Increasing allocations targeting the last-mile

The urban logistics market has attracted strong investor interest, particularly over the past 18-months. The Covid-19 pandemic has accelerated the structural shifts in the retail market, and the growth of e-commerce, driving investors to increase capital allocations to the sector.

4 minutes to read

With consumers demanding ever-faster delivery times, and the high costs associated with servicing the last-mile, retailers and logistics operators are pushing to improve their distribution models, reduce inefficiencies, and hold stock closer to consumers. This strong occupier demand to hold stock within urban areas is supporting investor sentiment.

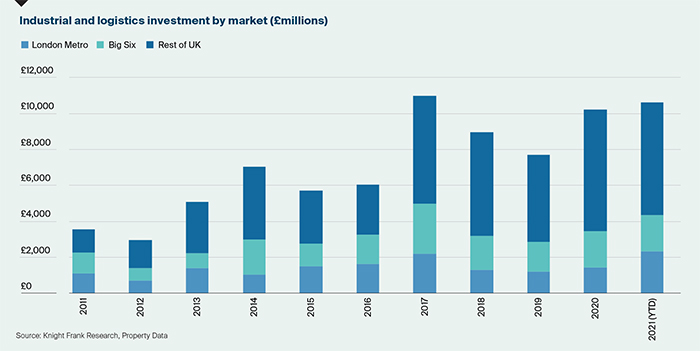

Investment into the industrial and logistics sector has already topped the full-year total for 2020, with £10.6 billion invested, and the fourth quarter still to come, investment is expected to reach record levels. 41% of the total transacted in 2021 was for assets located in the London metro area and the big six UK cities (Birmingham, Manchester, Bristol, Leeds, Glasgow, and Edinburgh). Investment into industrial and logistics assets located within the London metro region has totalled £2.3 billion so far this year, up 63% on the total for 2020.

Many institutional investors were already looking to tilt their portfolios towards the logistics sector and the Covid-19 pandemic has led them to intensify their push. Allocations to the UK industrial and logistics sector have increased from 21.0% five years ago, to 36.4% in Q2 2021, according to the MSCI/AREF All Balanced Fund Index.

Click image to enlarge

British Land recently announced a new investment strategy to target urban logistics opportunities. It has just agreed to pay £87 million for a warehouse near London and is also developing land into urban logistics space. Canadian investment firm BMO bought three regional UK logistics assets after selling a Royal Mail distribution centre in Bristol. BMO said it is diversifying out of larger, older distribution centres into modern facilities in areas of strong demand. InfraRed Capital Partners’ dedicated Urban Logistics Income Fund continues to both invest and rotate its portfolio, having traded several assets over the past year.

Those already invested in the sector are looking to increase their exposure and new entrants are looking to enter the market and this is driving competition which is, in turn, fuelling pricing. Average net initial yields for standard industrial in London were recorded at 3.08% in August 2021, down 38 bps from 3.46% in August 2020 and a post-GFC high of 7.60%. Yields in the South East and Eastern region have also recorded significant compression over the past year, with Inner SE & Eastern down 37 bps on August last year. Over the same period, net initial yields for standard industrial across the rest of the UK recorded just 16 bps compression over the past year. However, the strongest yield compression was recorded for distribution warehouse assets, with net initial yields down 73 bps year-on-year.

Despite strong investor sentiment for urban logistics, obtaining exposure in this arena can be tricky. With good quality, existing assets in short supply, the only option for many investors is to look to drive value through development.

Industrial developers and operators are now competing with residential developers for land. Over the past 20 years, large tracts of industrial land have been sacrificed to higher value use-classes such as residential. London lost around 100 ha of industrial land annually, compared to a release a target of just 37 ha per annum according to the now superseded London Plan (2016). This has led to limited stock available for occupiers and restricted opportunities for investors and developers.

However, given the growth in occupier demand, industrial developers and operators are now competing with residential developers for land. Amazon recently acquiring a site in Barnet with planning consent for a residential-led scheme. Examples of industrial land values starting to compete with residential values are not yet being seen outside of London, however, the rapid growth in online retailing has generated demand for urban and last-mile logistics throughout other UK cities and this is pushing up land values in these locations too.

Indirect investment is another method for investors seeking to gain exposure to the urban logistics sector. Urban Logistics REIT concentrates on the last-mile of the supply chain. Target assets have smaller lot sizes (typically under £10 million) and tend to be single-let assets under 200,000 sq ft. They are currently trading at a 17.6% premium over NAV (net asset value), 24th September 2021, with their latest fundraising oversubscribed.

Returns for the industrial and logistics sector have surpassed those across other real estate sectors, and logistics returns in urban areas have outperformed other locations. The highest returns for 2021 are forecast for Newham in East. London Boroughs of Tower Hamlets, Waltham Forest, Southwark, Redbridge, Croydon, and Ealing are all forecast to record total returns over 20% this year. Outside of London, the markets of Leeds, Maidstone, Manchester, Newcastle, Amber Valley (East Midlands), and Durham are all forecast for returns of more than 20%.

Download Future Gazing 2021