Housebuilders look to replenish land pipelines as sentiment improves

Plus, positive and pragmatic moves on the green belt and investors spend record sums acquiring and funding family homes to rent

4 minutes to read

UK housebuilders are back in the market for land in greater numbers following a hiatus in 2023 where many took a more cautious and selective approach to land buying. Greater stability in the housing market so far this year has resulted in sentiment in the land market starting to improve.

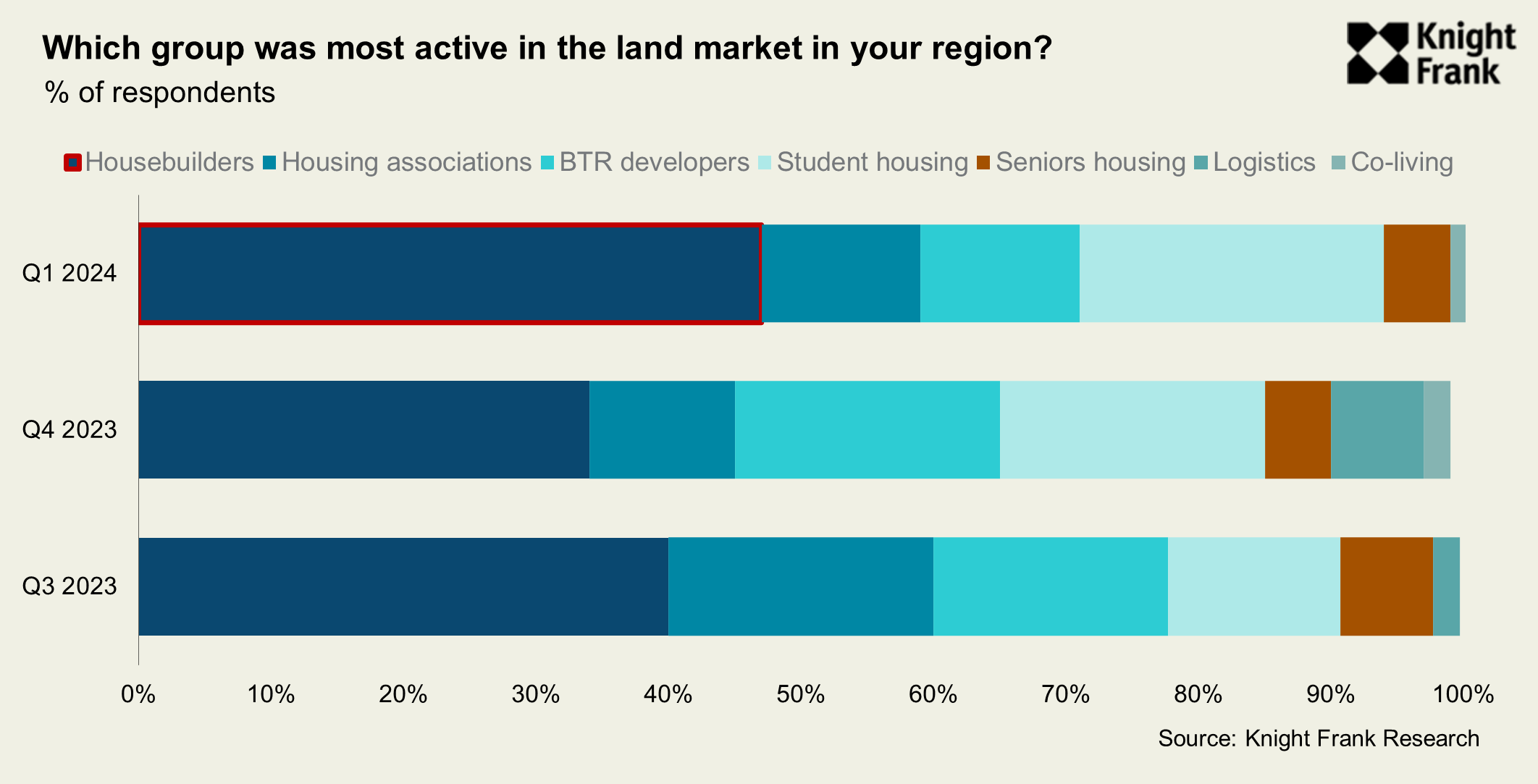

That’s the message from our Development Land Index, due for release next week (sign up to receive a copy here). The report, compiled by Anna Ward, also features the results of our quarterly survey of volume and SME housebuilders across the UK. Nearly half of respondents said housebuilders were the most active group in their regions, a step change from previous quarters.

