The Global Branded Residence Survey 2025

For this year’s Global Branded Residence Survey, we assessed the portfolios of nearly 80 luxury brands, from major established hotel groups such as Four Seasons and Ritz-Carlton to more recent non-hotel entrants including Bentley and Aston Martin. More than 1,000 live and pipeline schemes were reviewed across 83 countries, revealing an increasingly diverse sector in growth mode

5 minutes to read

A growth sector

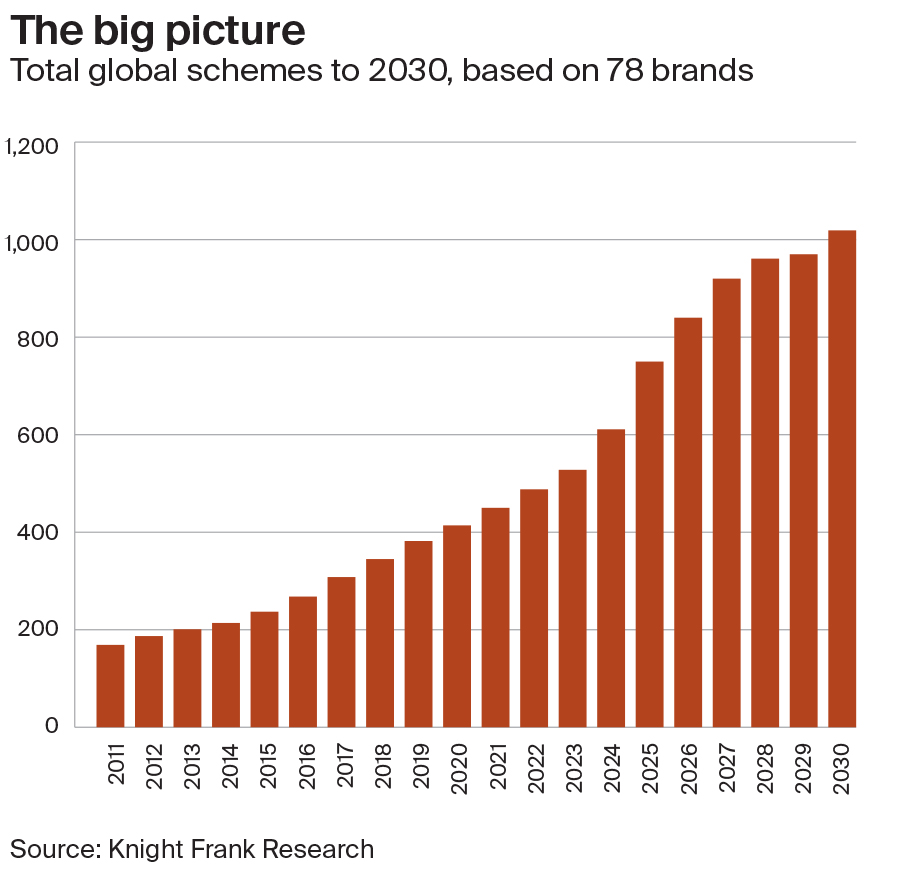

The branded residences sector has experienced strong, sustained growth, with the number of schemes rising from 169 in 2011 to 611 today and a forecast 1,019 by 2030. Unit numbers have surged in parallel – from just over 27,000 in 2011 to more than 162,000 projected by 2030. Momentum has accelerated since 2023, fuelled by growing demand for branded living and developers’ appetite for premium positioning. While growth is expected to moderate after 2028, the sector is projected to keep expanding, supported by increasing geographic diversity and the entry of new non-hotel brands.

