Sudan

The country continues to be under military rule and the leader of the civilian coalition recently resigned from the council. The COVID pandemic and the lack of clarity over the political situation has curtailed inbound investment. The subsequent contraction of the economy has meant property prices in Khartoum have fallen across all asset types.

1 minute to read

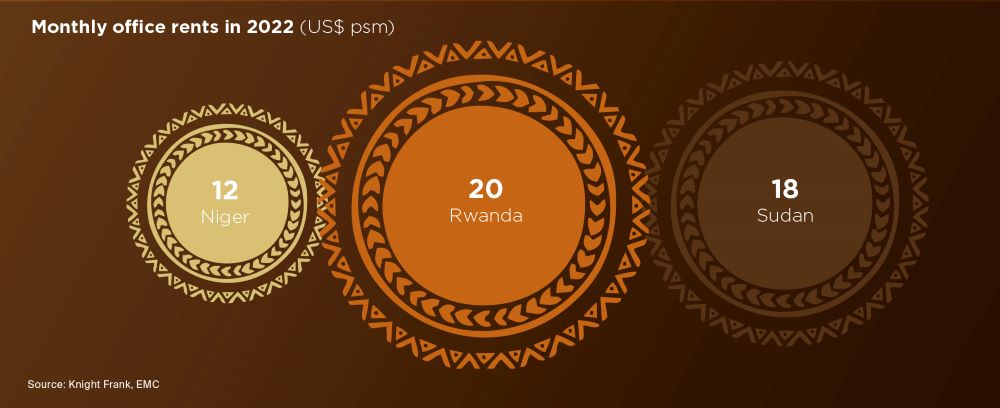

High vacancy rates are a defining feature of Khartoum’s office market. Landlords are competing for the few tenants in the market by lowering rents in an apparent ‘race to the bottom’. A prime example of this has been the Bybos Bank Building, where quoting monthly rents have slipped by almost 40% in the last two years, falling from US$ 28 psm in 2020 to US$ 15 psm today. It is difficult to determine the true impact on capital values as there have been such a limited number of transactions.

In general, the residential market is also experiencing high vacancy rates and falling lease rates. This has prompted a flight to quality, which is driving the emergence of a two-tiered market. Tenants are capitalising on low lease rates and upgrading where possible. At the upmarket 40,000 sqm Awtad Residential Compound in the El Manshiya district of Khartoum, for instance, villas were leasing for about US$ 1,800 per sqm in 2020, but are available today for about 30% less.