% to 38.5% in 2025, while new supply entering the market with almost complete pre-commitments.

Southeast Asia: Tightening markets and rising rents

Most Southeast Asian markets have entered the peak in their development cycles, resultihe availability of less space in many emerging markets. Rental growth in Jakarta is highest among the region at 6.9% quarter-on-quarter, as a lower new supply market has restored a much better balanced market and raised rentals for the second straight quarter.

Bangkok is also seeing higher rents as new prime-grade buildings coming into the market are being let at a premium. Despite increased vacancies, Kuala Lumpur remains relatively stable, with higher rents concentrated in transit-linked and Grade A buildings within integrated developments.

However, in Ho Chi Minh City, prime vacancy rates spiked to nearly 20% during the quarter due to over 69,000 square meters of new office space completion, highlighting the ongoing challenge of supply-demand imbalances in rapidly developing markets.

Singapore's prime office market remains stable, with most occupiers focused on renewals to minimise capital expenditure. In the second half of 2025, leasing activity is expected to focus on small and mid-size spaces in flight-to-quality moves.

India: The region's clear winner

India leads the regional recovery, with leasing volumes in its three largest markets rising over 20% to reach 1.2 million square meters in Q2 2025. This growth is remarkable not just for its scale, but for its sustainability. Business sentiment remains strong despite geopolitical headwinds.

Global Capability Centers (GCCs) remain the primary source of occupier demand, with Bengaluru leading GCC-related leasing. The city's performance has been exceptional. The 1.7 million square meters leased in H1 2025 have already surpassed volumes for the entire year of 2024.

Delhi-NCR is also at a new high, with 700,000 square meters leased in H1 2025, a record for the city. Perhaps most significantly, third-party IT service providers have re-emerged as a major force, more than doubling their market share from 10% to over 20% compared with the same period last year. This revival reflects AI adoption, reinforcing India's position as the preferred hub for outsourced IT services.

Looking ahead: Signs of broader recovery?

The modest 0.2% quarterly rent increase across the region may seem small, but the figure represents a significant psychological shift after years of decline. The recovery is being driven by several key factors: policy stabilisation in China, ongoing demand from financial services firms looking for alternatives to traditional Western hubs, the technology sector's resilience, and India's emergence as a global IT services powerhouse.

However, challenges remain. Trade tensions continue to create uncertainty, tariff policies remain inconsistent, and some markets are still working through oversupply issues. The key question for the next months of 2025 is whether this modest recovery can gain momentum or if external factors will derail the nascent improvement.

The full report can be found here.