Finding the Right Balance

With a demand-supply imbalance affecting both the residential and prime commercial markets, there are opportunities to accelerate the delivery of new product and meet expected demand across both sectors by creating mixed-use, mixed-income, walkable places that meet the needs of residents and allow employers to draw on the deepest pool of talent.

4 minutes to read

With a demand-supply imbalance affecting both the residential and prime commercial markets, there are opportunities to accelerate the delivery of new product and meet expected demand across both sectors by creating mixed-use, mixed-income, walkable places that meet the needs of residents and allow employers to draw on the deepest pool of talent.

Oliver Knight – Partner, Head of Residential Development Research

Nick Parr – Partner, City & East Land Agency

The concept of mixed-use spaces is nothing new

In recent years, London has diversified away from developments dominated by a single use. Best-in-class regeneration hubs such as Battersea Power Station, Elephant Park and Canary Wharf have all adapted their offer through the evolution of the original planning permission.

Earls Court is a prime example of this new horizon. ECDC’s new look proposals setting to deliver a far more balanced neighbourhood than the extant planning permission by CapCo. A range of uses for living, employment and leisure will help create a 24hr a day economy supporting all age groups, nationalities and walks of life. Transport and infrastructure remain key and Lendlease’s proposals at Euston Station can be the next CBD for London creating a single hyper connected estate in Central London for the first time. South Bank and Canada Water are other examples of hubs targeting a full breadth of residents, occupiers, workers, and visitors through new planning permissions focused on delivering mixed-use schemes.

However, where housing remains a key driver, mixed-use doesn’t necessarily have to mean residential and non-residential. Different risk profiles and delivery strategies around the Living Sector uses (Residential Sale, BTR, Seniors Housing, Student and Affordable Housing), are enabling those areas that are not suitable for business space to also provide a breadth of development through targeting different demographics for occupational purposes.

What makes mixed use schemes so compelling?

Consumer demographics play an important role. Simply put, people want to both live and work in versatile, dynamic locations that offer more than just one use. They speed-up the built environment’s contribution to reducing carbon emissions and enhance wellbeing from creating social connectivity between multiple real estate uses. Whilst the demand for this style of development from occupiers has driven compelling and sustained rental growth in these areas have created a ripple effect for buildings in the immediate vicinity.

An important consideration for mixed-use developers is ‘flexibility’ and how it allows for the de-risking of expected returns. The flexibility of mixed-use schemes is an important consideration:

Delivery strategy – This can be optimised to deliver the full spectrum of ‘cradle to grave’ living sector uses ahead of higher risk residential and office uses. Furthermore, the delivery of commercial sectors can also be reduced by delivering product at a range of pricing points.

Funding – Reduced risk and greater visibility over future cashflows for developers and finance providers.

Timing – Delivering the right product type at the right point in the cycle. Market timing risk is effectively diversified across a range of real estate uses.

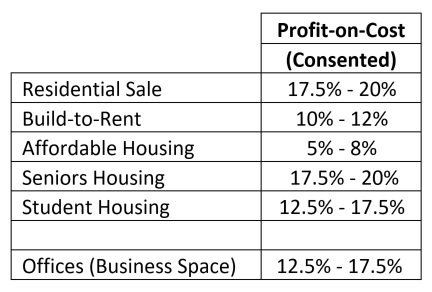

And finally, mixed-use schemes are generally more viable, or is it less risky, – particularly for residential schemes. Developer returns vary significantly depending on the exit route for a particular use – a ‘guaranteed’ exit such as Affordable Housing attracts a much lower Profit-on-Cost than those fully exposed to the market. The table below highlights a typical profit margin for each of the uses as well as business space for benchmarking.

Coupled with lower risk funding opportunities like a forward fund or forward commit structure, the Living Sectors can deliver a broader spectrum of early wins than selling off-plan in the international markets.

The demand for this style of development from occupiers has driven compelling and sustained rental growth in these areas have created a ripple effect for buildings in the immediate vicinity.

What is increasingly obvious is that building mixed-use is about so much more than simply meeting demand. It is vital to creating a modern city. As well as making better use of limited land availability, there is growing evidence that connecting people with goods, services, community and infrastructure has a positive impact on capital values and generates long-term social and community value.

Figure - High level Estimates of Profit On Cost Margin

Assuming appropriate development opportunity in London with planning

Source: Knight Frank Research