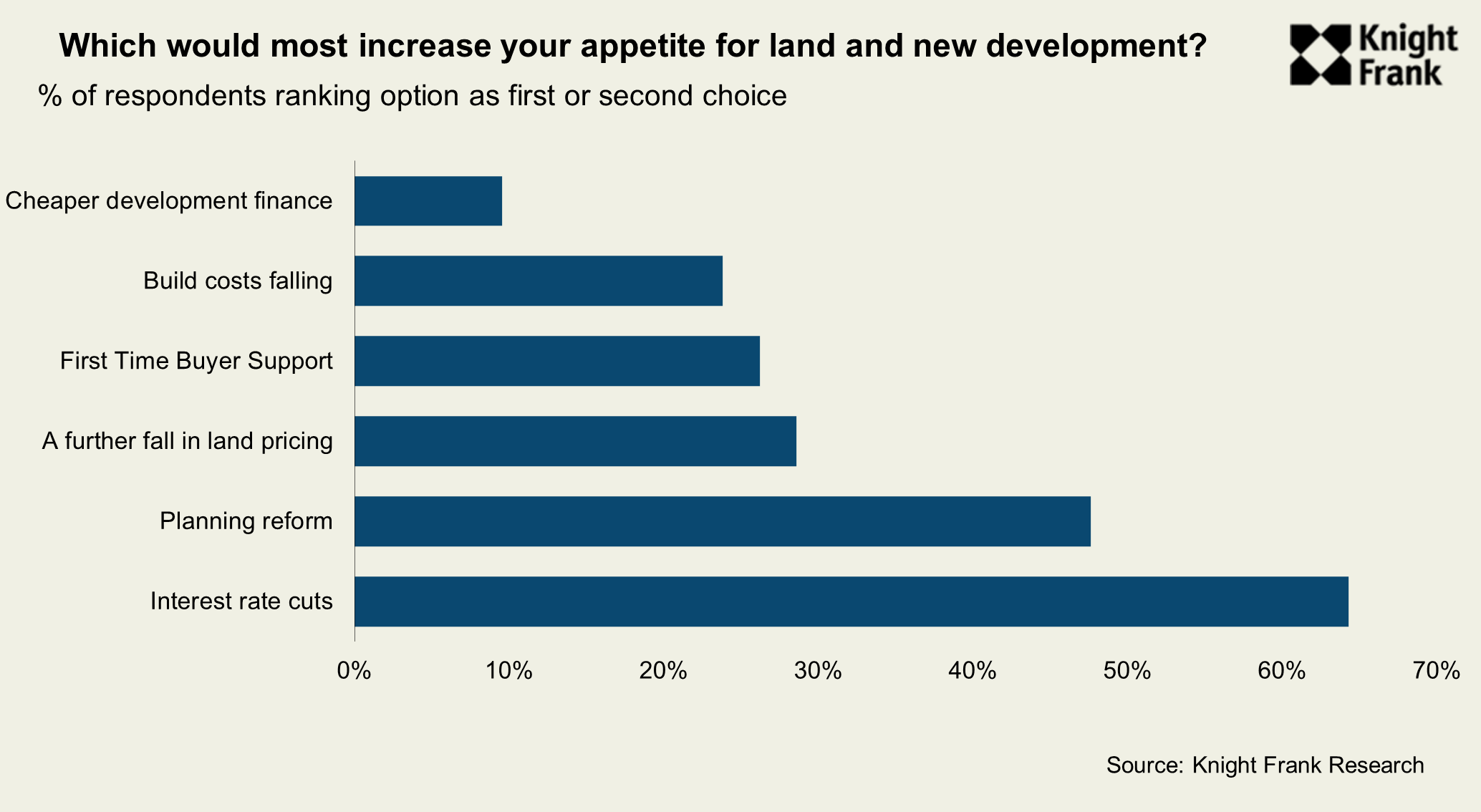

But while deals are underway as builders look to replenish pipelines, for the most-part there is still not much land changing hands. For that to change, over 60% of our survey respondents said that an interest rate cut is top of their wishlist. Money markets are currently betting on between one and two cuts this year, which will ease affordability pressures for buyers.

This ranked more highly than either planning reform (48%), a further fall in land pricing (29%) and more first-time buyer support (26%) when it comes to increasing their appetite for land and new development, our survey shows.

We expect demand for land will continue to steadily recover if conditions in the wider housing market remain stable. There has been a notable increase in sites coming to market in Q1. While deal times have lengthened, this will lead to transactions volumes building later this year.