Us Dominance Is (Only Slowly) Eroding

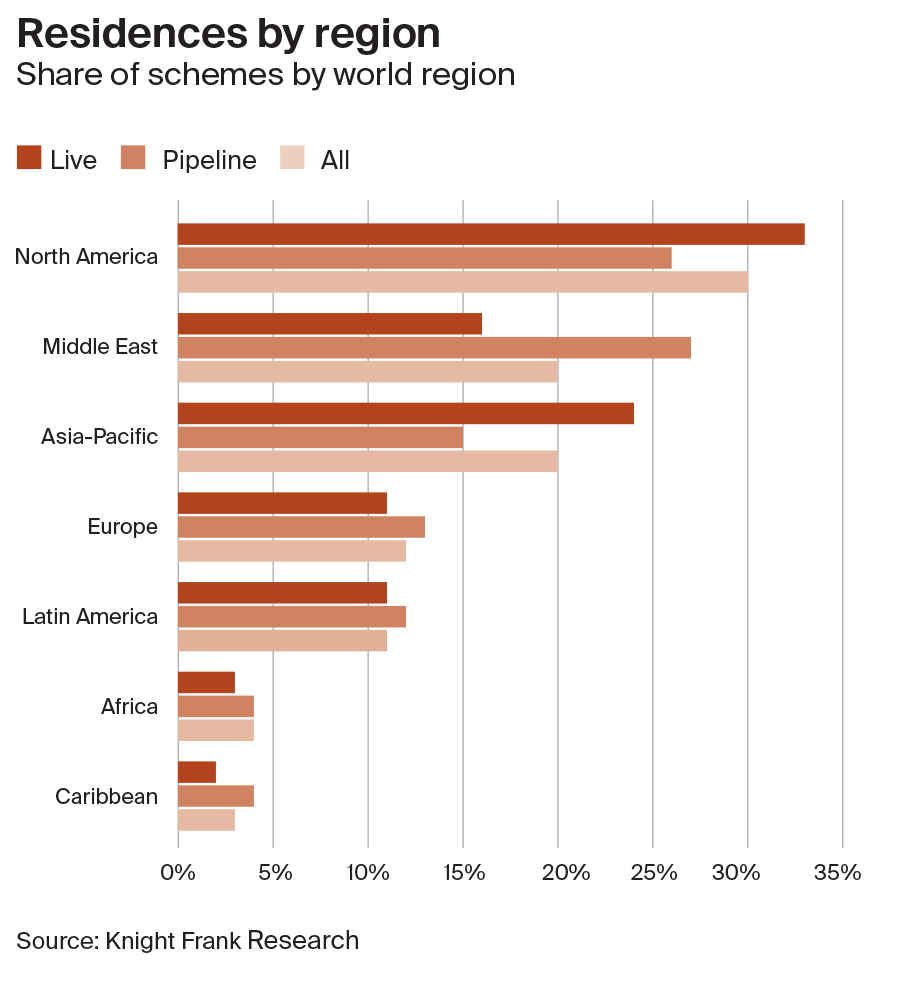

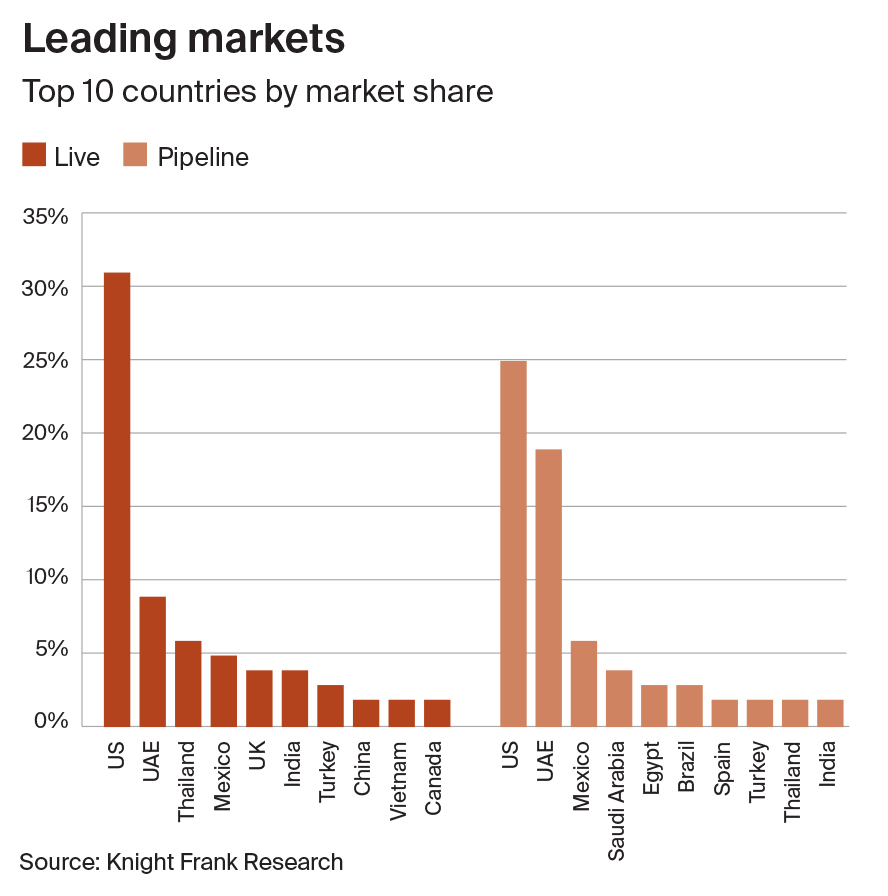

North America remains the dominant region for global branded residences – particularly the US – although its share of schemes is declining, from 32.7% of live schemes to 26.2% of pipeline projects. The Middle East shows the most significant increase, with its share of pipeline developments (26.7%) well ahead of its share of live projects (15.9%), driven largely by rapid expansion in the UAE and Saudi Arabia.

