Mauritius

The real estate market in Mauritius is slowly revving back to life in the wake of the pandemic. Its ever-popular residential market is expected to rebound as tourists return and global travel resumes, while its retail sector adjusts to the rise of online shopping.

2 minutes to read

Office leasing activity centred on business parks

Port Louise, traditionally the focus of commerce, has experienced a steady migration of firms to business parks developed over the last 10 to 15 years as a flight to quality takes hold in the wake of revised post-Covid occupational strategies. Those that remain benefit from the proximity of Government Departments, the courts and the Port.

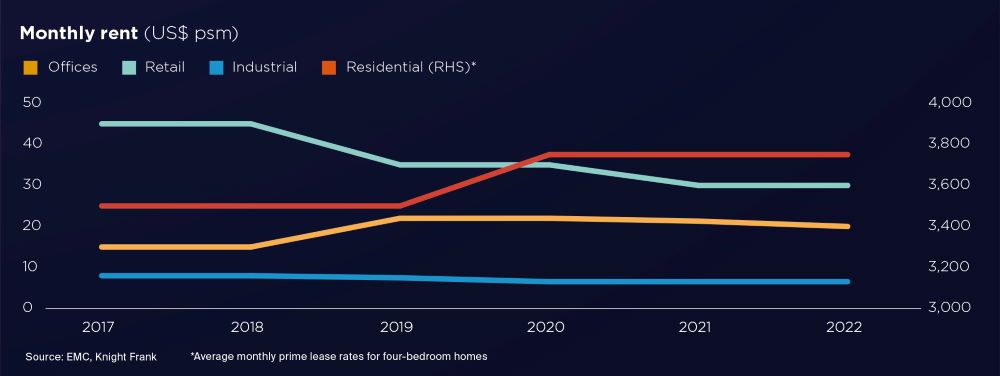

The office parks, spread across around 440,000 sqm, are referred to as Smart Cities and have spurred investment across the island. Office take-up within these cities has been robust. Monthly prime office rents here hover around the US$ 20 psm mark and due to their popularity, vacancy rates remain low (c.10%).

Retail bounces back

The success of the island’s retail sector has always been underpinned by high levels of inbound tourism, however the pandemic severely hurts retailers’ revenues, especially that of non-food-based businesses. Owners of the shopping malls in Mauritius, as in other countries, responded to the pandemic by offering rent reductions and rent-free periods to limit the number of retailers going out of business.

With global travel now normalising, retail on the island is enjoying a boost in activity, albeit the boom in online shopping means e-commerce is here to stay and retailers must adapt to the shift in consumer behaviour to survive.

Vacancy rates are low and monthly prime rents stand at around US$ 30 psm.

Stability persists in the industrial market

The heavily tourism reliant economy and relatively small population means the industrial sector in Mauritius remains small, with limited prospects for growth. Most warehousing is either owner-occupied, or leased by SMEs linked to emerging sectors such as bio-farming, organic farming, recycling and green energy technology.

Monthly lease rates have changed little over the last couple of years, remaining steady at US$ 7 psm. As rents are relatively low, negotiations tend to be centred around the specification of the unit, rather than its cost.

"With global travel now normalising, retail on the island is enjoying a boost in activity."

Residential market expected to rebound as international travel resumes

Generally, the residential market remains split between locals and international buyers resulting in a split in pricing for similar products, depending on whether or not they are located within government-approved developments where international ownership is permitted.

While capital value growth and rents have experienced limited growth throughout the pandemic, the low tax environment, stable governments and resumption in global travel will likely reignite international demand for homes in Mauritius, particularly among South African and French citizens.