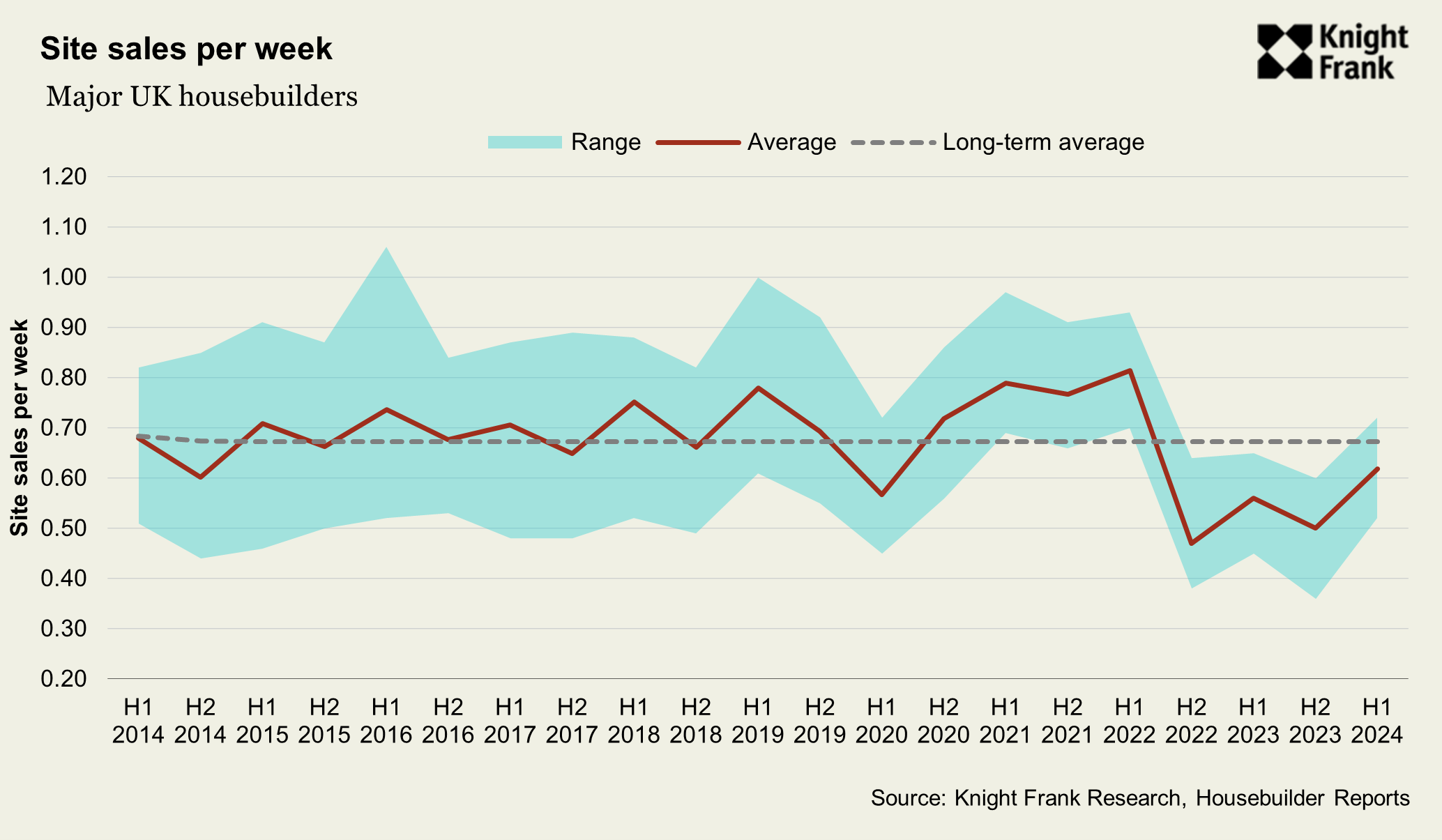

That said, developers will be encouraged by data which points to sales conditions improving. On average, housebuilder site sales per week have ticked up to 0.62, up from 0.56 in H1 2023 and from a low of 0.47 in H2 2022 following the mini-Budget in September (see chart). This is reflected by our survey results: nearly 40% of respondents said site visits and reservations had increased – which is the strongest reading since we first asked this question in late 2022.

Shades of green

The last month has been a big one for housing policy. Labour's announcement of their ‘five golden rules for the Green Belt’ represents a positive and pragmatic intervention. And one which signals the party's willingness to tackle contentious issues to boost housing delivery.

Knight Frank has been advocating for a mature conversation around the Green Belt for some time. Our recent analysis, led by Cameron McDonald, head of geospatial at Knight Frank, identified 11,500 brownfield sites (equating to less than one 1% of total Green Belt land) that have the potential to deliver up to 200,000 family homes.

Roland Brass, a partner in the planning team at Knight Frank, writes more about significance of the proposals here, noting that a lot will depend on how councils are empowered to grant permissions and allocate sites within their local plans, which can only be achieved through a robust update to the NPPF.

Single family takes centre stage

The UK's single family housing (SFH) rental market has been primed for growth for some time, but conditions were so optimal last year that investors spent a record £1.9 billion acquiring or funding more than 6,200 homes, up fivefold from 2022, according to a new Knight Frank report.

A further acceleration in growth is expected, should investors realise their ambitions. The report outlines the results of our survey of 20 leading institutional investors currently active in the market who, combined, are looking to spend £17 billion funding or acquiring family homes to rent over the next five years.

Investment last year has been supported by a greater willingness on the part of housebuilders to engage with investors to de-risk sites on the back of the slower sales market. Some 71% of deals in 2023 were facilitated through transactions with housebuilders, either through bulk deals of stock under construction, or via partnership agreements for yet-to-be-built houses.

Momentum looks to have continued into 2024, with a further £345 million spent on SFH in the first quarter, according to our Q1 Build to Rent investment update. SFH accounted for more than a quarter of the total £1.3 billion invested into the UK BTR market in the first quarter.