Asia-Pacific’s share is expected to ease, despite a strong pipeline in markets such as Thailand and India. This year’s survey indicates that developers are increasingly targeting growth markets in the Middle East, Latin America and beyond.

The Global Centre Of Gravity Is Shifting Eastward

Over time, the centre of gravity for global branded developments has been shifting steadily eastward – and slightly southward. Using the average latitude and longitude for all live and pipeline schemes, we can see how US dominance in the 1990s positioned the global centre of activity well to the west of the Atlantic. Since then, growth in Asian markets – and, more recently, in the Middle East – has pulled this point progressively eastward.

Hotel Brands Dominate, Now And In The Future…

With new brands entering the residences sector seemingly every day, you might be forgiven for thinking that car, fashion, sport or watch brands are the main story. They’re not. In fact, 83% of existing branded residences are hotel brands, and while this share is forecast to dip slightly in the future, it will remain at around 80%.

…With Actual Hotels Increasingly An Optional Extra

Looking at hotel brands alone, the vast majority of live schemes (82%) are, perhaps unsurprisingly, co-located with a hotel. However, looking at the future pipeline this is set to dip to 70%.

North America and the Middle East are the leaders in going it alone, with 49% and 43% of pipeline hotel branded schemes respectively being planned as standalone developments.

Key themes

This year’s Branded Residence Survey of more than 1,000 schemes revealed stand-out new themes across the sector, but also highlighted enduring core principles that developers and brands are working to strengthen

The ascendance of standalone branded residences: A defining trend, driven in part by the growth of non-hotel brands, but increasingly embraced by hotel brands as well. While present in the past, this model is becoming more common, catering to buyers who seek brand prestige and services but prefer privacy and dedicated facilities without sharing space with hotel guests. The ability to consider smaller, urban schemes – especially in European cities where limited footprints make a co-located hotel unviable – is another key driver.

Deeper integration of holistic wellness and longevity: Beyond standard spas and gyms, the new phase of branded schemes places a profound and explicit emphasis on holistic wellness, longevity and health-centric living. This involves the integration of dedicated wellness hubs, clinics and advanced therapies (such as hyperbaric therapy and cryotherapy), often alongside biophilic design. Wellness is evolving from a standard amenity into a core concept, moving from merely a “nice-to-have” to a science-backed offering that extends the branded experience into every aspect of residents’ daily health and vitality.

Proliferation of niche brand collaborations: As noted above, hotel brands remain deeply entrenched in the sector and are likely to continue dominating. This isn’t stopping new non-hotel brands from entering, however. Fashion and car brands are the most visible newcomers, but beyond Karl Lagerfeld and Bentley residences, restaurants (Major Food Group), retirement living (The Embassies), watches (Jacob & Co.) and wellness (SHA) are all vying to demonstrate the added value their brand heritage can bring to both developers and residents.

Strategic geographic diversification: While established luxury hubs such as Dubai and Miami remain strong, the future pipeline demonstrates significant expansion into new and emerging luxury markets. There’s also a deepening presence in newer markets, with notable growth areas including Saudi Arabia, Egypt, Japan, France and US markets beyond New York and Miami. This global phenomenon reflects developers and brands seeking new high-net-worth customer bases and diversifying their geographical footprint to mitigate risks and capture emerging wealth.

Emergence of master-planned branded communities: Beyond individual towers and resorts, there is a shift toward a more confident and ambitious approach. The next five years are set to showcase larger, integrated master- planned communities or districts, where multiple branded residential offerings coexist to create a comprehensive luxury ecosystem. Thailand, Malaysia, the UAE and Saudi Arabia dominate this more immersive and extensive lifestyle model, with residents benefiting from shared infrastructure and amenities.

Deeper curation of experiences: The future pipeline places an even greater emphasis on extreme exclusivity and highly curated, private experiences. This is reflected in the limited number of units in many new projects, as well as the development of private clubs and amenities within them. As competition intensifies, developers and brands are introducing unique offerings – such as chauffeured cars, yachts and access to private jets.

Unwavering focus on luxury and service: Despite the drive to differentiate through experiences, the core appeal of branded residences remains the promise of a luxury, five-star lifestyle – underpinned by exceptional service, as evidenced by some of the world's most expensive branded residences. Seamless access to hotel- grade amenities such as concierge, valet, housekeeping and in-room dining continues to be a major draw. The cachet of globally recognised names offers buyers an assurance of quality and service standards, but it is the consistent delivery of that promise that ultimately determines success.