Tunisia

High house prices are boosting activity in Tunisia’s residential leasing market, while the retail sector is rebalancing itself to account for more online shopping, while malls are focussing on creating lifestyle and experiential destinations.

2 minutes to read

Residential tenants forced to delay transition to homeownership

Unfavourable borrowing conditions and an oversupply of luxury homes in Tunis is starting to negatively impact house price growth, with average prices rising by just 4% in 2020 and 2021 (Tunisia’s National Institute of Statistics).

Despite this, high house prices mean that many buyers remain effectively locked out of home ownership, with little option but to continue renting before they are able to afford to transition to home ownership.

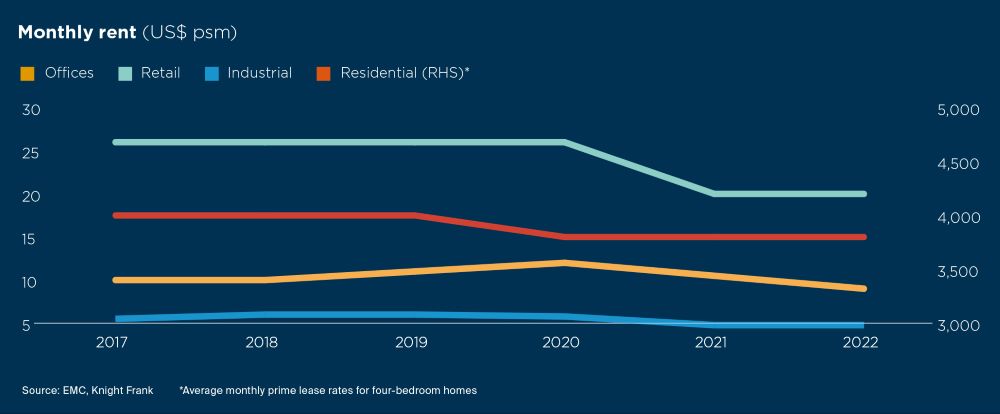

The resultant impact of this is an exceptionally active rental market, with monthly rents in northern parts of the city topping out at c. US$ 3,800. To put this into perspective, this is about US$ 300 higher than Tunisia’s income per capita.

Prime office market remains resilient

In general, average office rents have fallen in the wake of the COVID-19 pandemic and the subsequent shift in occupational strategies which now factor greater remote working. Many occupiers have used the pandemic as leverage to negotiate lower rates and landlords have become more flexible in terms of both incentives and terms, leaving tenants firmly in the driving seat.

"Occupancy levels are generally very high for best-in-class office buildings."

The prime office market is a very different story altogether. There has been little in the way of development activity in recent years and the supply pipeline is very limited. Occupancy levels are generally very high for best-in-class buildings and average monthly prime office rents are now around US$ 9 psm, but can rise above US$ 12 psm for smaller prime suites.

Lifestyle retail destinations thriving

Declining footfall in shopping malls- as a result of the pandemic and the rise in online shopping is resulting in many retailers either downsizing, or renegotiating leases. Landlords are for the most part amenable to rent reductions; the alternative would be rising void periods.

While the e-commerce sector has grown over the last two years, further expansion is being hampered by FX regulations, which is spooking international investors.

Despite the concerns about the long-term viability of physical stores, there has been considerable construction of malls outside of Tunis.

One such example is the 62,000 sqm Mall of Sousse, which features a multiplex cinema and a 10,000 sqm Carrefour store. It is currently the largest mall in the country and has high occupancy levels, supported by its positioning as a lifestyle destination, rather than just another collection of stores. Offering consumers experiences will continue to be key to the success of physical stores and malls.